SEPA (Single Euro Payments Area) represents a single euro payments market enabling citizens, business entities and public authorities to make cashless euro payment transactions in euro by means of uniform models and procedures applied equally throughout the SEPA area.

The SEPA area includes 36 states, of which 28 member states of the European Union and Iceland, Liechtenstein, Norway, Switzerland, Monaco San Marino, Andorra and the Holy See (the Vatican City State).

SEPA consists of:

- a single currency – the euro;

- a single set of payment instruments (credit transfer, direct debit);

- a common legal basis;

- common technical standards;

- infrastructure for the processing of payment transactions; and

- common business rules.

SEPA project in the European Union

The European Payments Council is the governing body for the development of the SEPA. The European Payments Council is a body of the European banking sector, which coordinates and adopts decisions in the area of payment operations. The European Payments Council contributes to the integration of the euro payments market by developing, inter alia, SEPA payment schemes as defined in the SEPA Credit Transfer and SEPA Direct Debit Rulebooks.

The members of the European Payments Council are payment service providers and their associations. The European Central Bank participates as an observer in the activities of all working groups of the European Payments Council.

A representative of the Republic of Croatia, nominated by the Croatian Banking Association, also participates in the work of the European Payments Council.

As the European Payments Council only comprises the representatives of the supply side of the payment service market, the European Commission and the European Central Bank have set up the SEPA Council thereby including the demand side of the payment service market in the SEPA project management. Pursuant to a decision of the European Central Bank, the SEPA Council was replaced by the Euro Retail Payments Board in December 2013, with the participation from the representatives of the payment service supply side (banking communities, payment institutions and electronic money institutions), demand side (the representatives of consumers, retailers, corporations, small and medium-sized enterprises and public administration bodies) and central banks.

The SEPA migration was carried out in every member state as part of the national projects for the implementation of SEPA standards.

