The Croatian National Bank announced on 30 September 2019 the new calculation of BOP, ED and IIP statistical indicators of the Republic of Croatia.

The CNB carries out the revision of external (BoP/IIP and ED) statistics every five years, and the published statistical indicators are harmonised with the new methodologies and standards in order to achieve higher accuracy, a more comprehensive scope and a better alignment with international statistical standards.

The new statistical calculation in 2019 is the result of the transition to new and better quality sources of data and of improvements of calculation methods used by the CNB in the process of compiling external statistics.

The most important improvements refer to 1) the new calculation of the indicators of tourism revenues in the BoP, 2) the inclusion of trade credits with the original maturity of up to six months in the external debt, both on the liabilities and on the assets side, 3) the estimate of workers’ informal remittances in the BoP, both on the credits and debits side, and 4) inclusion of the imports of used vehicles by natural persons from the EU in the BoP.

In parallel with the announcement of the revised external statistics' historical data, the CNB on 30 September 2019 also published the data of these statistics for the second quarter of 2019.

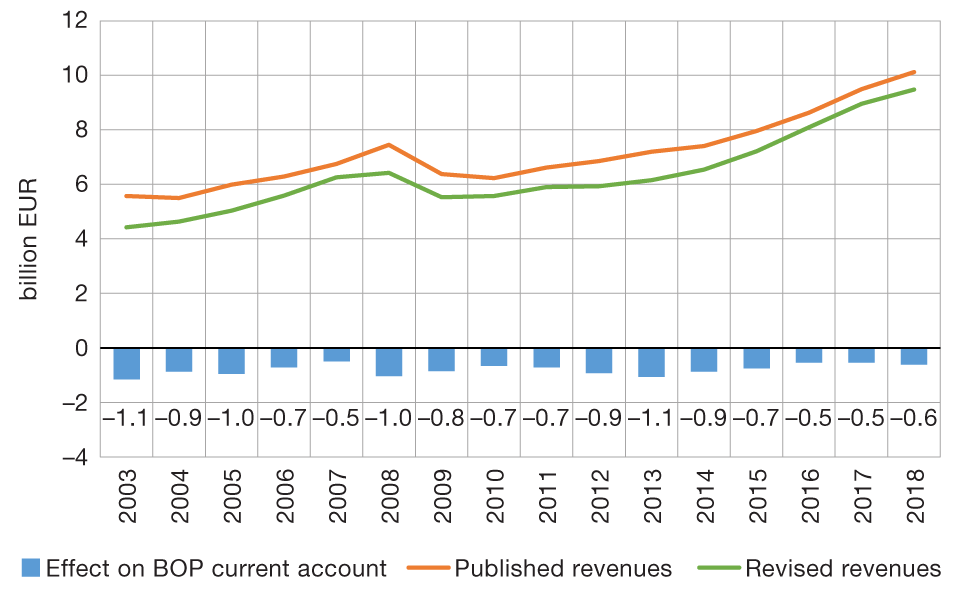

The new calculation of indicators of tourism revenues in the balance of payments applies improved methods (starting with the data for 2003), which are based on the combination of volume indicators and the indicators of the average consumption of foreign tourists, which is a common EU practice. The revised series reduces the revenues from tourist consumption in the range of ca. EUR 0.5bn to EUR 1.1bn, in the period from 2003 to 2018.

