Statistical releases provide a summary of the most recent values and trends for the published statistical indicators series compiled by the Croatian National Bank.

Statistics

- Release calendar

- Statistical releases

- Indicators of banking system operations

- Main macroeconomic indicators

-

Statistical data

-

Financial sector

- Republic of Croatia contribution to euro area monetary aggregates

- Consolidated balance sheet of MFIs

- Central bank (CNB)

- Other monetary financial institutions

- Other financial corporations

- General government sector

- External sector

- Financial accounts

- Securities

- Selected non-financial statistics

- Payment systems

- Payment services

- Currency

- Turnover of authorised exchange offices

- Archive

-

Financial sector

- SDDS

- Regulations

- Information for reporting entities

- Information for users of statistical data

- Use of confidential statistical data of the CNB for scientific purposes

- Statistical surveys

- Experimental statistics

Statistical releases

Release of the statistical data on deposits and loans of credit institutions for September 2023

Summary:

- At the end of September 2023, the deposits of households, non-financial corporations and the general government stood at EUR 37.8bn, EUR 16.6bn and EUR 5.0bn, respectively.

- In the past year household deposits increased at a rate of 6.0%.

- At the end of September 2023, loans to households, non-financial corporations and the general government stood at EUR 21.3bn, EUR 14.5bn and EUR 6.7bn, respectively.

- In the past year household loans increased at a rate of 8.1%, with housing loans recording the most significant growth at the rate of 10.0%.

