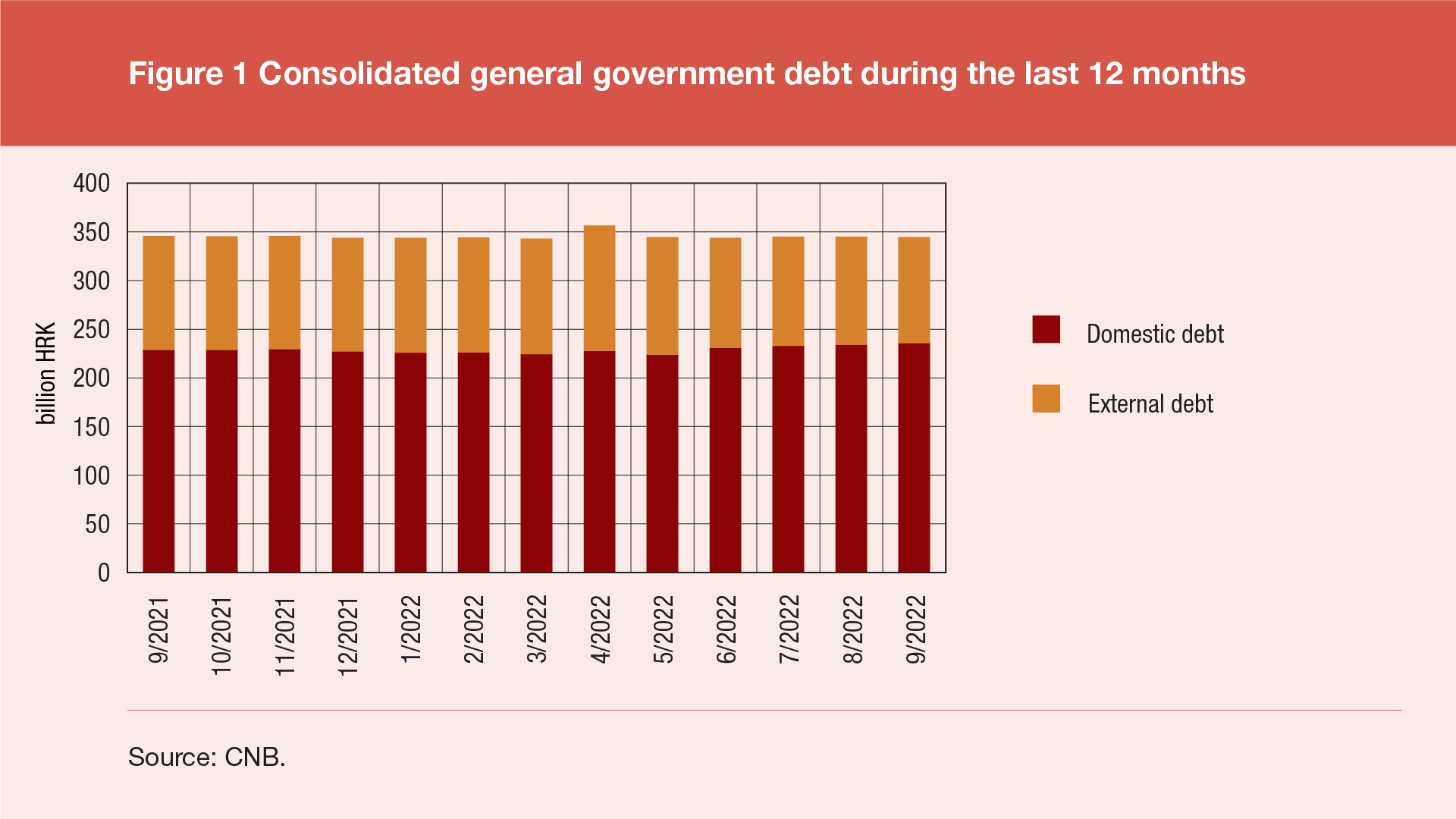

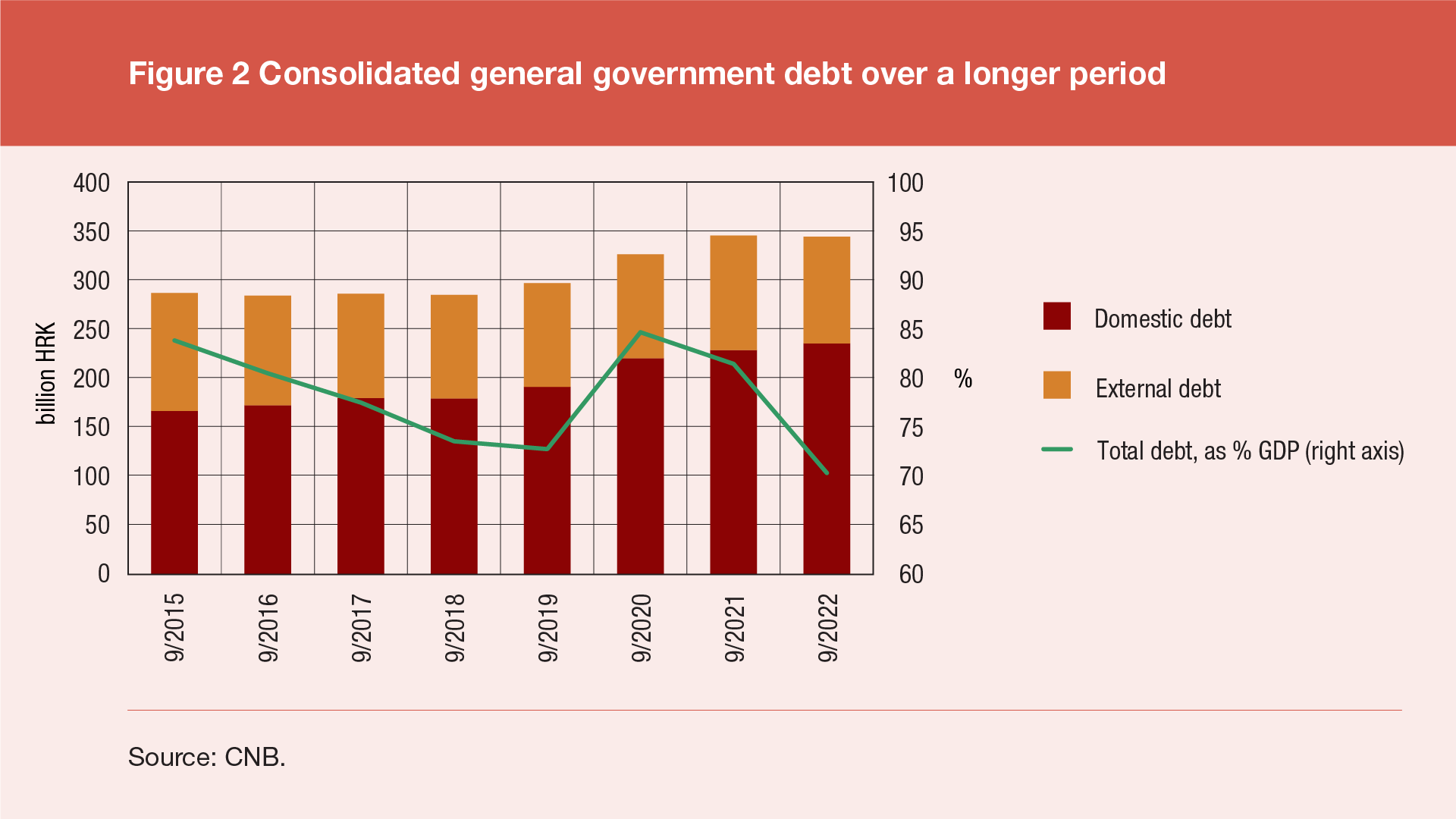

According to the final data of government finance statistics for the third quarter of 2022, the total consolidated debt of all general government sub-sectors[1] reached HRK 344.2bn at the end of September 2022, up by HRK 0.5bn (or 0.1%) from the end of June 2022 and down by HRK 1.3bn (or 0.4%) from the end of September 2021. The annual decrease in debt was due to a combination of a decrease in the external debt of HRK 8.1bn (or 7.0%) and an increase in the domestic debt of HRK 6.9bn (or 3.0%). Domestic debt rose by HRK 4.8bn (or 2.1%), and external debt fell by HRK 4.3bn (or 3.8%) compared to the end of the previous quarter.

Measured against the annual GDP[2], the share of debt in GDP continues to fall for the sixth consecutive quarter and is even recording a lower value than that at the end of the first quarter of 2020, i.e. at the moment just before the negative effects of the COVID-19 pandemic began adversely affecting this measure. The total debt at the end of September 2022 amounted to 70.4% of GDP, a decrease of 11.1 percentage points on an annual basis from 81.5% of GDP at the end of September 2021 and a decrease of 2.7 percentage points from the end of the previous quarter, when this share stood at 73.1%.

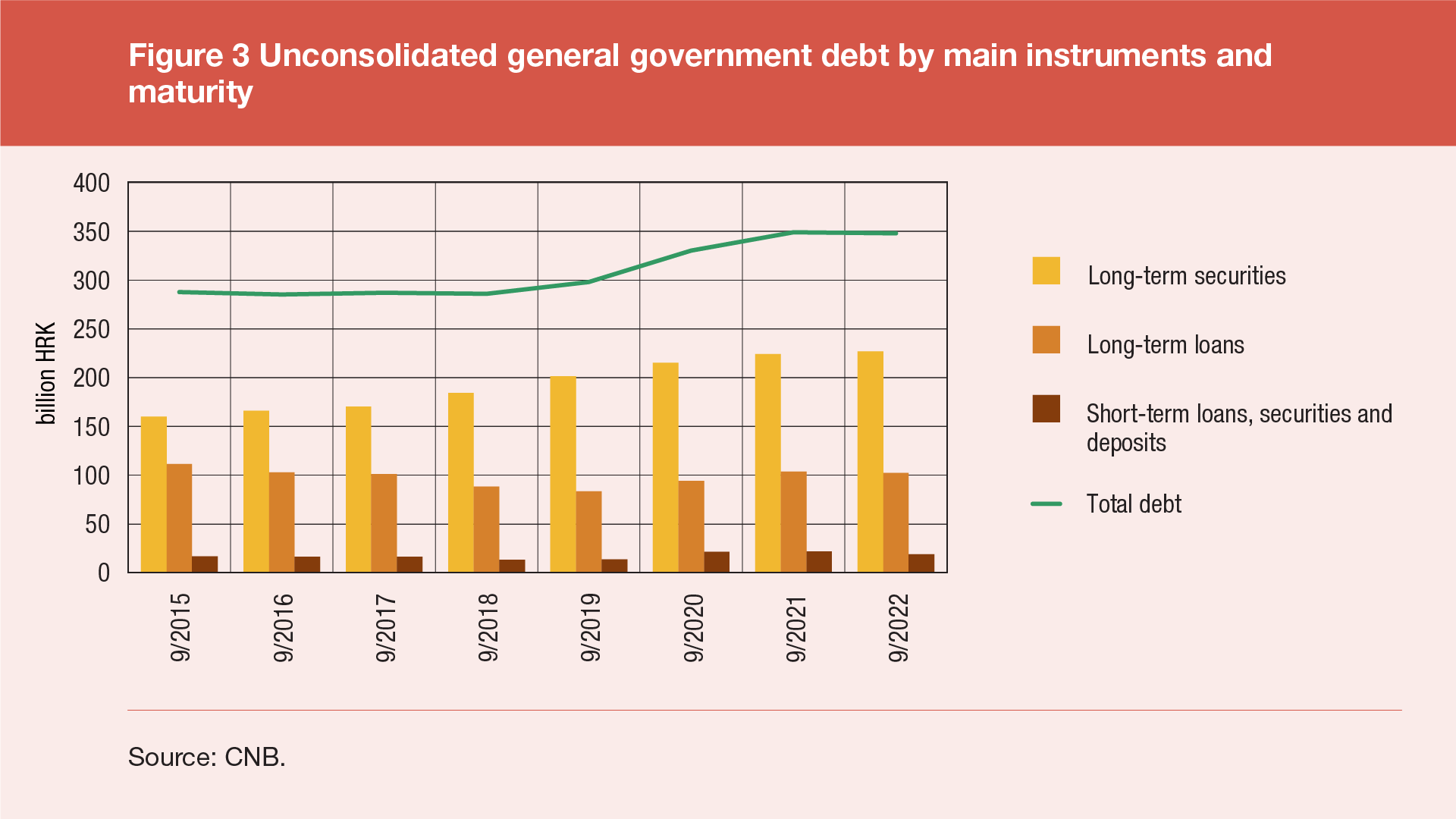

The general government debt structure by main debt instruments and maturity is available only on an unconsolidated basis[3]. Long-term debt instruments dominate the maturity structure of unconsolidated debt: at the end of September 2022 most of this debt was made up of bonds (65.3%), the second by importance were long-term loans (29.4%), and last were short-term loans, securities and deposits (jointly 5.4%). The short-term debt components decreased by HRK 2.8bn (or 13.2%) on an annual basis from the end of September 2021 to the end of September 2022, while the long-term debt components increased by HRK 1.8bn (or 0.5%) during the same period.

Statistical time series: Table I3 General government debt (ESA 2010)

-

This debt excludes the cross claims of institutions within the same sub-sector and between sectors, the so-called Maastricht debt. ↑

-

Calculated as the sum of the preceding four quarterly GDP figures. ↑

-

The unconsolidated debt represents the Maastricht debt increased by cross claims of different units within the general government sector. ↑