Figure 1 Revision of tourism revenues in the balance of payments of the RC

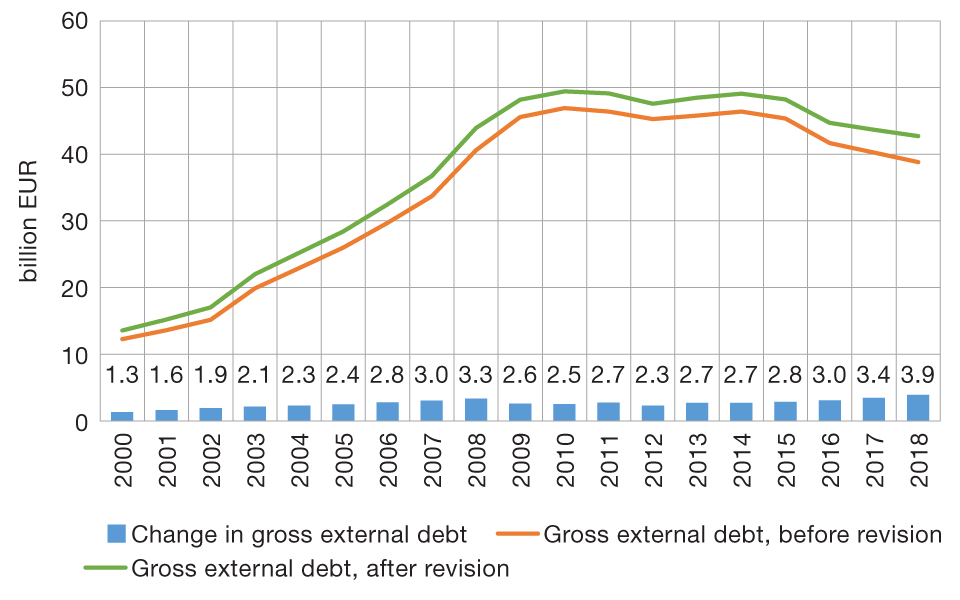

The inclusion of trade credits with the original maturity of up to six months in the external debt statistics is the result of the need for an additional alignment with international statistical standards. The contribution of this inclusion to the increase in the revised gross external debt ranges, depending on the year, from ca. EUR 1.3bn to EUR 3.9bn in the period from 2000 to 2018, while the contribution to the decrease of the net international investment position in the same period is much smaller, in the range of ca. EUR 0.4bn to EUR 1.4bn.

Figure 2 Revision of the gross external debt balance of the RC

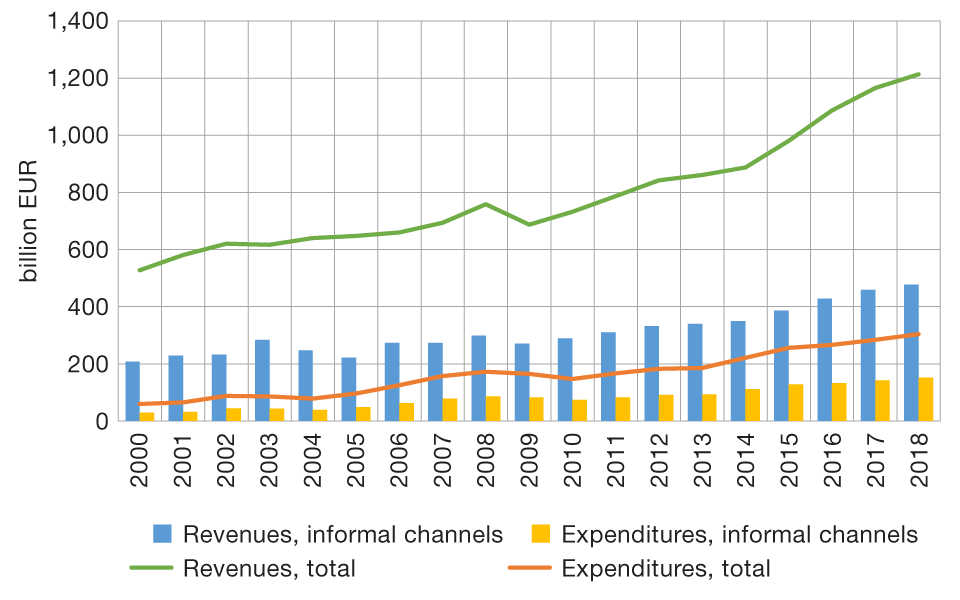

Prior to this revision, informal workers’ remittances, i.e. workers’ remittances in the form of cash transfers, were not included in the balance of payments of the Republic of Croatia because of the inadequate quality of the sources for the purposes of the quantification of such flows. In the meantime, additional information and data were acquired from the available sociological surveys and administrative sources to enable a better quality quantification of this phenomenon, and the estimate of associated flows was included in the BOP statistics in this revision. The effect of this inclusion on the current account balance is positive because of the larger amounts of such inflows than outflows and, depending on the year, this effect is varying from EUR 178m to EUR 326m.

