From August 2023 the comments on statistics, a short description of selected, recently issued statistical data in the area of monetary statistics and the non-residents sector statistics, are no longer published. They are replaced by Statistical releases.

Comments on the balance of payments, gross external debt and the international investment position in 2Q 2023

The current and capital account balance improved noticeably in the second quarter of 2023 relative to the same period in the previous year, primarily as a reflection of the strong increase in the total surplus in the secondary income and capital transaction accounts amid record payments from EU funds to end beneficiaries. The financial account of the balance of payments registered a net capital outflow with an improvement in the relative indicators of external debt and the international investment position.

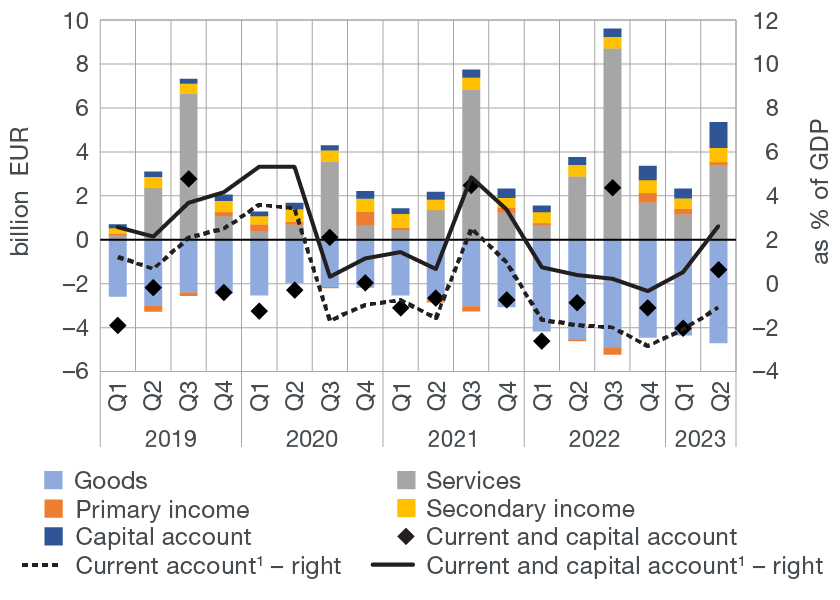

The current and capital account of the balance of payments ran a surplus of EUR 0.6bn in the second quarter of 2023, which is an increase of EUR 1.5bn from the same period of the previous year. This was primarily due to transactions with the EU budget, i.e. strong increase in the total surplus in the secondary income and capital transaction accounts (by EUR 1.0bn) amid record payments from EU funds to end beneficiaries. Namely, excellent absorption is predominantly linked to the fact that the last day of June 2023 was the final deadline for the disbursement of the remaining funds for post-earthquake reconstruction from the EU solidarity fund. In addition, favourable developments were also aided by the growth in the primary income account surplus, which to a great extent reflects higher payments of direct subsidies to the domestic agricultural sector from the EU budget. With the exception of EU funds, the improvement in the current and capital account balance was aided by the increase in net export of services, primarily as a result of strong increase in revenues from tourism. In contrast, foreign trade deficit widened paired with the concurrent decrease in goods exports and imports on an annual level. If the last four quarters are observed, the cumulative surplus in the current and capital account in the period up to the end of June 2023 totalled 2.6% of GDP, which was 3 percentage points more than the balance registered in the entire 2022.