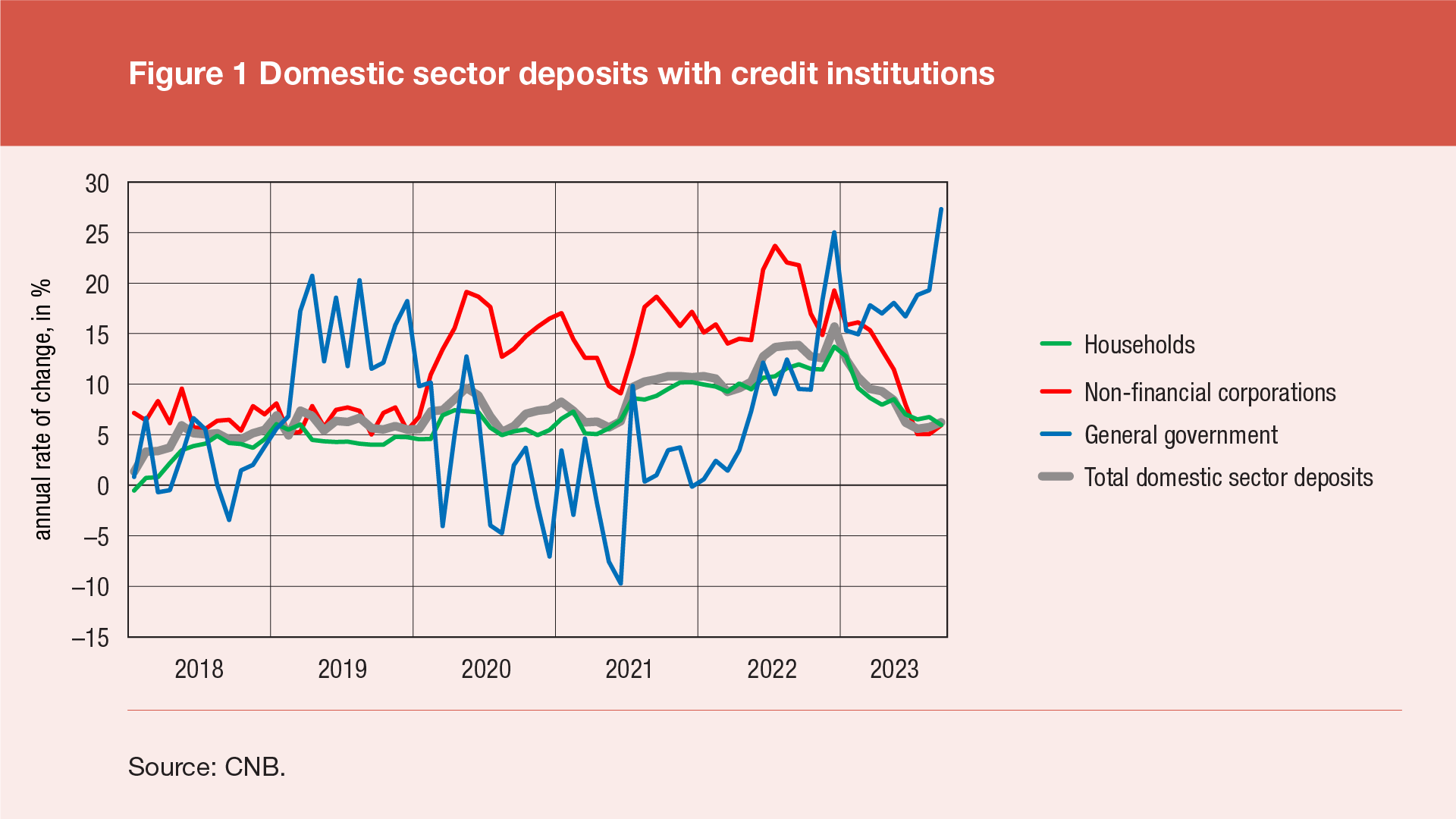

According to monetary statistics data[1], at the end of September 2023, total domestic sector deposits[2] amounted to EUR 61.2bn. In the third quarter of 2023, total domestic sector deposits increased by EUR 3.6bn (6.3%), and compared to the end of the third quarter of 2022, an increase of EUR 3.6bn (6.2%) was recorded. The annual growth rate of total deposits at the end of September 2023 remained the same as at the end of June 2023.

Broken down by sectors, in the third quarter of 2023, the largest increase in deposits was recorded in non-financial corporations by EUR 1.5bn (10.0%) and households by EUR 1.3bn (3.7%), while general government deposits increased by EUR 0.5bn (12.2%).

At the end of September 2023, the deposits of households, non-financial corporations and the general government stood at EUR 37.8bn, EUR 16.6bn and EUR 5.0bn, respectively.