Figure 3 Estimated amount of informal workers’ remittances in the balance of payments of the RC

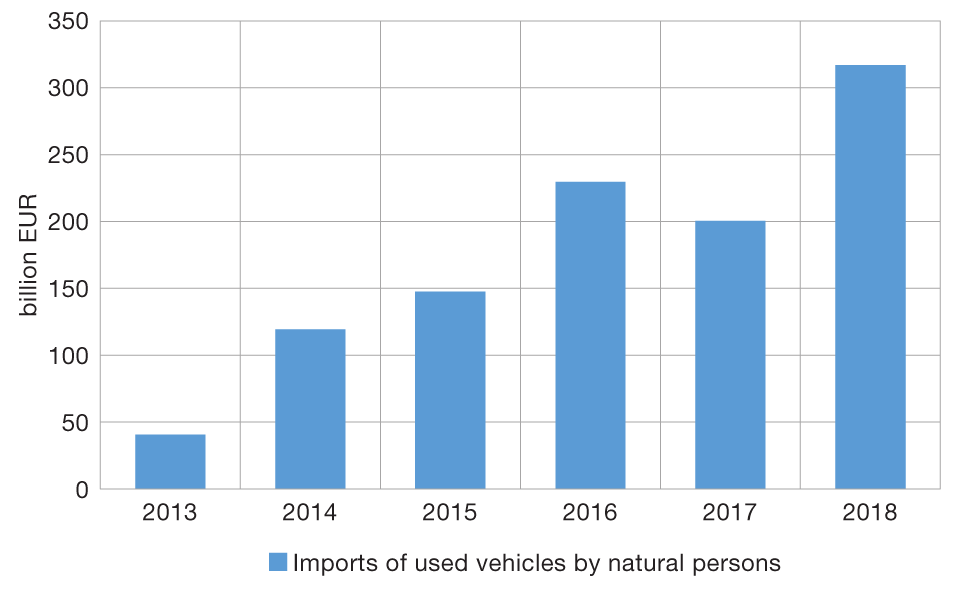

The estimate of the value of the imports of used vehicles from the EU by natural persons has not been included in the goods account of the balance of payments of the RC because natural persons are not covered by the Intrastat reporting system containing information on the intra-EU trade in goods. For this reason, this amount in the period from 2013 to 2018 had to be estimated. The effect of this revision of the value of goods debits in the BoP is a reduction of the current account balance, ranging from EUR 41m in 2013 to EUR 317m in 2018.

Figure 4 Estimated imports of used vehicles not included in the balance of payments of the RC

The implemented external statistics revision also brings other improvements to the external statistics compiled by the CNB: 1)the switch to a better quality source of data for the estimate of transactions arising from trading in financial derivatives for the institutional sectors of the general government and other monetary financial institutions; 2) the switch to the new source of data for the estimate of the value of transactions in non-resident securities traded by residents; 3) the estimate of the quantitative effects of non-performing loans (“bad loans”) sold abroad; 4) based on the new source of data, the estimate of the value of pension funds' investments abroad in the assets that do not contain the International Securities Identification Number (ISIN) securities code; and 5) the resolution of discrepancies between the published and the calculated balances and transactions in foreign loans of all sectors from 2010 to 2018 that remained unresolved by regular revisions.

The statistical data revision will have an impact on external macroeconomic indicators (as shown in Table 1).

Table 1 Effect of the revision on the external statistics, 2013–2018