From August 2023 the comments on statistics, a short description of selected, recently issued statistical data in the area of monetary statistics and the non-residents sector statistics, are no longer published. They are replaced by Statistical releases.

Comments on the balance of payments and the international investment position in 4Q 2016

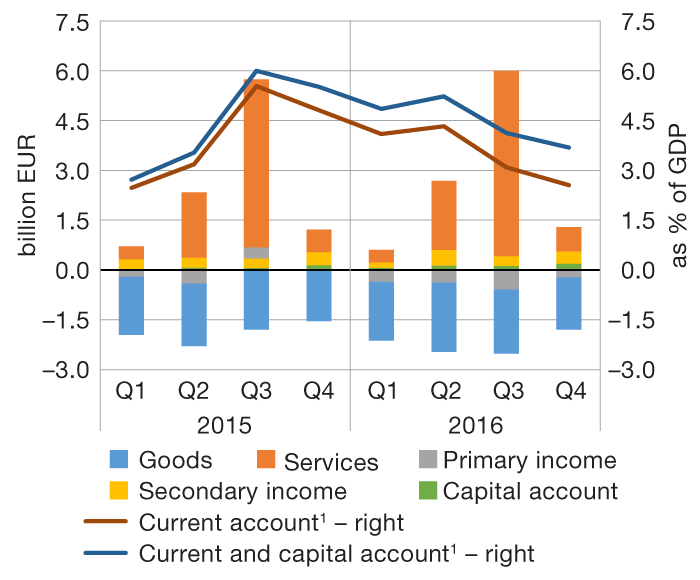

The current and capital account of the balance of payments ran a deficit of EUR 0.5bn in the last quarter of 2016, having widened EUR 0.2bn from the same period of the previous year. The widening of the deficit was mostly driven by deterioration in the primary income account (EUR 0.2bn), mostly relating to higher expenditures from direct investment (i.e. greater profit of domestic business entities owned by non-residents). Better business results were observed in a large number of activities, particularly financial activities, production of oil and refined petroleum products and pharmaceutical industry. Business results of residents based on their foreign investments also improved. The deficit in the foreign trade in goods also widened slightly, despite faster growth in goods exports (7.1%) than imports (5.1%), while the surplus in foreign trade in services increased. Net revenues from telecommunications, computer and information services rose sharply, while net revenues from tourism fell slightly as a result of a relatively sharp increase in tourist consumption of residents abroad. A small decline in the secondary income account surplus, resulting from slightly larger payments into EU budget had an unfavourable impact on the current account balance. By contrast, the use of EU funds of current and capital nature rose only slightly.

Figure 1 Balance of payments

| a) Current and capital account | b) Financial account |

|

|

1 Four-quarter moving average

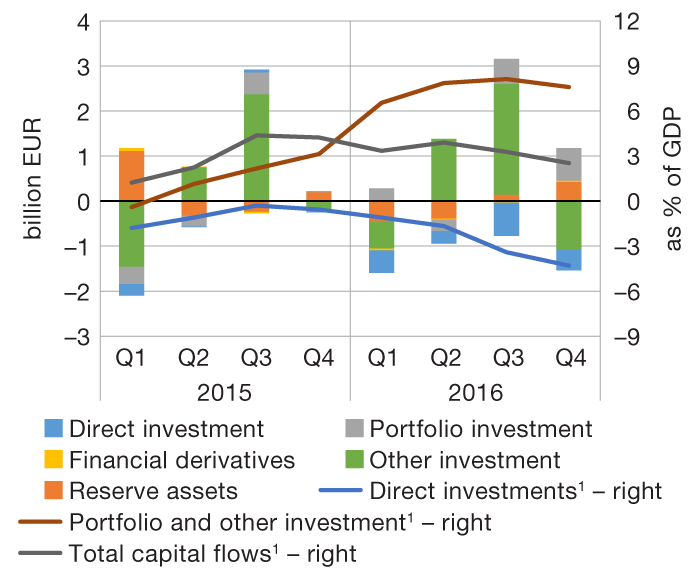

Note: In the figure above showing the financial account, the positive value denotes net capital outflow abroad and the negative value denotes net capital inflow.

Source: CNB.