SEPA project in the Republic of Croatia

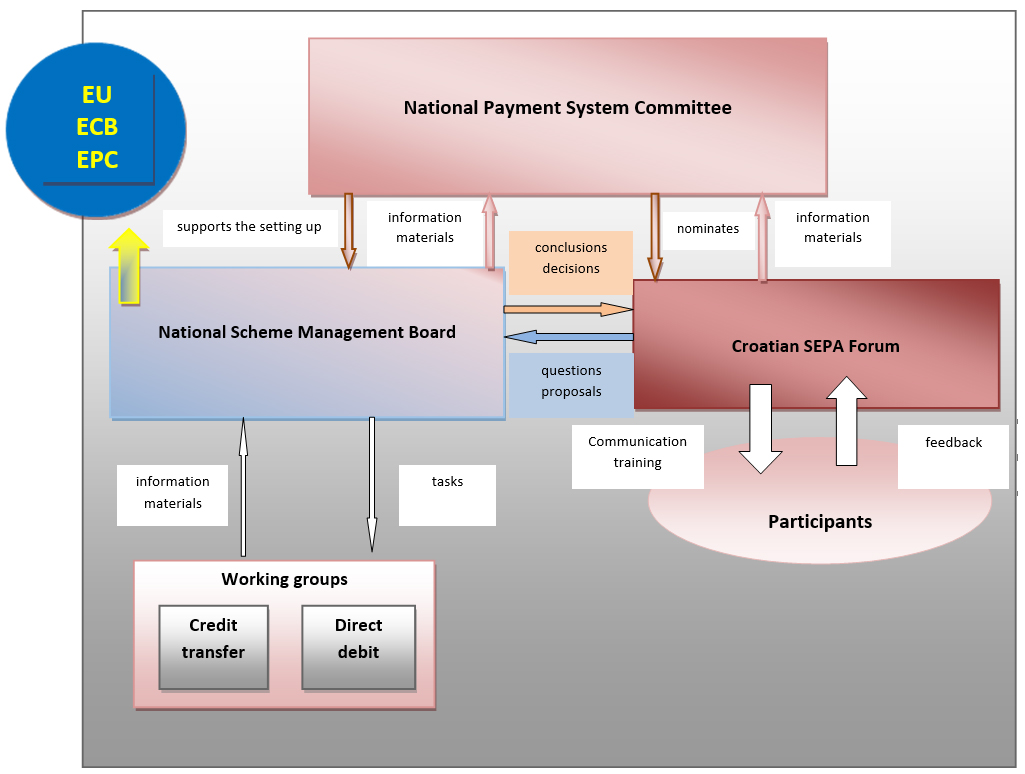

The national SEPA project was launched in April 2013 upon the initiative of the National Payment System Committee (NPSC)[1], an interinstitutional body providing support to the functioning of the payment system in the Republic of Croatia.

At the 20th NPSC meeting it was decided that the SEPA project in the Republic of Croatia would be managed by the National Payment System Committee, which coordinates, channels and monitors the activities of working groups, discusses open issues and compiles reports on the course of the project.

The SEPA working bodies in the Republic of Croatia are the Croatian SEPA Coordination Committee (CSCC) and the Croatian SEPA Forum (CSF). These bodies are independent in the performance of their tasks and report to the National Payment System Committee on completed activities. With regard to the scope of their tasks, if necessary, the working bodies can set up special working groups.

The Decisions on the establishment of SEPA working bodies (the Decision on the establishment of the Croatian SEPA Coordination Committee and the Decision on the establishment of the Croatian SEPA Forum) were enacted at the 22nd NPSC meeting in May 2013.

After preparing and adopting the national schemes for the execution of payment transactions of credit transfers and direct debits, i.e. the Rules of the HRK SCT scheme, Core HRK SDD scheme and B2B HRK SDD scheme, the CSCC has concluded that it is necessary to set up a special body that would be charged with the management of the schemes.

At its 24th meeting held on 18 May 2015, the National Payment System Committee adopted the decision to set up the National Scheme Management Board (NSMB).

With the setting up of the NSMB, the need for the operation of the CSCC has ceased, and the NSMB took over the role in the further management of national SEPA schemes, as well as the task of a further development of the SEPA project in the Republic of Croatia.

SEPA payment instruments

In order to achieve the SEPA goals, new payment instruments have been developed, the SEPA Credit Transfer and the SEPA Direct Debit, which are used for euro payments throughout the SEPA area.

SEPA payment instruments are used in line with SEPA payment schemes, consisting of a common set of rules, practices and standards agreed on an interbank level. These schemes are defined by SEPA Rulebooks, i.e., the SEPA Credit Transfer Rulebook and the SEPA Direct Debit Rulebook. The rules and standards described in the Rulebooks are obligatory for payment service providers that adhered to SEPA schemes. The same set of SEPA payment instruments and uniform rules for SEPA schemes enable payment service users to execute cashless payment transactions in euro in the same manner and under the same conditions throughout the SEPA area.

Credit transfer

Credit transfer means a national or cross-border payment service for crediting a payee's payment account with a payment transaction or a series of payment transactions from a payer's payment account by the PSP which holds the payer's payment account, based on an instruction given by the payer.

Direct debit

Direct debit means a national or cross-border payment service for debiting a payer's payment account, where a payment transaction is initiated by the payee on the basis of the payer's consent.

The SEPA migration in the Republic of Croatia has led to changes in the rules of execution of the payment instruments and payment infrastructure existing at the time. By a decision of the National Payment System Committee, kuna payment transactions were included in the national SEPA project in addition to euro payment transactions. The application of SEPA standards to kuna payment transactions ensured a single technological platform in the Republic of Croatia for the processing of payment transactions as well as the necessary preconditions for the further development of payment services in the Republic of Croatia in compliance with European standards. This also enabled an adequate preparation of the overall payment system in the Republic of Croatia on time for the introduction of the euro as the official currency from 1 January 2023.

