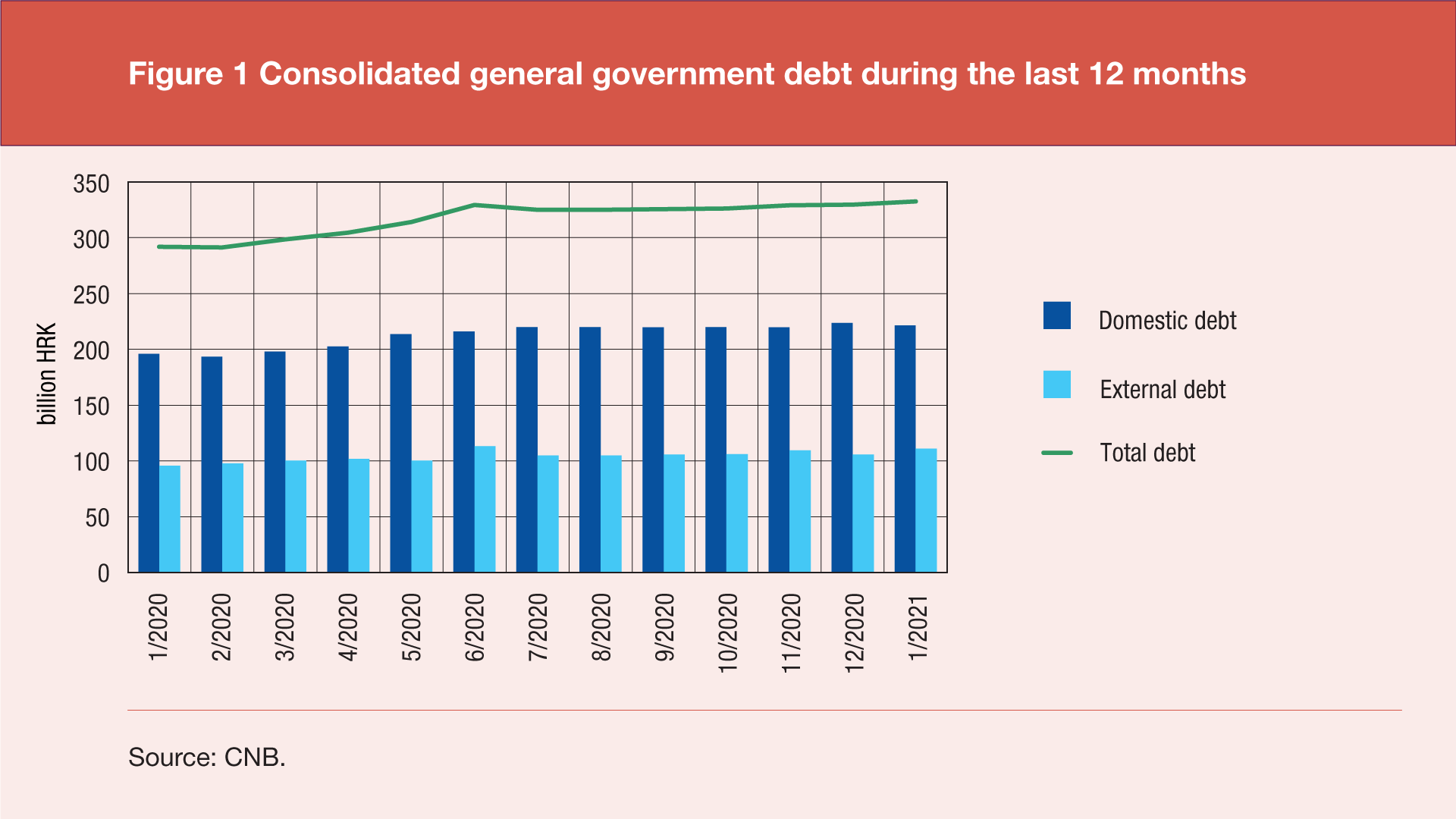

The total consolidated debt of all general government sub-sectors[1] reached HRK 332.3bn at the end of January 2021, up HRK 2.6bn (or 0.8%) since the end of the previous month and by HRK 40.6bn (or 13.9%) since the end-January 2020. The January increase was due to an increase in the foreign debt component in the amount of HRK 5.0bn (or 4.8%) while the domestic component shrunk by HRK 2.4bn (or 1.1%) in the same month. However, the increase in the last twelve months was mostly due to the increase in the domestic debt component of HRK 25.2bn (or 12.9%) since the end-January 2020.