The financial account of the balance of payments saw a net inflow of capital (increase in net foreign liabilities) of EUR 0.4bn in the last quarter of 2016, a large increase from the same period of the previous year. In terms of the type of investment, the inflow of capital (EUR 1.1bn) took place mainly in the account of other investments (which comprises changes in foreign assets and liabilities of the domestic sectors based on loans, trade credits and currency and deposits). It was determined by a sharp fall in foreign assets of banks (EUR 1.6bn), with slightly over one half of that amount (EUR 0.9bn) being purchased by the central bank from the banks in foreign exchange interventions. This resulted in a rise in international reserves. Net liabilities from direct investments also rose (EUR 0.4bn), mostly owing to retained earnings of foreign-owned entities and borrowing from affiliated enterprises abroad. Direct equity investments continued to be modest and mainly involved investment in property, accommodation capacity and information and service activities. The account of portfolio investment saw a fall in net liabilities of EUR 0.7bn, mainly as a result of transactions in the secondary market (domestic institutional investors purchasing some of Croatian government eurobonds from foreign investors), which led to a fall in central government external debt. In addition, domestic sectors' investments in foreign debt securities also rose. Gross international reserves went up by EUR 0.4bn, mostly due to foreign exchange interventions of the central bank, in spite of a withdrawal of the government deposit with the central bank and the closing of a part of reverse repo transactions (foreign liabilities of the central bank recorded in the account of other investments fell by the same amount). If the change in gross international reserves and liabilities of the CNB is excluded, net foreign financial liabilities rose by EUR 1.1bn in the last quarter of 2016, in contrast with their fall of EUR 0.4bn in the same period of the previous year.

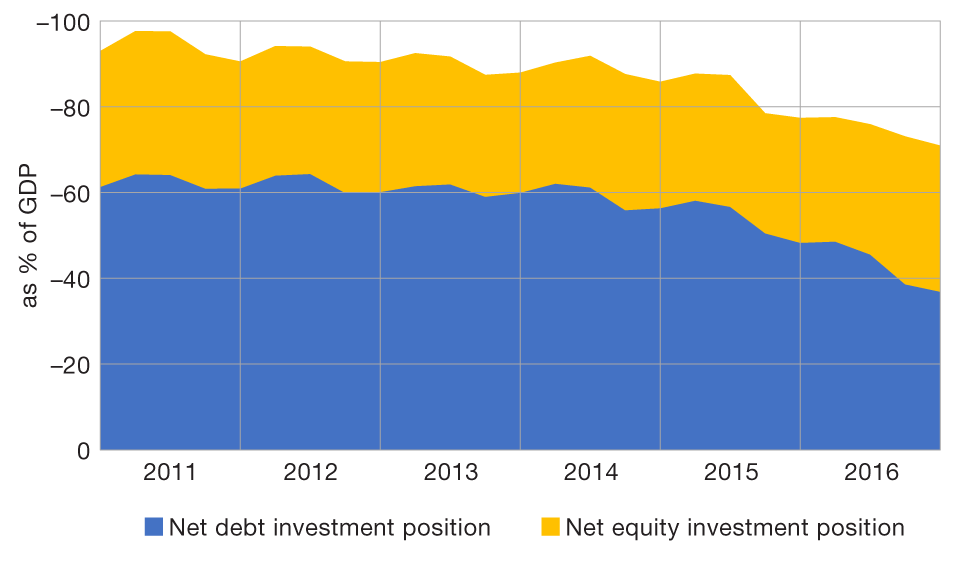

Although the described transactions in the financial account of the balance of payments contributed to growth in total net liabilities, the net international investment position improved by EUR 0.6bn in the last quarter of 2016, owing to the value adjustment of assets and liabilities (exchange rate, price and other adjustments not covered by balance of payments statistics). At the end of the year, the net international investment position was down to EUR –32.3bn, with the trend of external imbalances improvement continuing for several years in a row.

Figure 2 International investment position (net)

Note: International investment position (net) equals the difference between domestic sectors' foreign assets and liabilities. Net debt investments include financial derivatives.

Source: CNB.

