From August 2023 the comments on statistics, a short description of selected, recently issued statistical data in the area of monetary statistics and the non-residents sector statistics, are no longer published. They are replaced by Statistical releases.

Comments on monetary developments for December 2019

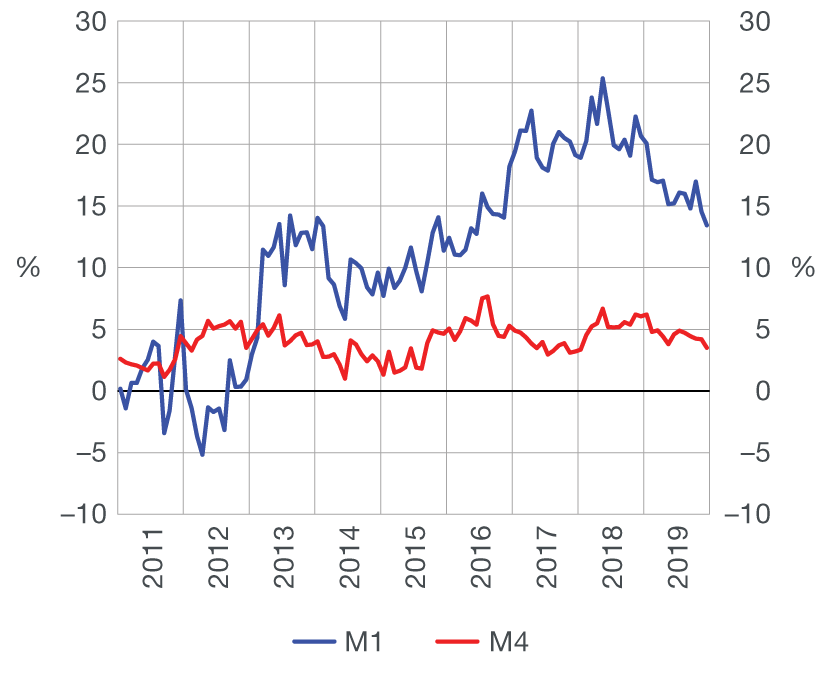

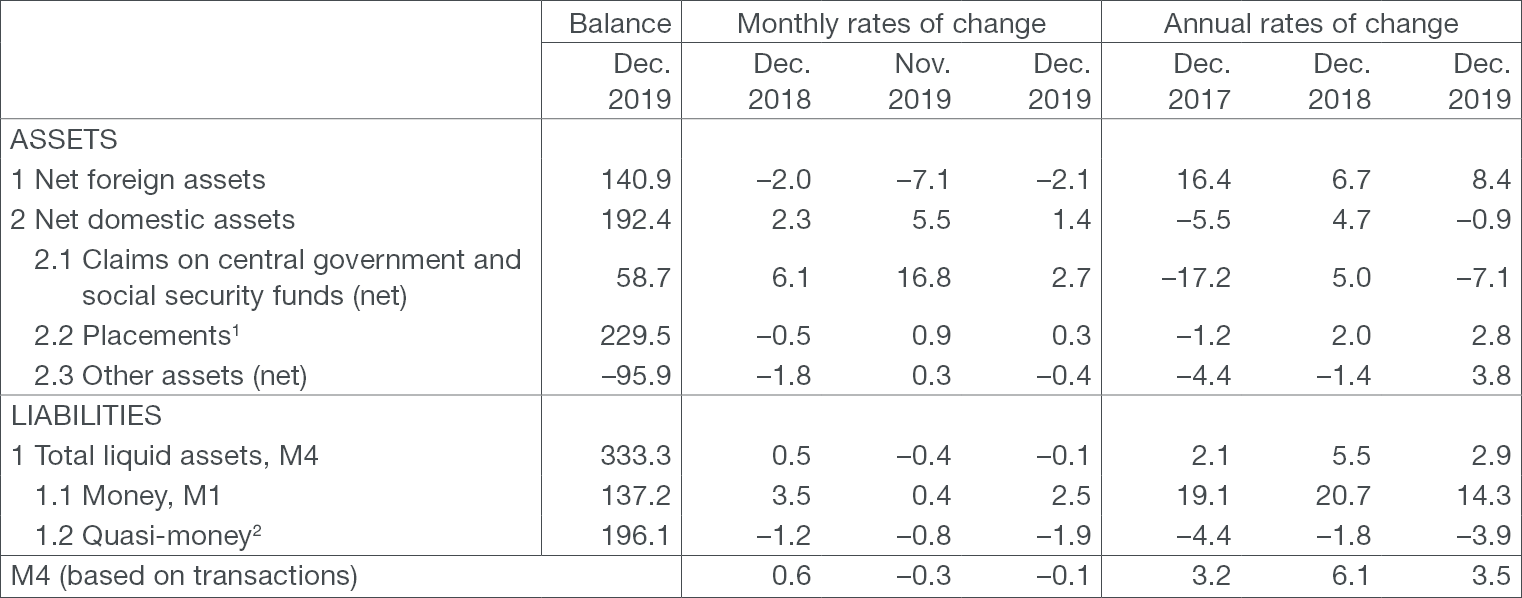

Total liquid assets (M4) held steady in December 2019 and stood at HRK 333.3bn at the end of the month (Table 1). On an annual basis, the growth of total liquid assets (M4) slowed down to 3.5% at the end of December, from 6.1% at the end of 2018, while the annual growth of money (M1) slowed down to 13.4%, from 20.7% (Figure 1). The slowdown in monetary growth in 2019 was a result of the slower growth in net domestic assets of monetary institutions. Such developments were determined by the decline in net claims on the central government and social security funds (–7.1%), while the growth of domestic placements (2.8%) and net foreign assets (8.4%) was stronger than in 2018 (Table 1).

