From August 2023 the comments on statistics, a short description of selected, recently issued statistical data in the area of monetary statistics and the non-residents sector statistics, are no longer published. They are replaced by Statistical releases.

Comments on loan and deposit developments in April 2023

Total deposits of domestic sectors[1] rose in April after having fallen steadily throughout the first quarter of 2023. The corporate sector continued to shift funds from overnight to time deposits. Lending to domestic sectors continued to rise, reflecting the increase in loans to corporates and to a lesser extent the increase in loans to households, particularly general-purpose cash loans.

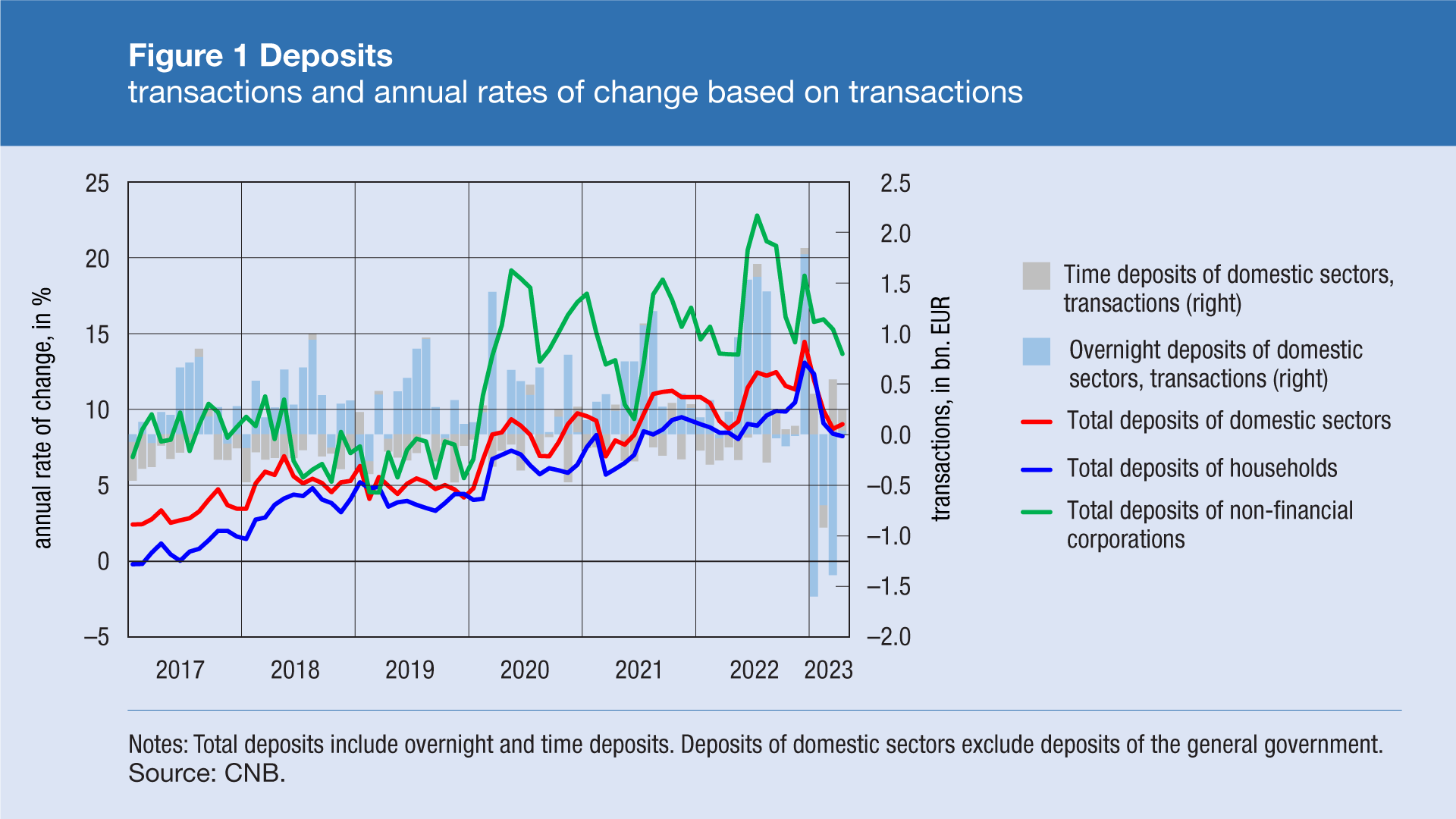

Total deposits of the domestic sectors rose by EUR 0.3bn (0.5% transaction-based) in April from the previous month, after having fallen in the previous three months. The bulk of the increase can be attributed to time deposits (EUR 0.2bn), and for the first time in 2023, overnight deposits also rose, albeit slightly[2]. Time deposits of non-bank financial institutions and non-financial corporations rose, with a visible shift from corporate overnight deposits, which fell, to time deposits, driven by interest rate increase. In contrast, a much smaller increase in interest rates on household time deposits resulted in a fall in household time deposits in April, while household overnight deposits rose for the first time since December 2022. On an annual level, the growth in total deposits of the domestic sectors accelerated from 8.7% in March to 9.0% in April (transaction-based). The annual growth in deposits of non-bank financial institutions accelerated, in contrast with the fall in the annual growth in deposits of non-financial corporations and households (Figure 1).