If developments in the entire 2016 are observed, the surplus in the current and capital account of the balance of payments stood at 3.7% of GDP (5.5% of GDP in 2015). This decline was exclusively due to the base effect of the conversion of loans in Swiss francs (estimated at approximately 2% of GDP) which in 2015 led to the worsening of the business results of banks in foreign ownership and thus contributed to a sharp increase in the current account surplus. Outflows in the financial account in 2016 were smaller than in the previous year and the international investment position continued to improve owing to deleveraging, from –77.4% of GDP at the end of 2015 to –71,0% of GDP at the end of 2016.

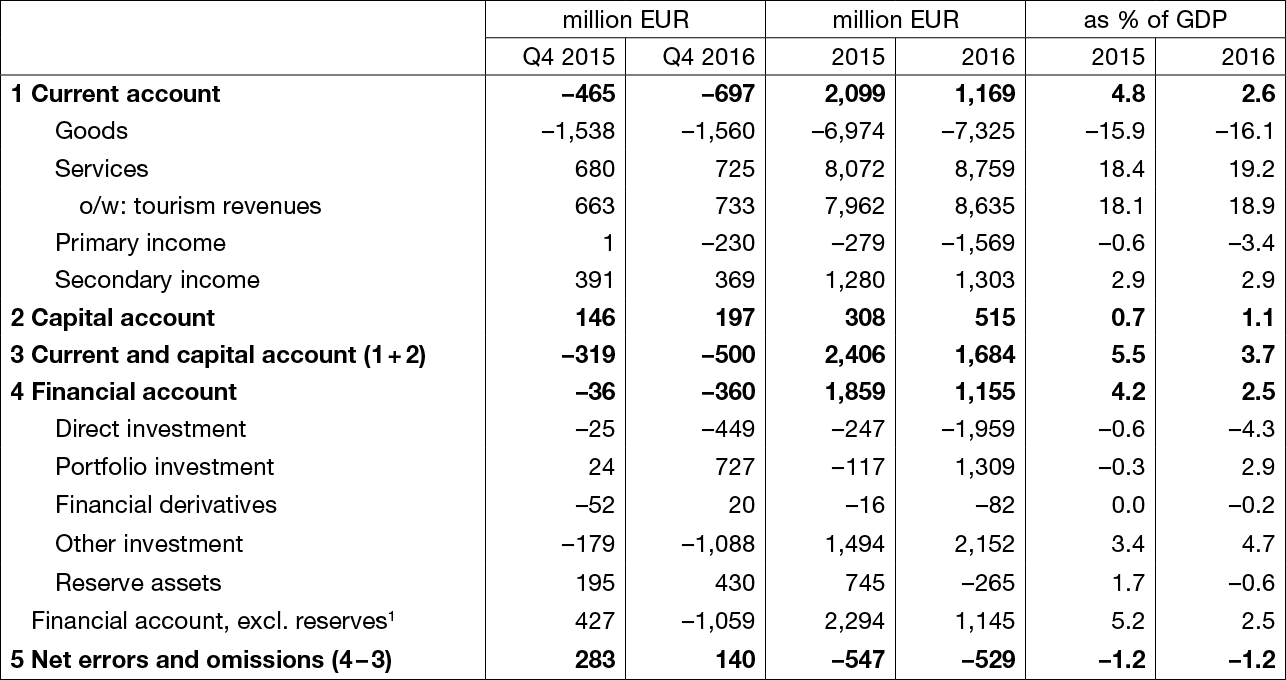

Table 1 Balance of payments

1 Excluding the change in gross international reserves and foreign liabilities of the CNB (investment of a part of reserves in reverse repo agreements results in a simultaneous, same-amount increase in assets and liabilities of the CNB).

Note: The positive value of financial transactions denotes net capital outflow abroad and the negative value denotes net capital inflow.

Source: CNB.

Data revision

Data on the balance of payments and the international investment position are revised in accordance with the commonly used practice, based on data obtained after the last quarterly dissemination. In addition, for the purpose of alignment of the balance of payments statistics with EU standards, for the periods starting with the first quarter of 2014, the goods account was revised by reducing the amount of imports and exports taken from CBS foreign trade statistics by the share which does not involve a change in ownership between residents and non-residents, not already excluded by the CBS. (see press release).