National SEPA migration plan

In order to implement the Croatian SEPA project on time and within the deadlines set forth in Regulation (EU) No 260/2012 and inform all SEPA project participants affected by changes in the area of payment operations, the National Payment System Committee adopted the National SEPA Migration Plan. The document comprises a detailed description of the activity plan and the course of migration within the defined deadlines.

The complete document is published on the Croatian SEPA project website.

Since in the meantime certain changes have occurred in the organisational structure of the implementation of the SEPA project and changes proposed in the previously accepted deadlines that refer to the beginning of the implementation of specific activities from the SEPA Migration Plan, the NPSC accepted its amendments unanimously at its 24th and 26th meeting.

As a result of the accepted amendments, the National SEPA Migration Plan – Annex 1 was prepared, containing the following: the organisational scheme of the SEPA project was changed, the decision was adopted on the termination of work of the CSCC and the NSMB was set up, the new dates for the beginning of the implementation of the Rules of the HRK SCT Scheme, the Rules of the HRK SDD Core Scheme and the Rules of the HRK SDD B2B Scheme and the new date for the beginning of operation of the EuroNCS were agreed.

The National SEPA Migration Plan – Annex 1 is available here.

Subsequently, pursuant to the proposal to defer the date for the implementation of HRK SDD schemes set in Annex 1 to the National SEPA Migration Plan, at its 27th meeting, the NPSC adopted a decision supplementing the HRK SDD Core Scheme Rules (v2.0) and the HRK SDD B2B Scheme Rules (v2.0), setting a new deadline for the beginning of their implementation.

In accordance with the accepted changes, in January 2017, the National Migration Plan – Annex 2 was prepared, changing the date for the beginning of implementation of the HRK SDD Core Scheme Rules and the HRK SDD B2B Scheme Rules.

In the meantime, the NSMB proposed to the NPSC a different model of migration of the existing direct debits to SEPA direct debits, which includes minor changes in migration dates.

At its 28th meeting, held on 3 May 2017, the NPSC accepted the NSMB's proposal and, accordingly, the National SEPA Migration Plan was updated and Annex 3 was prepared.

SEPA legal framework

The SEPA legal framework consists of the following regulations:

I Directive (EU) 2015/2366

In 2015, the EU adopted a new Directive (EU) 2015/2366 of the European Parliament and of the Council of 25 November 2015 on payment services in the internal market, amending Directives 2002/65/EC, 2009/110/EC and 2013/36/EU and Regulation (EU) No 1093/2010, and repealing Directive 2007/64/EC, to improve the existing rules for safer payments and consumer protection taking new digital payment services into account. Directive (EU) 2015/2366 became applicable in January 2018.

II Payment System Act

The provisions of Directive (EU) 2015/2366 on payment services in the Republic of Croatia are transposed into the Payment System Act.

III Regulation (EU) 2021/1230

Regulation (EU) 2021/1230 of the European Parliament and of the Council of 14 July 2021 on cross-border payments in the Union by which the provisions of Regulation (EC) No 924/2009 and any of its subsequent amendments that are at the same time repealed by this Regulation are consolidated in a new legally binding act, prescribes the obligatory application of the same charges for cross-border payments in euro (payments between the payment service providers that are located in different member states including Norway, Island and Lichtenstein) and charges for corresponding national payments in the national currency of the member state.

For more information on regulations repealed by this Regulation see here.

IV Regulation (EU) No 260/2012

Regulation (EU) No 260/2012 of the European Parliament and of the Council of 14 March 2012 establishing technical and business requirements for credit transfers and direct debits in euro and amending Regulation (EC) No 924/2009 prescribes deadlines for the migration from existing national credit transfers and direct debits in euro to the SEPA credit transfer and direct debit schemes in accordance with the defined rules and technical standards. Regulation (EU) No 260/2012 prescribes the mandatory application of technical standards and defined rules, including the use of the International Bank Account Number (IBAN) and the financial services messaging standard (ISO 20022 XML) for all credit transfers and direct debits in euro in the European Union.

