The main objective of macroprudential measures is to strengthen banking system resilience against possible and sudden shocks. For this purpose, the CNB uses preventive measures and measures aimed at increasing banking system resilience:

- Capital conservation buffer (CCoB)

- Countercyclical capital buffer (CCyB)

- Systemic risk buffer (SRB)

- Systemically important institutions buffer (G-SII and O-SII)

- Reciprocation of measures

- Other measures and activities

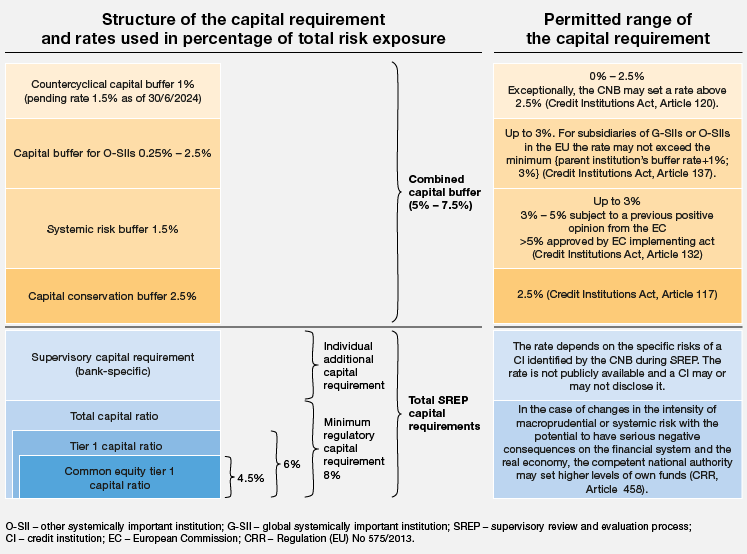

Structure of capital requirements for banks

Credit institutions in Croatia are required to maintain a capital requirement between 13% and 15.5% of total risk exposure (depending on the systemic importance of the credit institution), to which an individual capital requirement is added for each credit institution. The capital requirement structure is shown below.

The minimum own funds requirement amounts to 8% of total risk exposure. It is maintained as tier 1 (common equity tier 1 and additional tier 1) and tier 2 capital, whereby all credit institutions must, at any given moment, meet the following capital requirements:

- common equity tier 1 capital ratio of at least 4.5%;

- tier 1 capital ratio of at least 6%;

- total capital ratio of at least 8%.

The combined capital buffer is held in the form of common equity tier 1 ratio and amounts between 5% and 7.5% of total risk exposure, depending on the systemic importance of the credit institution. It consists of capital buffers that are functions of particular types of systemic risk. They include:

- the capital conservation buffer of 2.5%;

- the countercyclical capital buffer;

- the systemic risk buffer; and

- the systemically important credit institutions buffer.

The total amount of the combined capital requirement of a credit institution depends on the calibration of particular instruments. The combined capital buffer consists of the capital conservation buffer of 2.5% for all credit institutions, the countercyclical capital buffer that currently amounts to 1%, the systemic risk buffer of 1.5%, and the other systemically important institutions (O-SII) buffer that currently amounts between 0.25% and 2.5%.