"Despite significant risks and costs related to the size and structure of their balance sheets against a background of low yields in financial markets, in managing international reserves central banks of small and open economies have to continue to abide by their usual basic principles: liquidity and safety," stated Governor Vujčić at the end of his participation in the 17th Executive Forum for Policy-Makers and Senior Officials, held on 15 and 16 April in Washington within the World Bank Reserves Advisory and Management Program (RAMP).

Participating in the panel on managing central bank balance sheets in the post-crisis era, Governor Vujčić spoke of the general trend of increase in central bank balance sheets in the last decade, which has in small and open economies resulted from, among other things, a considerable international reserve growth. The reserve growth has in these countries been motivated, on the one hand, by their efforts to create sufficient foreign exchange liquidity reserves to mitigate external shocks and ward off the negative effects of potential future crises and, on the other hand, by their wish to preserve the competitiveness of international trade under conditions of strong appreciation pressures on domestic currencies, which has led central banks to increasingly rely on foreign exchange interventions. Despite the positive effects of the reserve accumulation, primarily as regards the improvement of their adequacy indicators, high international reserves are related to a number of costs and risks, with their management further hindered under current conditions of low and negative euro yields, especially if they become long term.

"In general, potential investment policies for managing high international reserves against a backdrop of low and negative interest rates include diversifying reserve investment instruments, accepting a reasonable, but higher degree of credit risk, and increasing maturity. As far as Croatia is concerned, its entry into the euro area will have a favourable effect on part of the risks related to international reserve management as the need to maintain the stability of the exchange rate of the kuna versus the euro will disappear and, in turn, the need for foreign exchange purchases from banks as a cause for the further build-up of foreign exchange reserves, as currently is the case," said Governor Vujčić.

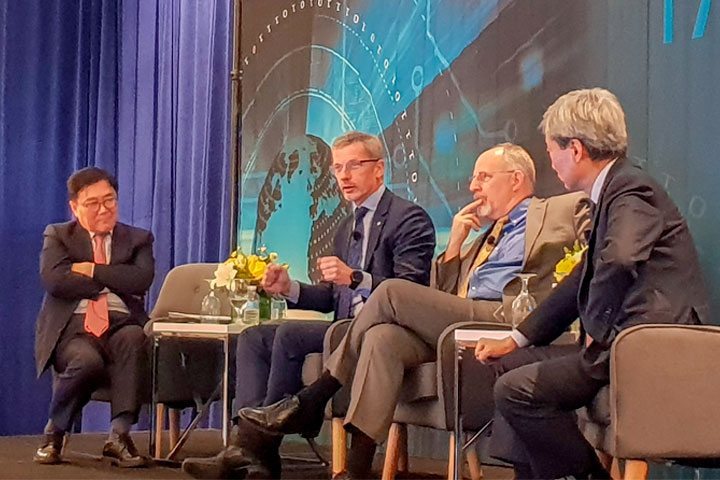

Also participating in the panel were Heung Sik Choo, director of the World Bank Investment Management Department, Peter Stella, an international expert, and Hyun Song Shin, economic adviser and head of research in the Bank for International Settlements.