From August 2023 the comments on statistics, a short description of selected, recently issued statistical data in the area of monetary statistics and the non-residents sector statistics, are no longer published. They are replaced by Statistical releases.

Comments on loan and deposit developments in February 2023

February 2023 was marked by a decrease in total deposits of domestic sectors[1], largely of the household sector, subscribing for the first time a substantial amount of government bonds in the primary market. Loans to domestic sectors[2] increased over the same period, mostly reflecting the continued growth in loans to non-financial corporations. Loans to households also picked up, primarily owing to a rise in general-purpose cash loans, while housing loans are expected to increase significantly in the upcoming months due to a new round of the housing loans subsidy programme.

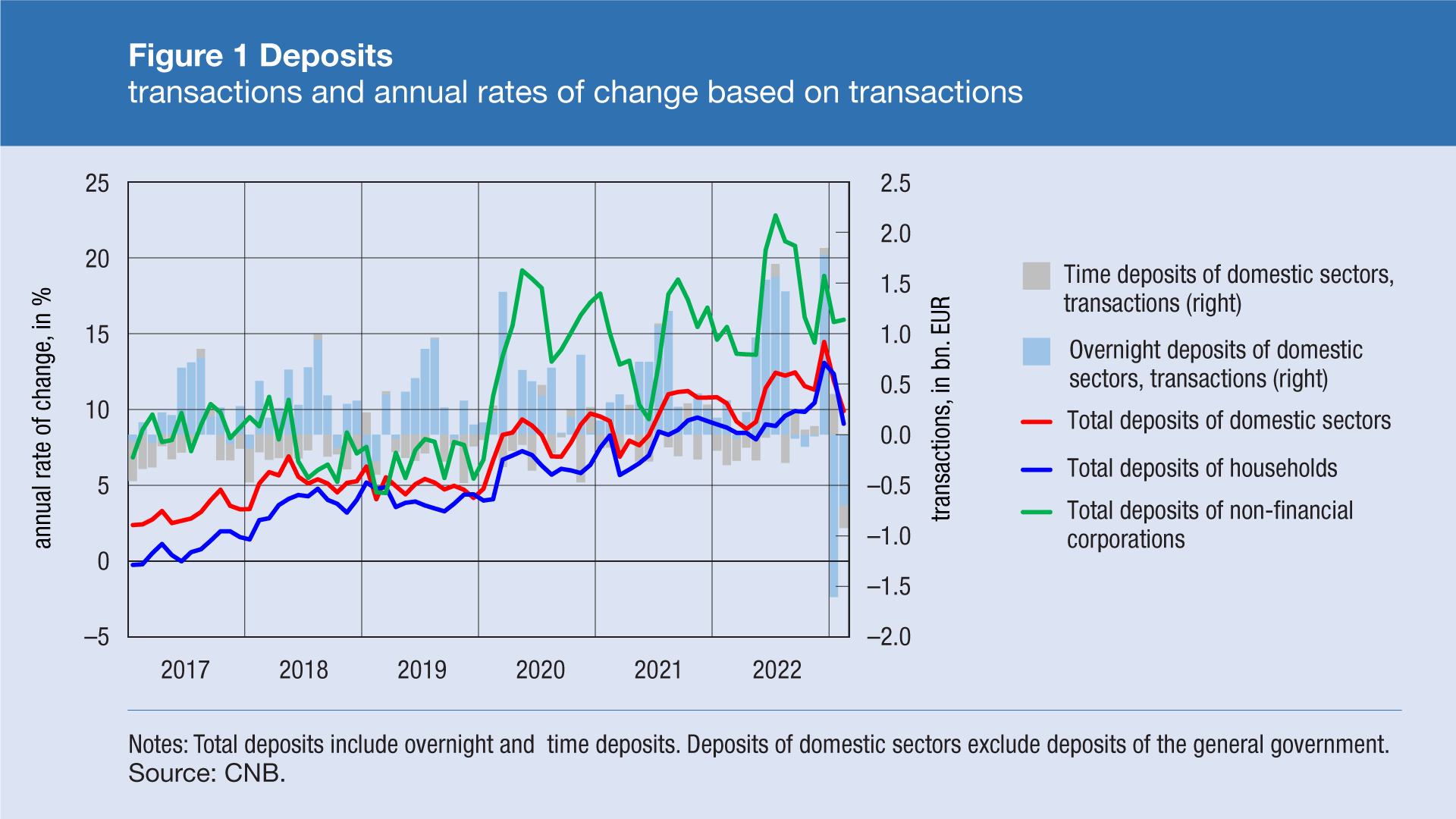

Total deposits of domestic sectors decreased by a further EUR 0.9bn or 1.7% (transaction-based) in February 2023 from the month before. The decrease in total deposits is reflected in a decline both in overnight deposits[3] and, to a lesser degree, in time deposits. Broken down by sectors, the largest decline was recorded in the household sector, mirroring the subscription of government bonds, standing at around EUR 1bn at the end of February.[4] Deposits of non-financial corporations also decreased, albeit to a substantially lesser extent, with a continued spillover of overnight deposits to time deposits due to the upward trend in interest rates on time deposits. On an annual level, the growth of total deposits of domestic sectors decelerated from 11.9% in January to 9.9% in February (transaction-based), attributable to a slowdown in the growth of household deposits (from 12.3% to 9.1%), while deposits of non-financial corporations edged up (from 15.8% to 15.9%) (Figure 1). Following the adoption of the euro, currency in circulation in Croatia cannot be precisely calculated. In other words, the precise quantification of currency in circulation can only be obtained for the euro area as a whole, and this aggregate is broken down into balance sheets of national central banks by applying the capital key of the European Central Bank. Nevertheless, the decline in the net supplied amount of currency from the CNB vault (in both kuna and euro) underpinned a rise in deposits and a drop in currency in circulation.