| Figure 1 Monetary aggregates annual rates of change based on transactions |

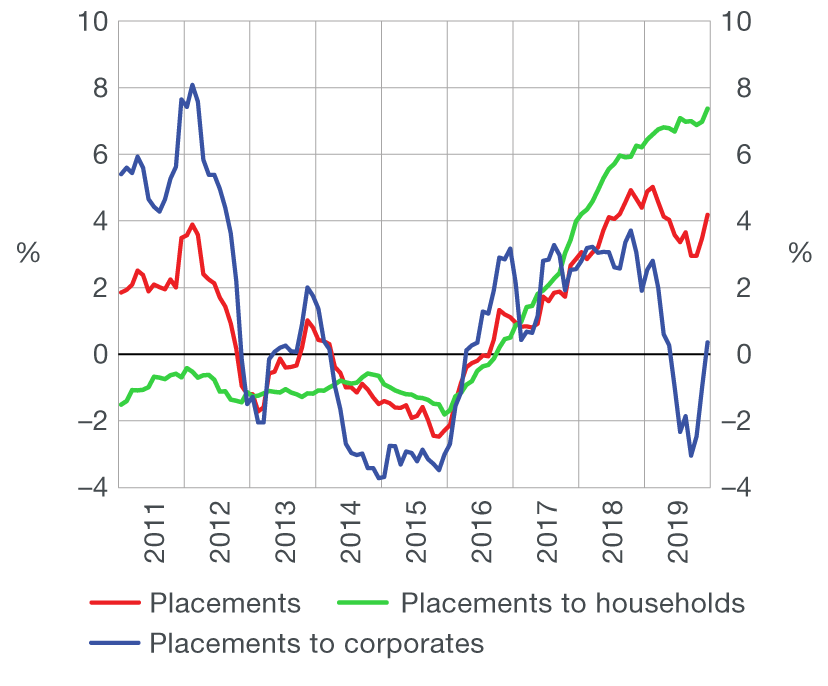

Figure 2 Placements annual rates of change based on transactions |

|

|

| Source: CNB. |

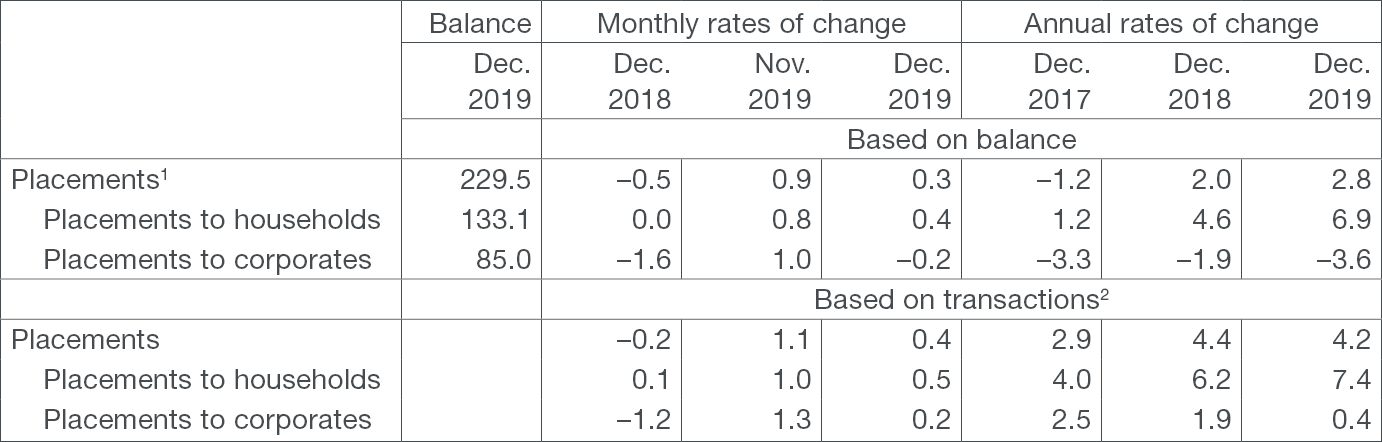

Total placements of monetary institutions to domestic sectors (excluding the government) increased by HRK 1.0bn in December, their annual growth accelerating to 4.2% (transaction-based, Figure 2). The placements to non-financial corporations, after six continuous months of decline, increased by 0.4% on an annual level at the end of 2019. In addition to only a negligible increase in new borrowings, this was predominantly aided by the waning of a larger part of the negative effect of the activation of government guarantees to shipyards at the end of last year. The remaining part is expected to wear off at the beginning of this year. The annual growth of placements to the household sector accelerated to 7.4% in December (Table 2). A stronger growth of placements to households was spurred predominantly by the continued annual growth of housing loans that reached 6.4% at the end of 2019, which also surely reflects the effect of the continued housing loans subsidy programme implemented by the Croatian Government. At the same time, the annual growth of general-purpose cash loans accelerated negligibly to 11.5%. The annual growth in the nominal stock of placements, totalling 2.8% in December, was lower than transaction-based growth, primarily as a consequence of the sale of non-performing corporate placements.

Table 1 Summary consolidated balance sheet of monetary institutions

in billion HRK and %

1 The sum total of asset items 2.2 to 2.8 of Bulletin Table B1: Consolidated balance sheet of monetary financial institutions.

2 The sum total of liability items 2 to 5 of Bulletin Table B1: Consolidated balance sheet of monetary financial institutions.

Source: CNB.

Table 2 Placements (except the central government) and main components

in billion HRK and %

1 In addition to placements to households and corporates, they also include placements to the local government and other financial institutions.

2 The transactions show changes that exclude the effects of exchange rate changes, securities price adjustments, reclassification and write-off of placements, including the sale of placements in the amount of their value adjustment.

Source: CNB.

For detailed information on monetary statistics as at December 2019, see: