Statistical releases provide a summary of the most recent values and trends for the published statistical indicators series compiled by the Croatian National Bank.

Statistics

- Release calendar

- Statistical releases

- Indicators of banking system operations

- Main macroeconomic indicators

-

Statistical data

-

Financial sector

- Republic of Croatia contribution to euro area monetary aggregates

- Consolidated balance sheet of MFIs

- Central bank (CNB)

- Other monetary financial institutions

- Other financial corporations

- General government sector

- External sector

- Financial accounts

- Securities

- Selected non-financial statistics

- Payment systems

- Payment services

- Currency

- Turnover of authorised exchange offices

- Archive

-

Financial sector

- SDDS

- Regulations

- Information for reporting entities

- Information for users of statistical data

- Use of confidential statistical data of the CNB for scientific purposes

- Statistical surveys

- Experimental statistics

Statistical releases

Credit institutions’ interest rate statistics for April 2022

Statistical indicators of interest rates[1] of credit institutions on their main sources of funds mostly continued their years-long downward trend (time deposits) or stagnation (transaction accounts) in April 2022.

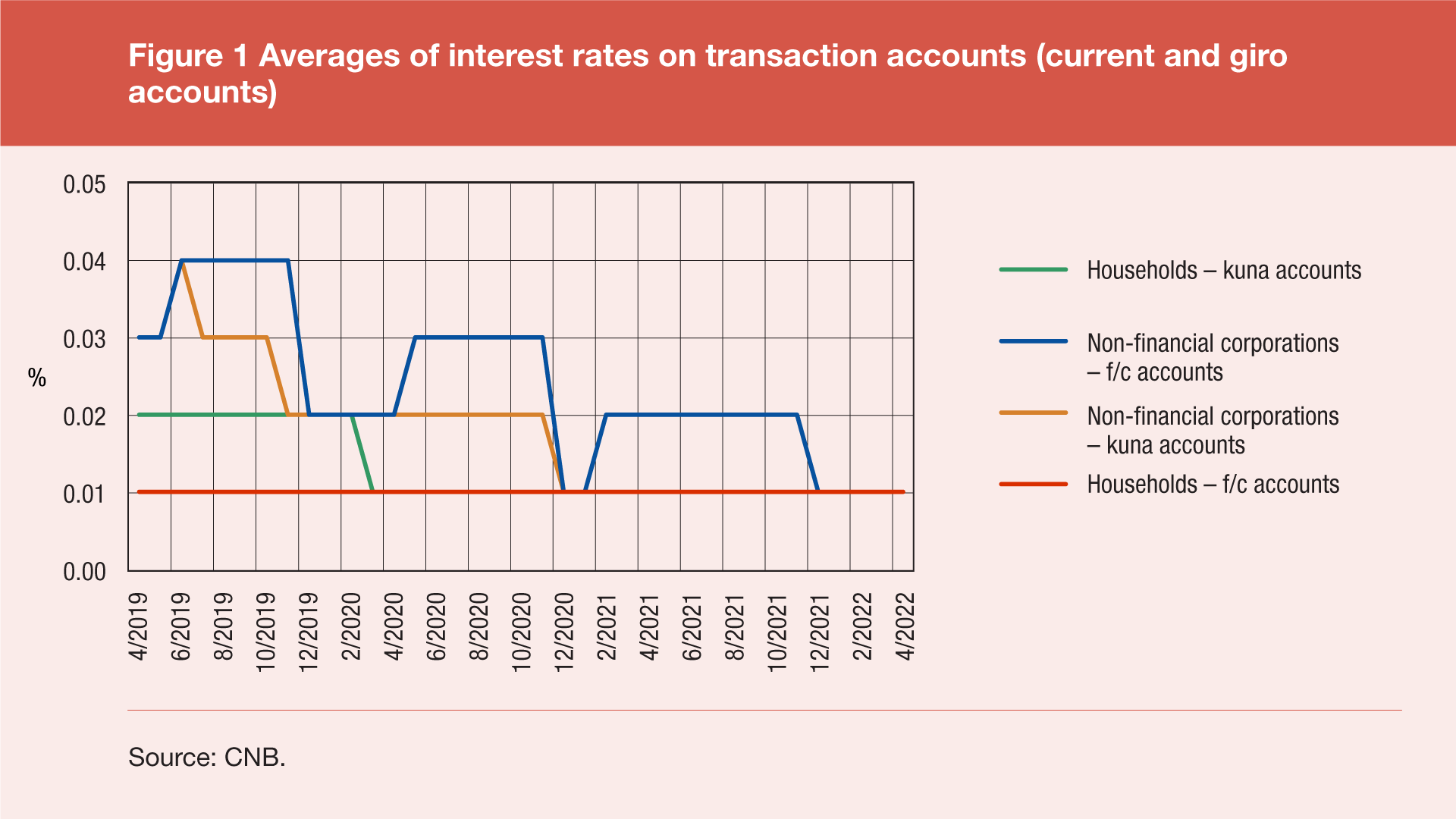

As regards transaction accounts (current and giro), the average of interest rates on kuna and foreign currency accounts of non-financial corporations and households in April 2022 was approximately at the same level as in April 2021, while all four averages stood at 0.01%.