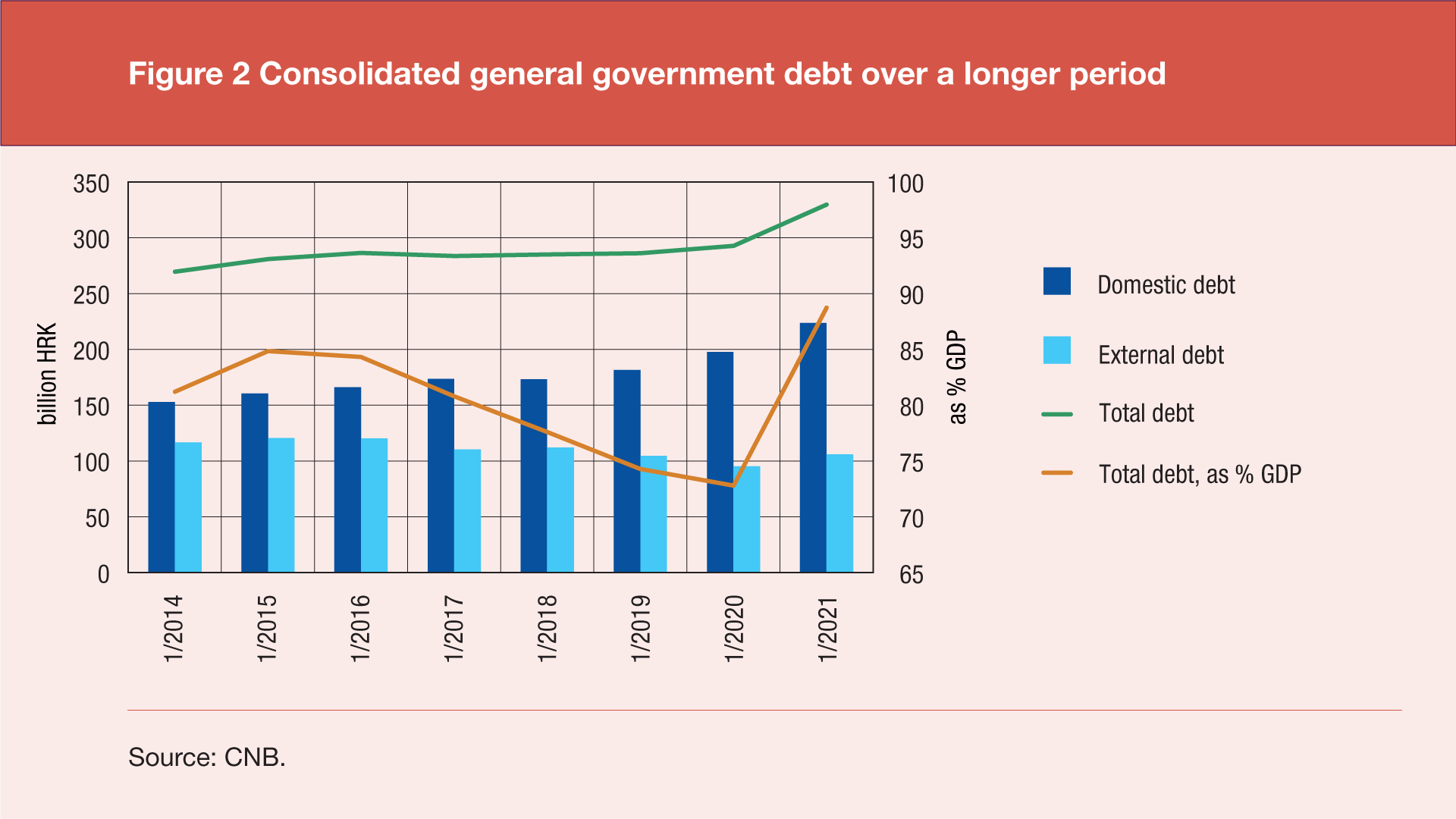

Following the recent revision of the data[2] on the gross domestic product (GDP) the relative indicators of the general government debt have changed mildly relative to their previously published values. Measured against the annual GDP[3], the total debt amounted to 88.7% of the annual GDP at the end of December 2020, and 72.8% of the annual GDP at the end of December 2019.

