From August 2023 the comments on statistics, a short description of selected, recently issued statistical data in the area of monetary statistics and the non-residents sector statistics, are no longer published. They are replaced by Statistical releases.

Comments on loan and deposit developments in May 2023

Total deposits of domestic sectors[1] rose very moderately in May reflecting the growth in overnight deposits of households and non-financial corporations. At the same time, time deposits of all domestic sectors decreased. Relatively strong credit activity continued in May, accompanied by a significant flow of new loans to households (in particular housing loans granted under the government subsidy programme) as well as to corporations, if at a weaker intensity of annual growth.

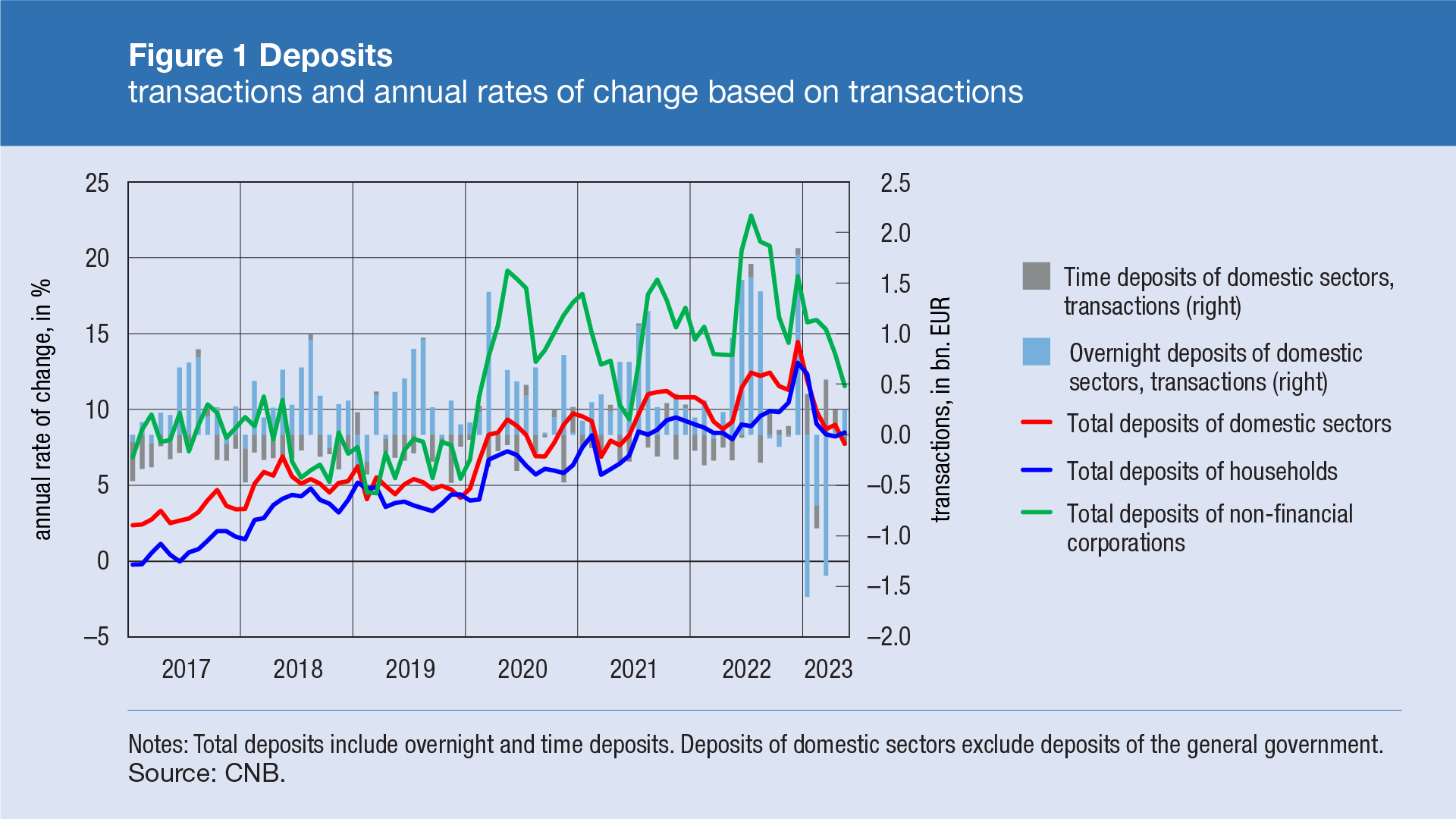

Total deposits of domestic sectors rose very moderately by EUR 0.1bn or 0.3% (transaction- based) in May from April. Overnight deposits[2] increased (EUR 0.2bn) and time deposits decreased slightly (EUR 0.1bn). The increase in household deposits (EUR 0.2bn) and, to a lesser extent, in corporate deposits (EUR 0.1bn) mostly contributed to the increase in total overnight deposits, while overnight deposits of non-banking financial institutions decreased (EUR 0.1bn). In contrast, time deposits of all domestic sectors declined in May. On an annual level, the growth in total deposits of the domestic sectors decelerated from 9.0% in April to 7.7% in May (transaction-based) as a result of base effect, i.e. a sharp increase in deposits in May of the previous year. The decline in the deposits of non-banking financial institutions widened strongly on an annual level, while the growth in corporate deposits continued to decelerate (Figure 1).

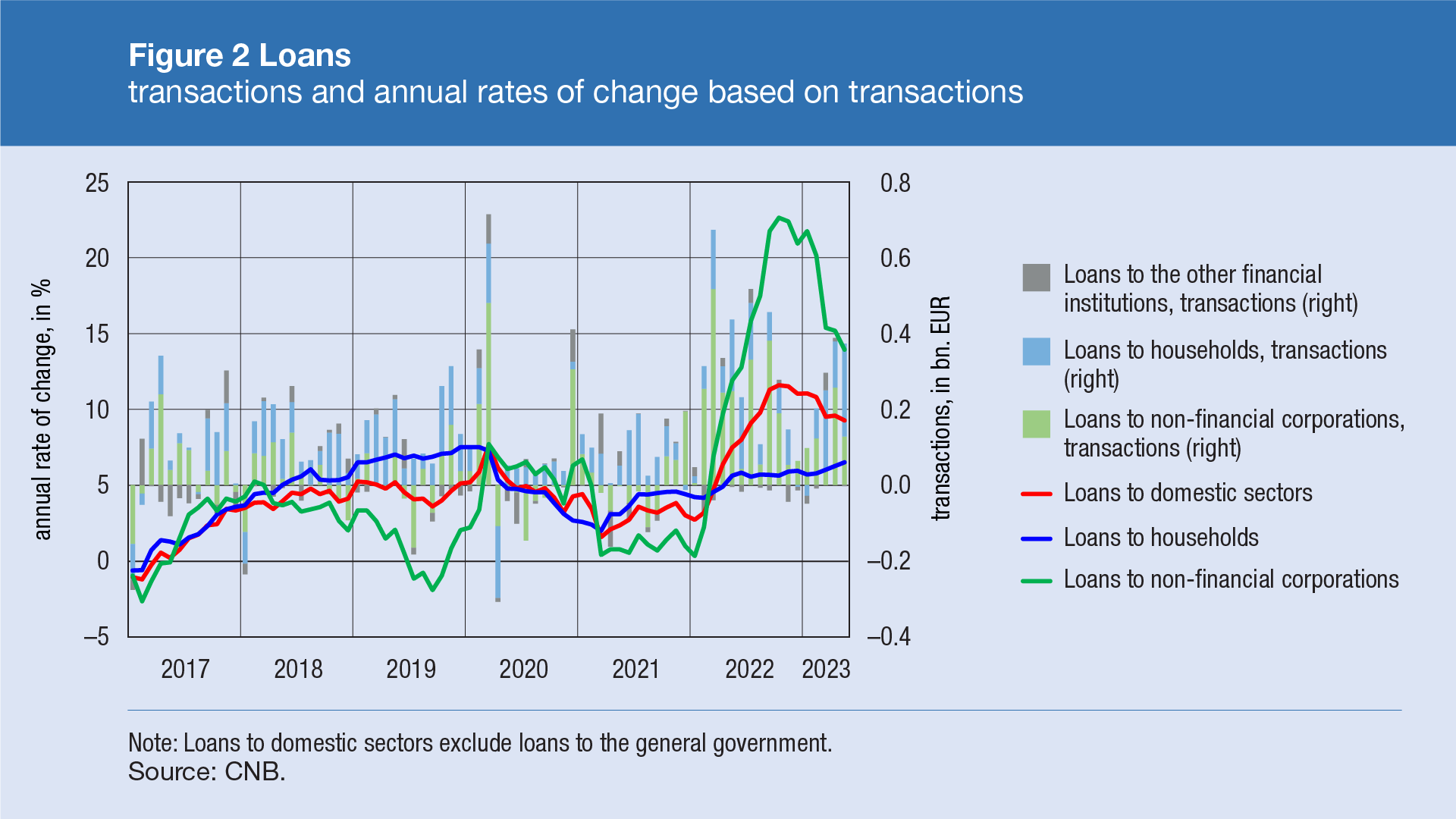

In May, loans to the domestic sector also continued to rise by EUR 0.4bn or 1.1% (transaction-based) from April. Broken down by sectors, household loans increased the most (EUR 0.2bn) following a new round of the housing loans subsidy programme and the increase in general-purpose cash loans. Loans to non-financial corporations increased by EUR 0.1bn of which the largest share accounted for loans for working capital and syndicated loans. On an annual level, household loans accelerated moderately (from 6.3% in April to 6.5% in May, based on transactions) mirroring the growth in general-purpose cash loans (from 5.0% to 5.7%), while the growth in housing loans decelerated slightly (from 9.8% to 9.5%) taking into account the stronger growth in May of the previous year. Strong credit activity in May last year also slowed down the increase in corporate loans (from 15.2% to 13.9%) so that total loans to the domestic sector decelerated (from 9.6% to 9.3%, Figure 2).

For detailed information on monetary statistics as at May 2023, see:

Central bank (CNB)

Other monetary financial institutions