Member states that had not introduced the euro, including the Republic of Croatia, were obliged to fulfil SEPA requirements prescribed by the said Regulation at the latest until 31 October 2016.

The deadline for member states that had introduced the euro for the migration to SEPA credit transfers and direct debits was 1 February 2014. The deadline was later prolonged pursuant to Regulation (EU) No 248/2014 of the European Parliament and of the Council of 26 February 2014 amending Regulation (EU) No 260/2012 until 1 August 2014.

V Act on the Implementation of EU Regulations Governing Payment Systems

With the aim of implementing Regulation (EC) No 924/2009, Regulation (EU) No 260/2012 and Regulation (EU) No 2015/751 in the segment defining the national authorities competent for exercising supervision and dealing with complaints, regulating out-of-court complaints and redress procedures and defining infringements of regulations, the Republic of Croatia adopted the Act on the Implementation of EU Regulations Governing Payment Systems.

VI Regulation (EC) No 1781/2006

Regulation (EC) No 1781/2006 of the European Parliament and of the Council of 15 November 2006 on information on the payer accompanying transfers of funds imposes the obligation on payment service providers to have transfers of funds accompanied by accurate and meaningful information on the payer so that it is always possible to trace the transfer of funds back to the payer himself, regarding activities related to the prevention, investigation and detection of money laundering and terrorist financing.

On 20 May 2015, the European Parliament and the Council adopted Regulation (EU) No 2015/847 of the European Parliament and of the Council of 20 May 2015 on information accompanying transfers of funds and repealing Regulation (EC) No 1781/2006.

The Regulation shall apply from 26 June 2017, and from that date Regulation (EC) No 1781/2006 shall cease to apply.

SEPA infrastructure for the clearing and settlement of payment transactions

Regulation (EU) No 260/2012 requires the operators of euro retail payment systems in the European Union or their participants to ensure that the payment system is technically interoperable with other retail payment systems in the EU.

Specifically, the SEPA infrastructure for the clearing and settlement of payment transactions must be capable of processing SEPA euro payments made between all SEPA scheme participants. The reachability of all SEPA scheme participants, irrespective of in which country of the SEPA area they are located, can be ensured by establishing technical interoperability of payment infrastructures.

According to the National SEPA Migration Plan, a single national payment infrastructure for the clearing of national and cross-border SEPA credit transfers in euro will be set up in the Republic of Croatia, in line with the agreement with the Croatian banking community.

The EuroNCS payment system became operational on 6 June 2016. It is a new payment system in the Republic of Croatia that executes the clearing of euro payment transactions implemented according to the rules of the SEPA Credit Transfer (SCT) scheme for credit transfers of the European Payments Council.

In addition, for the purpose of maintaining euro accounts of banks, the Croatian National Bank has set up the TARGET2 HR national component of the payment system to settle the clearing of national and cross-border payment transactions in euro. TARGET2 (the Trans-European Automated Real-time Gross settlement Express Transfer system) is a centralised large-value payment system in euro, which is supervised by the European Central Bank.

The TARGET2-HR national component, in which the settlement of the clearing in EuroNCS is executed, started production operations on 1 February 2016, in accordance with the National SEPA Migration Plan.

Useful Links

All information related to the SEPA project in the Republic of Croatia is available at the official website of the Croatian SEPA project.

Other links:

EUROPEAN CENTRAL BANK

EUROPEAN PAYMENTS COUNCIL

EUROPEAN COMMISSION

Video on SEPA

The European Central Bank has published an informative video on the SEPA.

- The main tasks of the National Payment System Committee relate to all aspects of functioning of the domestic payment system, including, among other things, defining and proposing the implementation of joint measures within the payment system, aimed at ensuring a uniform implementation of regulations and proposing guidelines for the development of the domestic payment system in accordance with EU Directives and accepted international standards.↑