Figure 1 Balance of payments

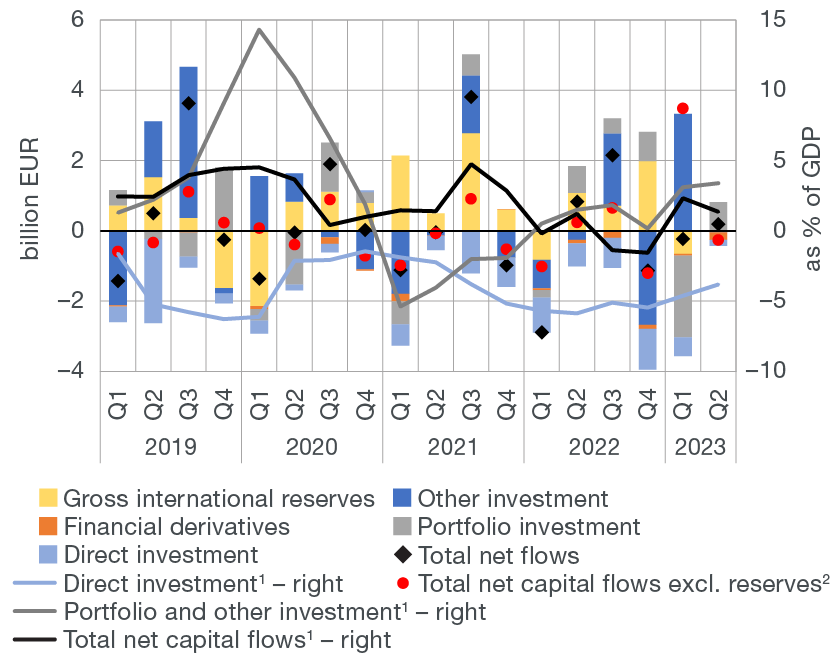

| a) Current and capital account | b) Financial account |

|

|

1 Sum of the last four quarters.

2 Excluding the change in the gross international reserves and foreign liabilities of the CNB.

Note: In the figure showing the financial account, the positive value denotes net capital outflow abroad and the negative value denotes net capital inflow.

Source: CNB.