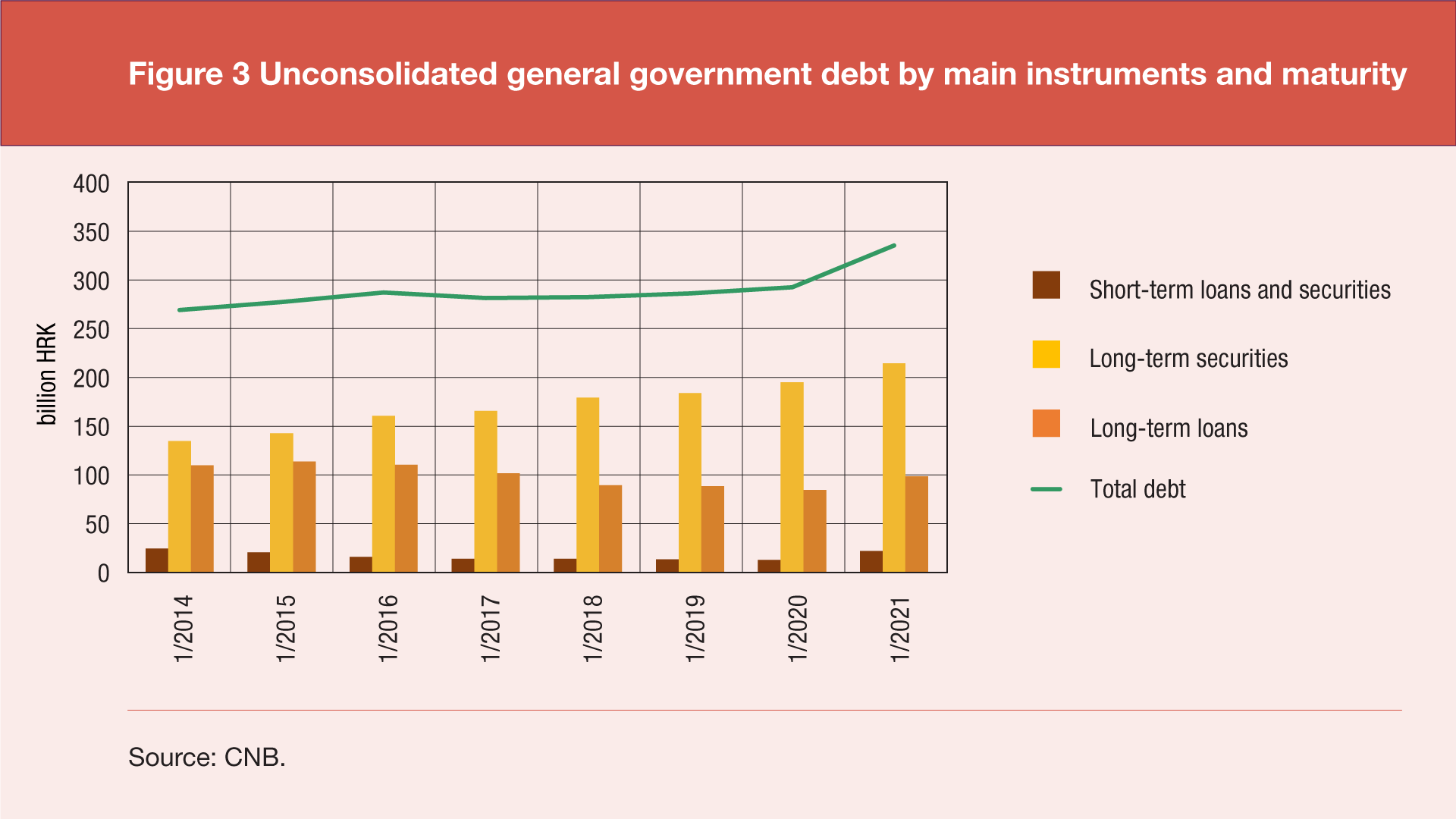

Data on the structure of the general government debt by main instruments and maturity is available only for the general government unconsolidated debt[4]. Long-term debt instruments dominate the maturity structure of this debt: at the end of January 2021 most of the debt was made up of bonds (64.0%), the second by importance were long-term loans (29.4%), and last were short-term loans and securities (jointly 6.6%). The total short-term debt (short-term loans and securities) increased by HRK 348m (or 1.6%) in January 2021 and by HRK 9.3bn (or 72.7%) in the twelve months since end-January 2020.

Statistical time series: Table I3 General government debt (ESA 2010).

-

This debt excludes the cross claims of institutions within the same sub-sector and between sectors, the so-called Maastricht debt. ↑

-

published on April 22, 2021 as part of the Excessive deficit procedure report for the Republic of Croatia ↑

-

Calculated as the sum of the preceding four quarterly GDP figures. ↑

-

The unconsolidated debt represents the Maastricht debt increased by cross claims of different units within the general government sector. ↑