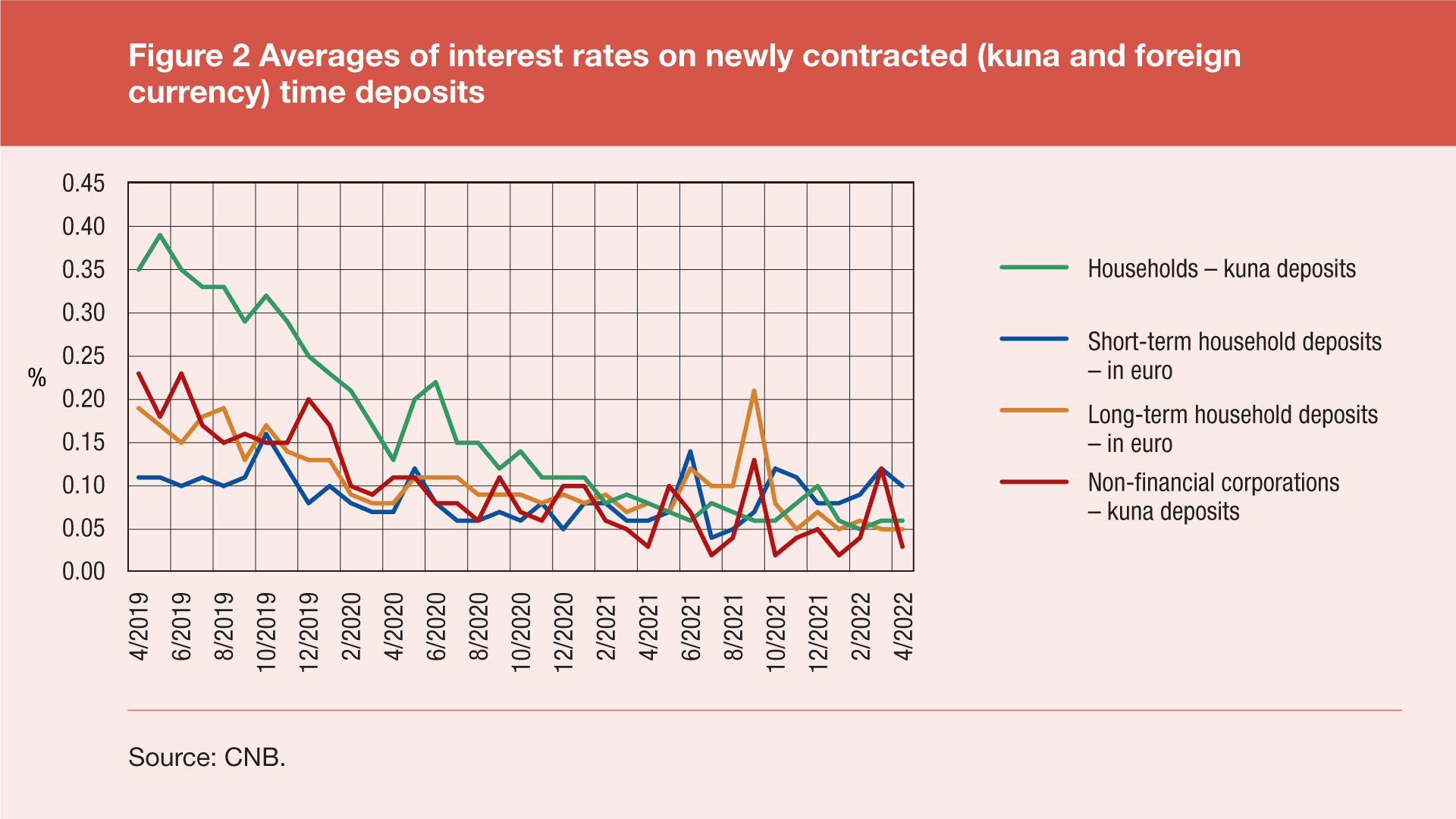

In April 2022, the average of interest rates on household time deposits in kuna stood at 0.06% (0.02 percentage points lower than in the same month of the previous year), while the average of interest rates on kuna time deposits of non-financial corporations was at the same level as in April 2021 and stood at 0.03%. The averages of interest rates on short-term and long-term household time deposits in euro stood at 0.1% and 0.05% respectively in April 2022.