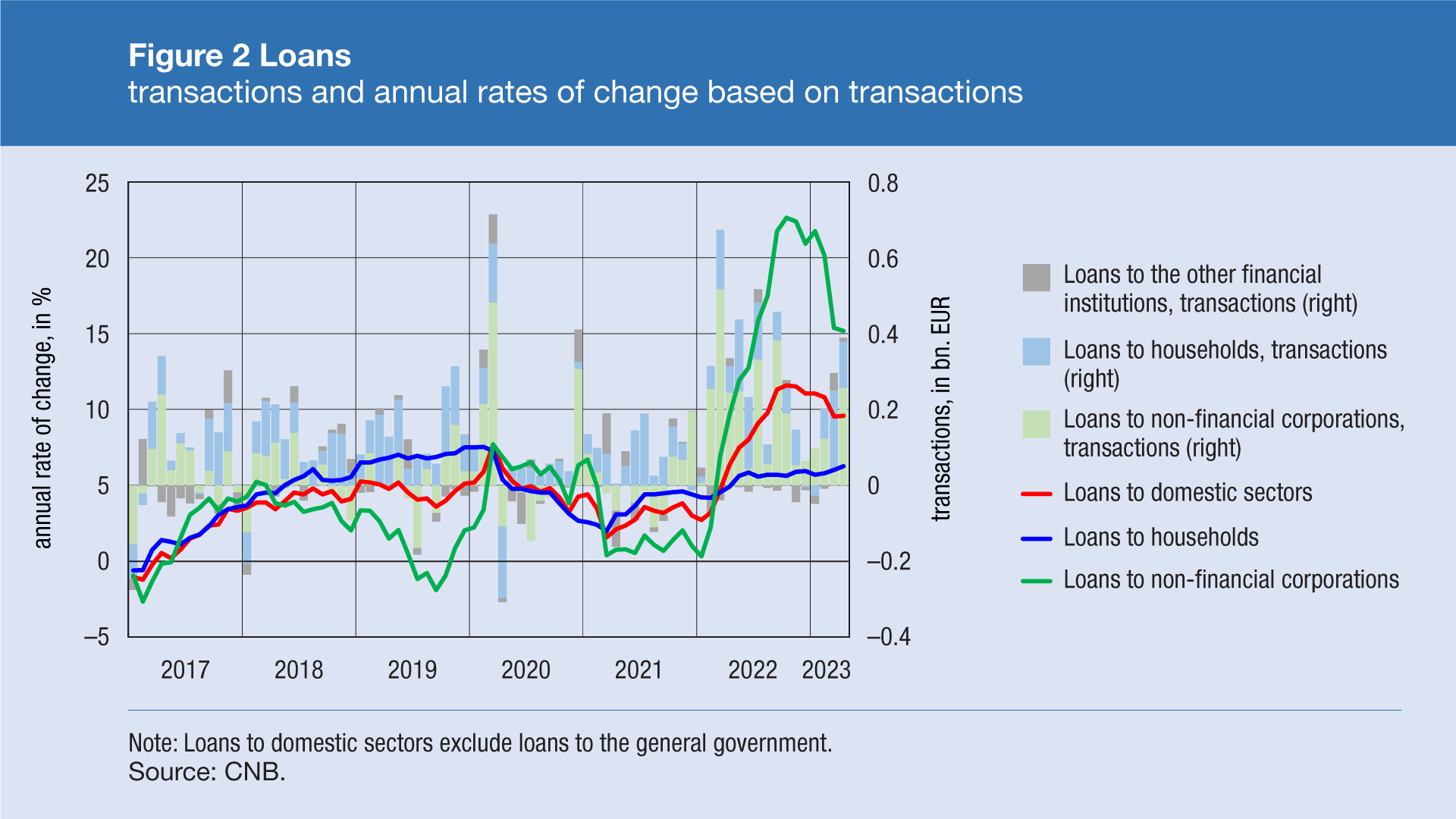

In April, loans to the domestic sector rose by EUR 0.4bn or 1.1% (transaction-based) from March. Loans to non-financial corporations account for the bulk of the mentioned loans growth (EUR 0.3bn) while loans to households account for the rest of the increase (EUR 0.1bn). Loans in the activities of transportation and storage rose the most. In terms of loans by purpose, loans for working capital and investment loans rose the most. As regards household loans, general-purpose cash loans rose faster than housing loans, which recorded only a marginal increase. On an annual level, the growth in loans to domestic sectors accelerated only slightly, from 9.5% in March to 9.6% in April. The growth in loans to non-financial corporations slowed down from 15.4% in March to 15.2% in April, transaction-based, while loans to households continued to accelerate, having risen from 6.0% to 6.3%, primarily mirroring acceleration in the growth of general-purpose cash loans (up from 4.3% to 5.0%), and a less pronounced acceleration in housing loans growth (up from 9.6% to 9.8%) (Figure 2).

For detailed information on monetary statistics as at April 2023, see:

Central bank (CNB)

Other monetary financial institutions