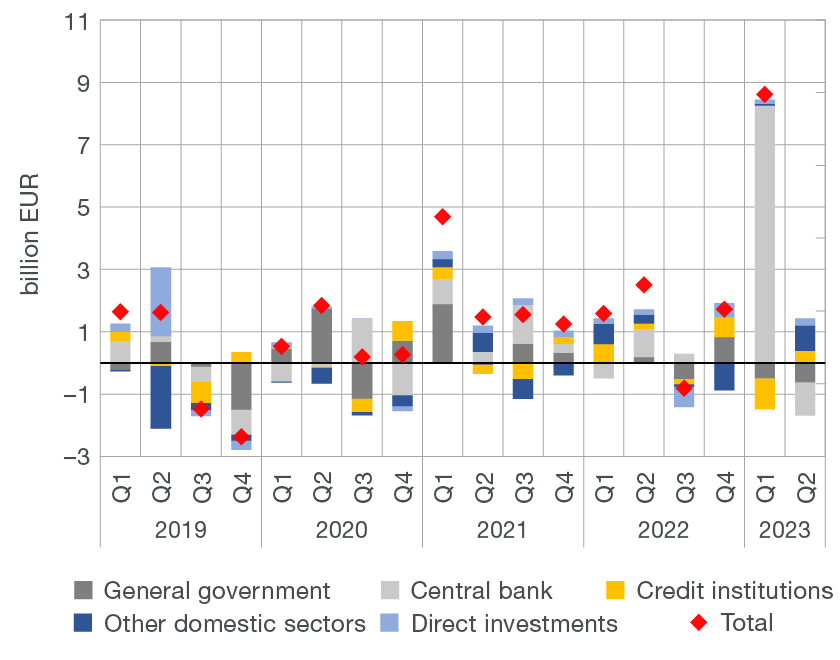

The financial account of the balance of payments recorded a net capital outflow of EUR 0.2bn in the second quarter of 2023, which is a decrease of EUR 0.6bn from the same period of the previous year (Figure 1b). The registered net capital outflow was exclusively a result of the strong outflow from the account of portfolio investments, primarily due to the noticeable increase in foreign assets amid the growth in investments of domestic residents in debt securities abroad. In contrast, in the period from April to June, net capital inflow was registered in all sub-accounts, with it being almost equal in amount when it comes to financial derivatives, direct investments and international reserves, while it was negligible in other investment account. Namely, financial derivatives registered a net inflow because the government fully repaid the international USD bond in April, which, due to the currency swap agreement generated favourable foreign exchange gains in the period to maturity. At the same time, net inflow caused a reduction in international reserves, which now, after Croatia joined the euro area, refers exclusively to the USD portfolio managed by the CNB. Finally, net inflow in the account of direct investments was relatively modest following a negative inflow of equity investments arising from several enterprises from the manufacturing and the accommodation industry paying out the profit from previous periods and thus reducing the value of own capital. The accumulation of euro cash flowing in from other parts of the euro area became a considerable factor in the outflow of funds from the financial account.

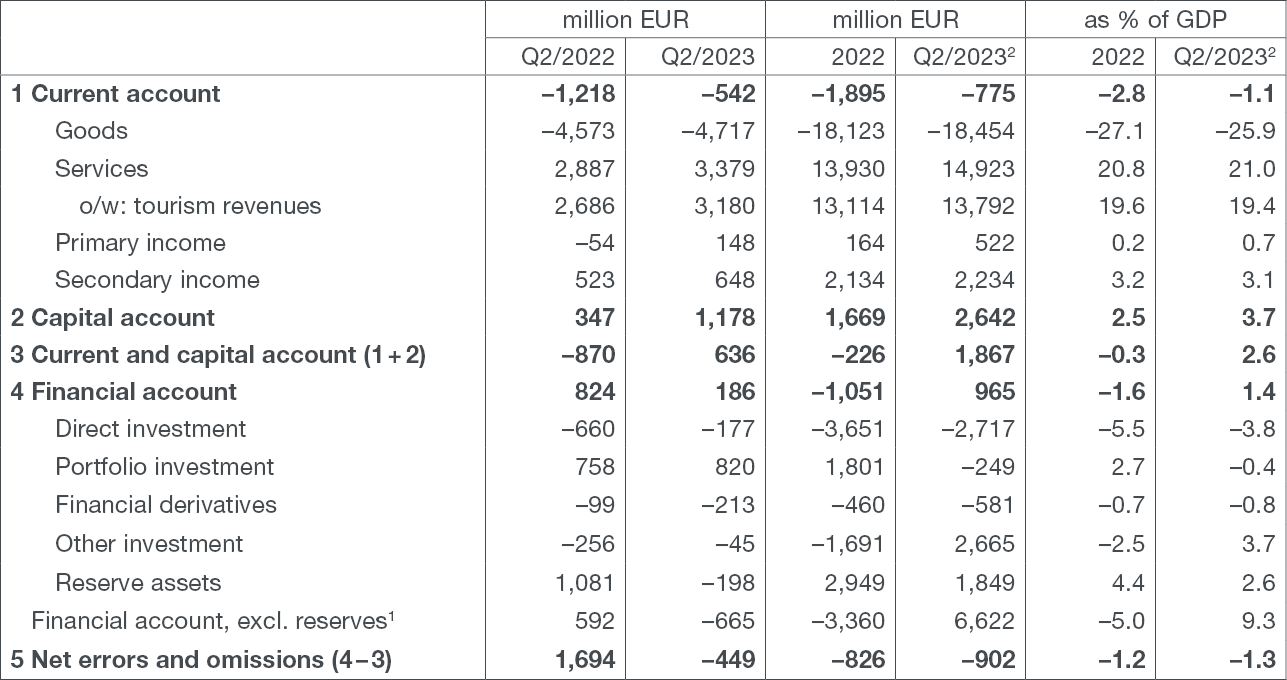

Table 1 Balance of payments

1 Excluding the change in the gross international reserves and foreign liabilities of the CNB. The investment of a portion of international reserves in reverse repo agreements results in a simultaneous change in CNB assets (recorded in the reserve assets account) and liabilities (recorded in the other investment account) and thus has a neutral impact both on changes in the central bank's net foreign position and the overall financial account balance.

2 Sum of the last four quarters.

Note: The positive value of financial transactions denotes net capital outflow abroad and the negative value denotes net capital inflow.