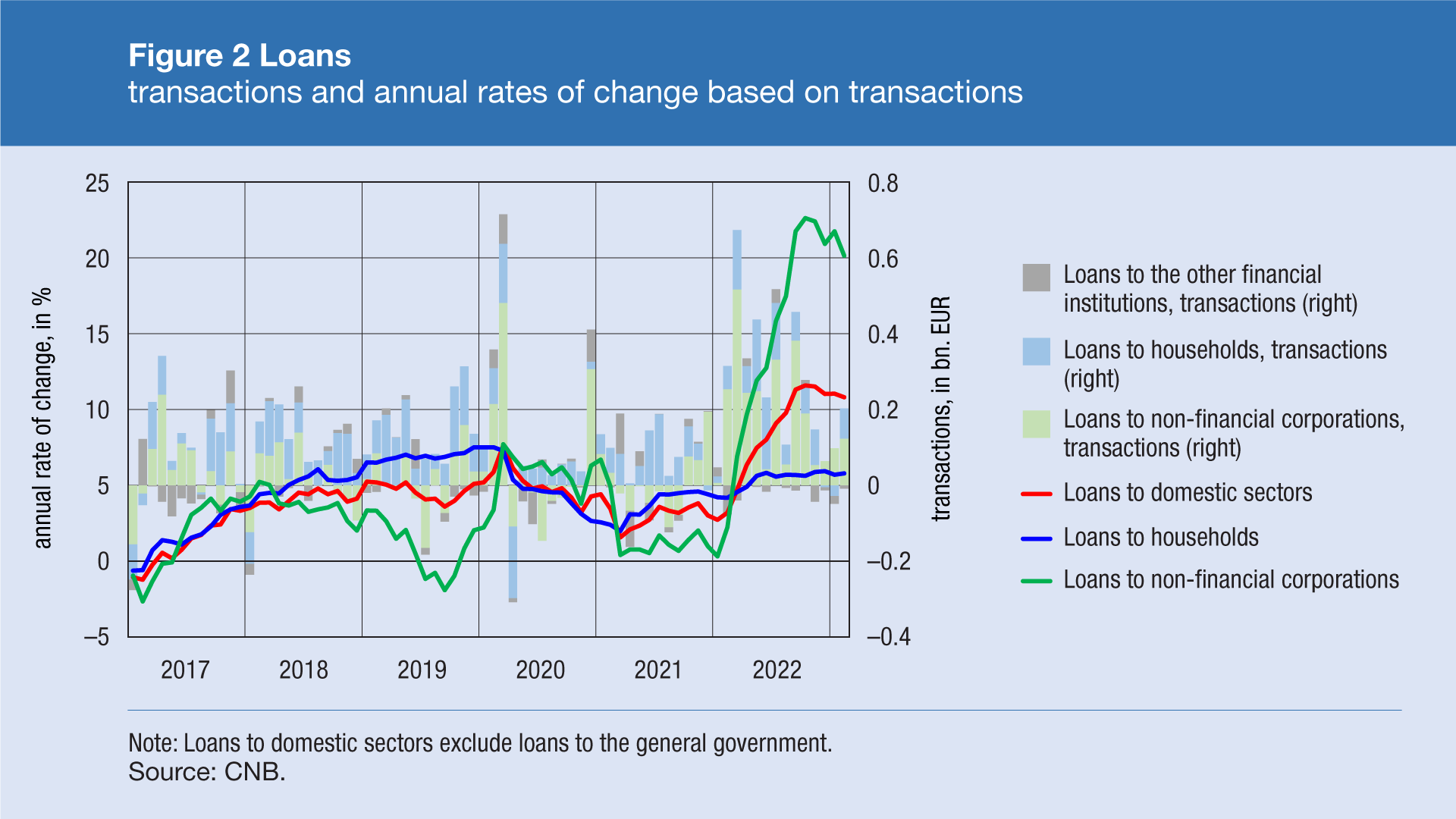

Loans to domestic sectors grew by EUR 195m or 0.6% (transaction-based) in February 2023, predominantly reflecting the rise in lending to non-financial corporations (EUR 124m or 0.9%), mostly in the manufacturing and construction sectors, as well as in the area of accommodation and food service activities. Loans to households also edged up, while loans to other financial institutions declined. The growth in loans to households came from general-purpose cash loans, while housing loans should pick up substantially in the upcoming months, following a new round of the housing loans subsidy programme launched in mid-March. Notwithstanding the monthly growth in corporate loans, the annual growth in loans to non-financial corporations moderated from 21.7% in January to 20.1% in February due to the base effect, i.e. on account of a strong growth in corporate loans in February last year. The annual growth in household loans accelerated only slightly (from 5.7% to 5.8%, Figure 2), reflecting a rise in general-purpose cash loans (from 2.9% to 3.5%), while housing loans decelerated (from 10.0% to 9.8%).

For detailed information on monetary statistics as at February 2023, see:

Central bank (CNB)

Other monetary financial institutions

-

Excluding the general government. ↑

-

Excluding the general government. ↑

-

Overnight deposits are deposits which clients place at a bank overnight. The most common categories of such deposits are funds in current accounts and giro accounts (transaction accounts). ↑

-

At the end of the month, the paid funds were mostly held on temporary bank accounts of underwriters and were not yet transferred to the Ministry of Finance. ↑