Statistical indicators of interest rates of credit institutions on the most important types of loans granted to households and non-financial corporations also mostly continued their years-long decline in April 2022.

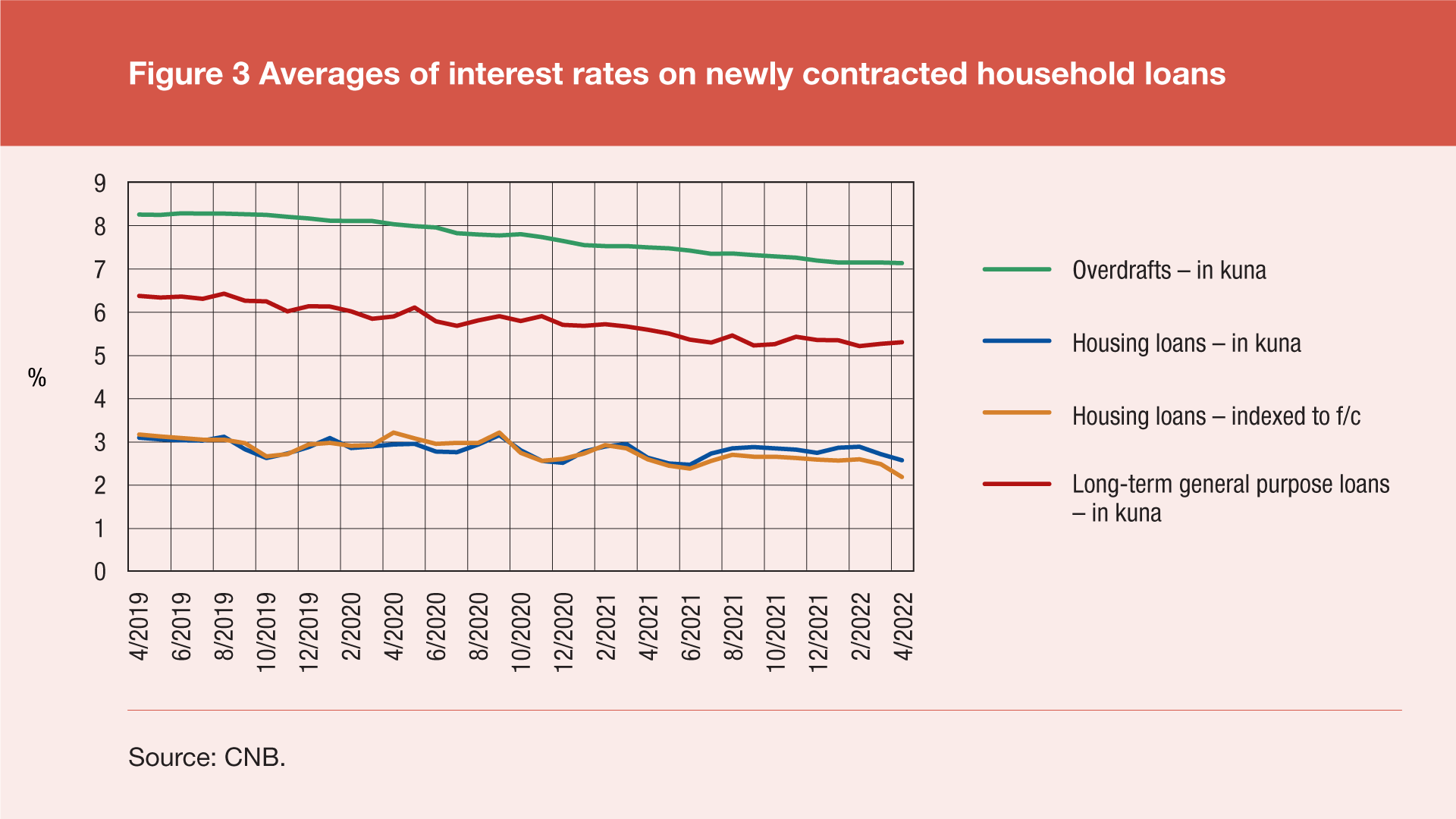

As for the main categories of household loans, the highest average of interest rates in April 2022 was recorded for kuna loans in the form of transaction account overdrafts (7.14%, down 0.36 percentage points from April 2021) and the lowest average was seen in housing loans indexed to foreign currency (2.19%, down by 0.41 percentage points from April 2021), where both loan categories have a slight downward trend on quarterly and annual basis.