Source: CNB.

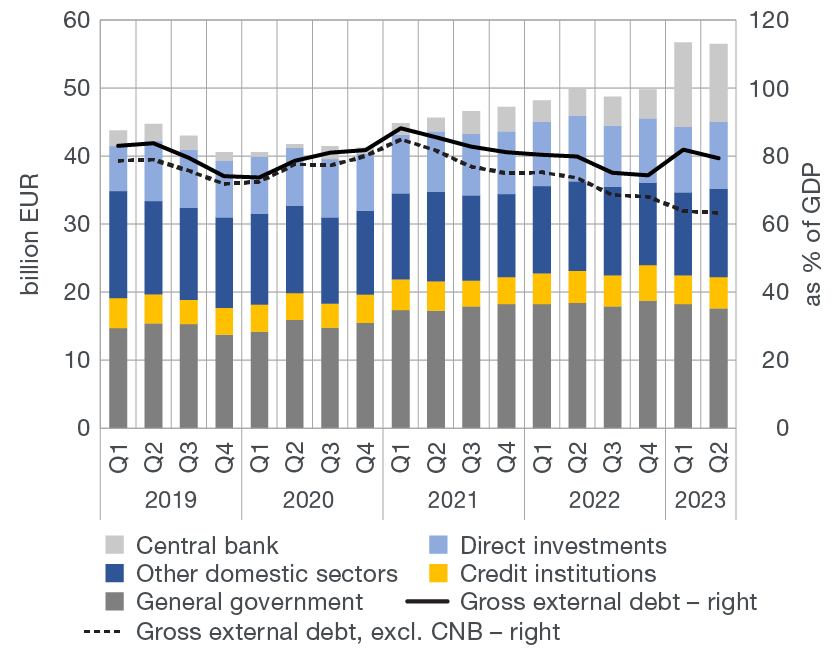

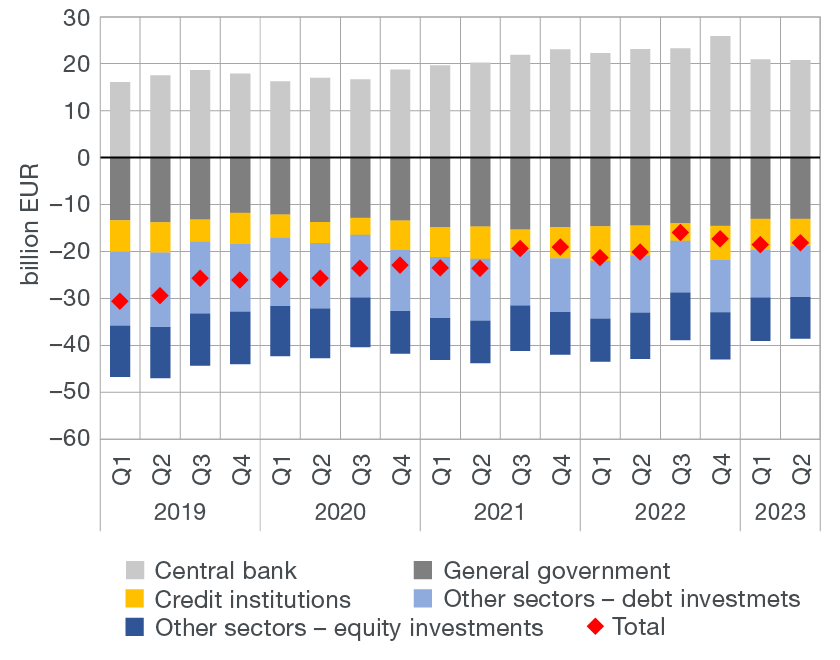

The gross external debt was EUR 56.5bn at the end of June 2023, or 79.4% of GDP (Figure 2a), which is a decrease of EUR 0.3bn or 2.6% of GDP from the end of March 2023, due mostly to the fall in debt of the central and general government and the growth in nominal GDP.