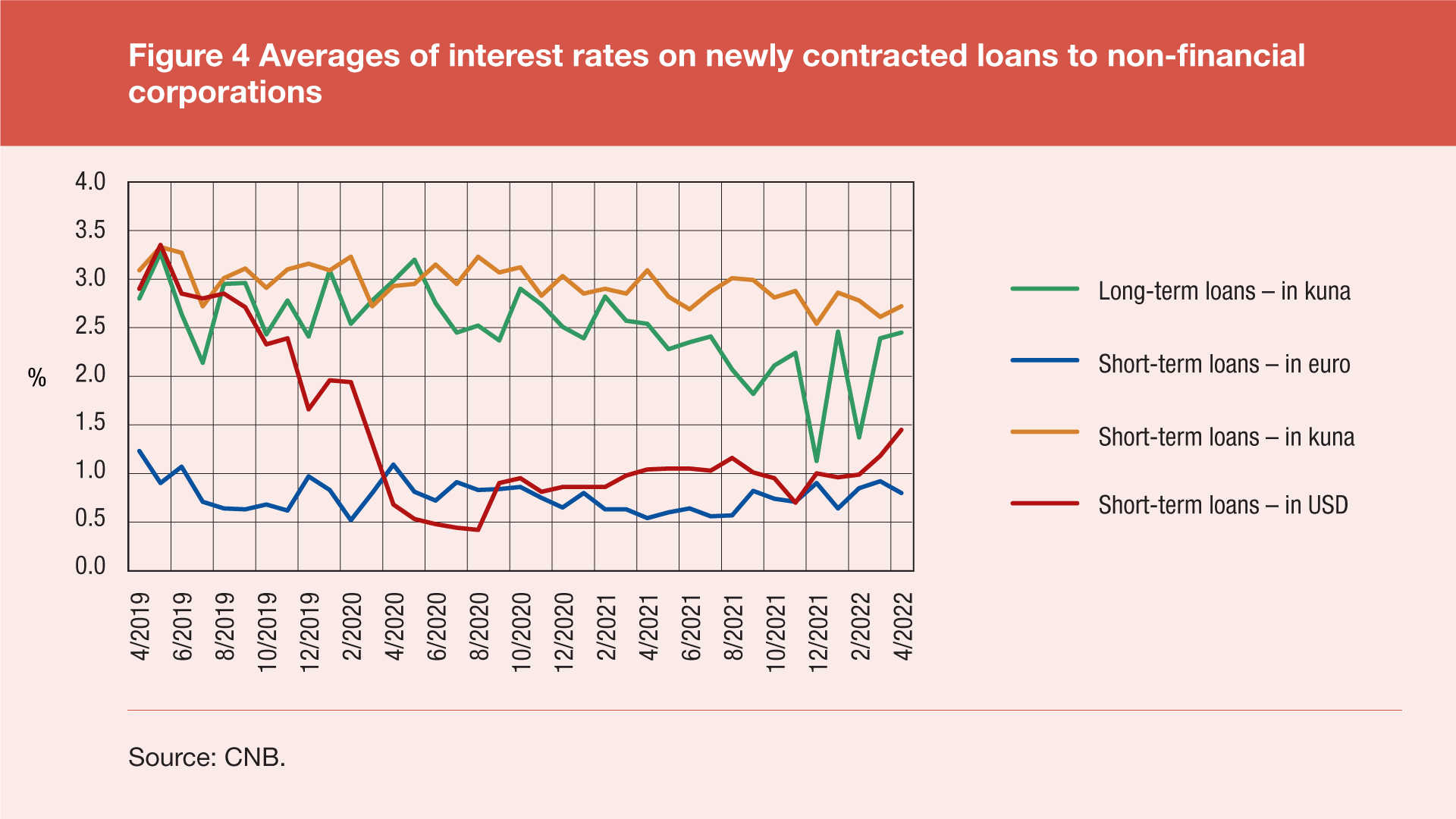

As regards the main categories of loans to non-financial corporations, the highest average of interest rates in April 2022 was seen in short-term kuna loans (2.72%, down by 0.37 percentage points from April 2021) and the lowest average was recorded in short-term euro loans (0.8%, up by 0.26 percentage points from April 2021).

Statistical time series: Credit institutions’ interest rates

-

Statistical indicators of interest rates are calculated as weighted monthly averages of agreed (nominal) interest rates on new deposit and loan contracts between credit institutions and their clients from the household sector (citizens and non-profit organisations) and the non-financial corporate sector (corporations outside the financial sector and the government sector) in a given month. New contracts include all contracts that specify for the first time the interest rate, and all renegotiations of the terms and conditions of the existing contracts. The weights used in the calculation are contracted amounts of newly received deposits and newly granted loans, with the exception of transaction accounts and demand deposits as well as transaction account overdrafts and credit card loans, which are assumed to be contractually renewed each month, but in indefinite amounts; for this reason, the weights used are their corresponding book balances at the end of a month. Indicators that are being calculated differ according to the instrument, currency, maturity and sector to which deposits and loans relate. ↑