Figure 2 Gross external debt

| a) Stock of gross external debt | b) Change in gross external debt |

|

|

Note: Changes in gross external debt are a result of net transactions of domestic sectors and exchange rate and other adjustments.

Source: CNB.

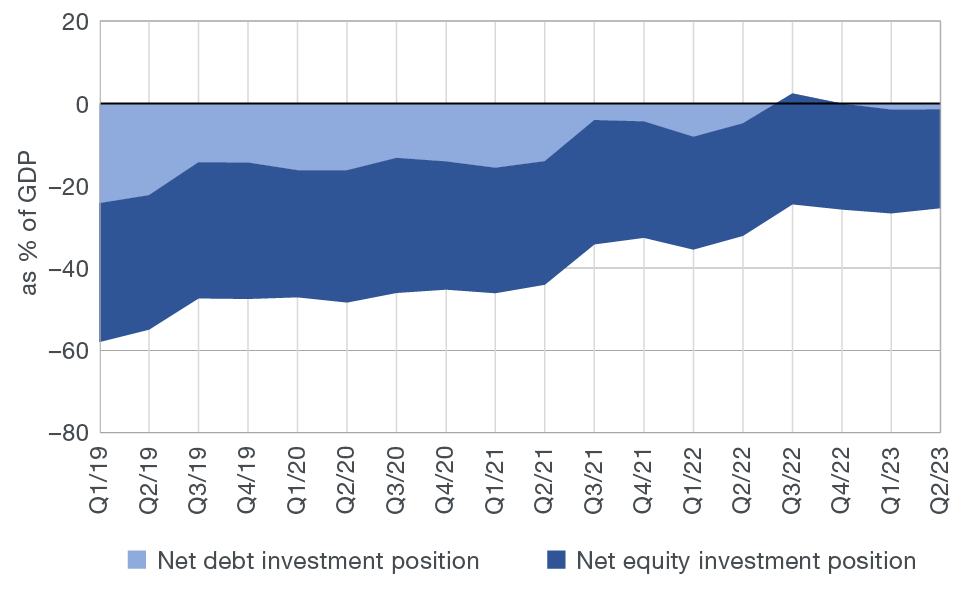

The net external debt reduced mildly in the second quarter of 2023 (EUR 0.2bn), predominantly as a result of the seasonal improvement in banks’ net foreign position. Thus, the stock of net external debt stood at EUR 1.5%bn or 2.1% of GDP at the end of June 2023, up from EUR 1.6bn or 2.4% of GDP at the end of March 2023. Together with the decrease in net equity liabilities, the decrease in net external debt was reflected in the net international investment position, which improved negligibly from EUR –18.5bn at the end of March 2023 to EUR –18,1bn at the end of June (Figure 3.a). Accordingly, the relative indicator of the net international investment position improved to –25.5% of GDP at the end of June from –26.7% of GDP at the end of March 2023 (Figure 3b).

Figure 3 International investment position

| a) Position by sector | b) Relative indicator by type of investment |

|

|

Note: The international investment position equals the difference between domestic sectors' foreign assets and liabilities at the end of a period. The negative value of the net international investment position indicates that foreign liabilities of Croatian residents are greater than their foreign assets. Included are assets and liabilities based on debt instruments, equity investments, financial derivatives, and other instruments. Figure 3b includes financial derivatives and other liabilities in the net debt investment position.

Source: CNB.

Data revision

Data on the balance of payments, gross external debt and the international investment position are revised in accordance with the commonly used yearly practice, based on subsequently available data and methodological changes. The most important improvements in the data quality relate to estimates of current transfers of the government sector, employee compensations on the expenditure side, reclassification of a portion of portfolio equity investments to other investments and life and non-life insurance reserves. The revision effect was most visible in the current account of the balance of payments in 2022, when it totalled EUR –0.8, while the effect on the financial account balance was less prominent, totalling EUR –0.3 in the same year.

For more details see: External statistics revision

Detailed balance of payments data

Detailed outstanding gross external debt data

Detailed data on the international investment position