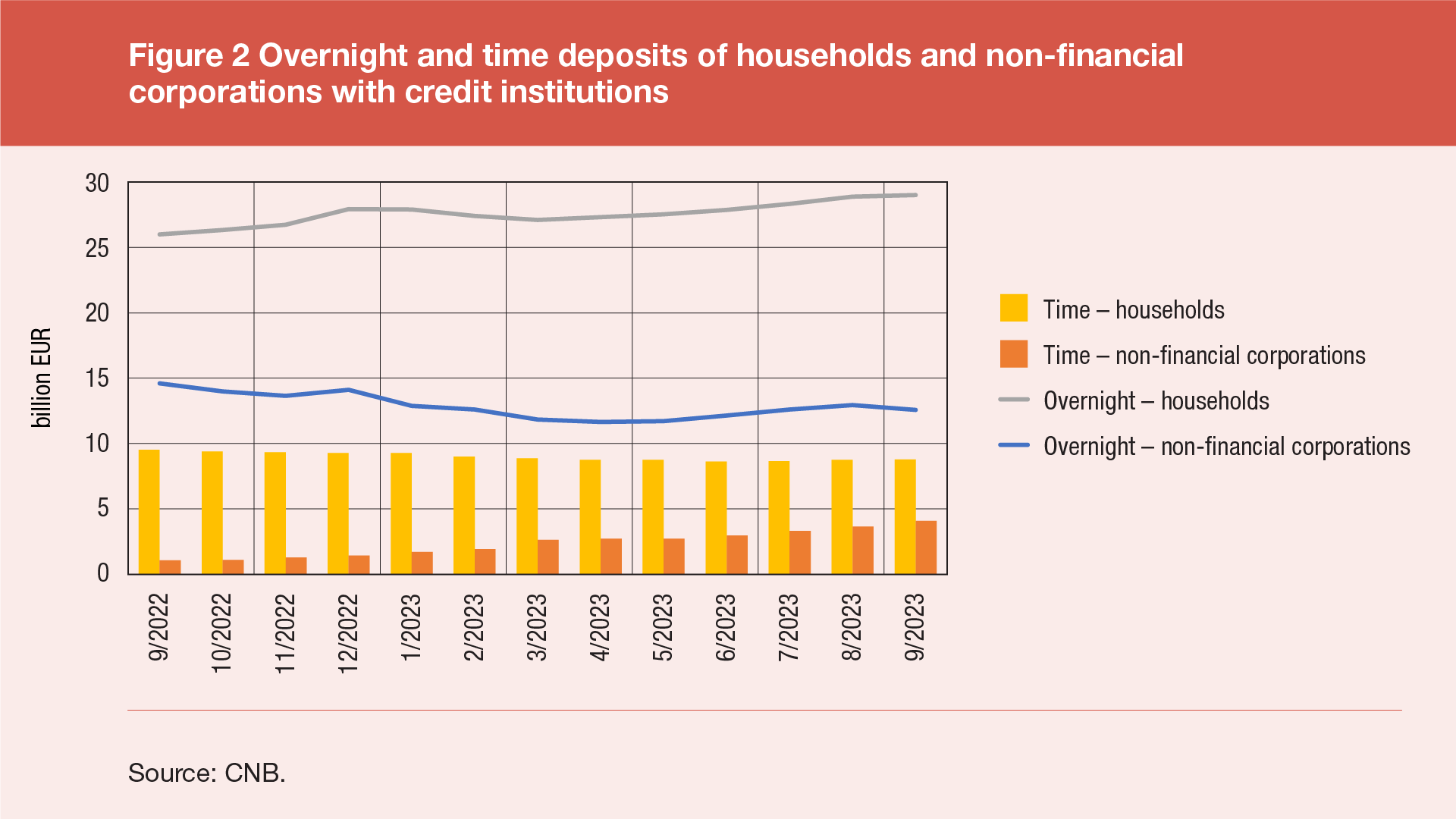

At the end of September 2023, overnight deposits of domestic sectors[3] stood at EUR 46.0bn, with households accounting for EUR 29.0bn, non-financial corporations EUR 12.6bn and the general government EUR 3.6bn. In the third quarter of 2023, overnight deposits of households and non-financial corporations with credit institutions increased by EUR 1.2bn (4.3%) and EUR 0.4bn (3.5%), respectively.

The annual growth rate of total overnight deposits decelerated from 5.0% at the end of June 2023 to 1.5% at the end of September 2023. The decline in overnight deposits of non-financial corporations accelerated, which began in April 2023, with the annual growth rate of –6.7% at the end of June 2023 and –14.1% at the end of September 2023. The growth of overnight deposits of households decelerated with the annual growth rate of 14.2% at the end of June 2023 and 11.2% at the end of September 2023.

At the end of September 2023, time deposits of domestic sectors stood at EUR 15.2bn, with time deposits of households and non-financial corporations accounting for EUR 8.8bn and EUR 4.1bn, respectively. In the third quarter of 2023, time deposits of non-financial corporations increased by EUR 1.1bn (36.4%), while household time deposits rose only slightly (EUR 0.2bn or 1.8%).

On an annual level, the growth in total time deposits accelerated from 10.2% at the end of June 2023 to 23.4% at the end of September 2023. Time deposits of non-financial corporations additionally accelerated their already fast growth, which had been recorded from the beginning of 2023, from 200.6% annually at the end of June 2023 to 277.8% annually at the end of September 2023. At the same time, the annual decline in time deposits of households decelerated from –11.0% at the end of June 2023 to –8.2% at the end of September 2023.

At the end of September 2023, total loans to domestic sectors stood at EUR 42.9bn, which is an increase of EUR 0.8bn (1.9%) from the end of the second quarter of 2023 and an increase of EUR 2.6bn (6.6%) from the end of the third quarter of 2022. On an annual level, the growth in total loans to domestic sectors decelerated from 7.2% at the end of June 2023 to 6.6% at the end of September 2023.

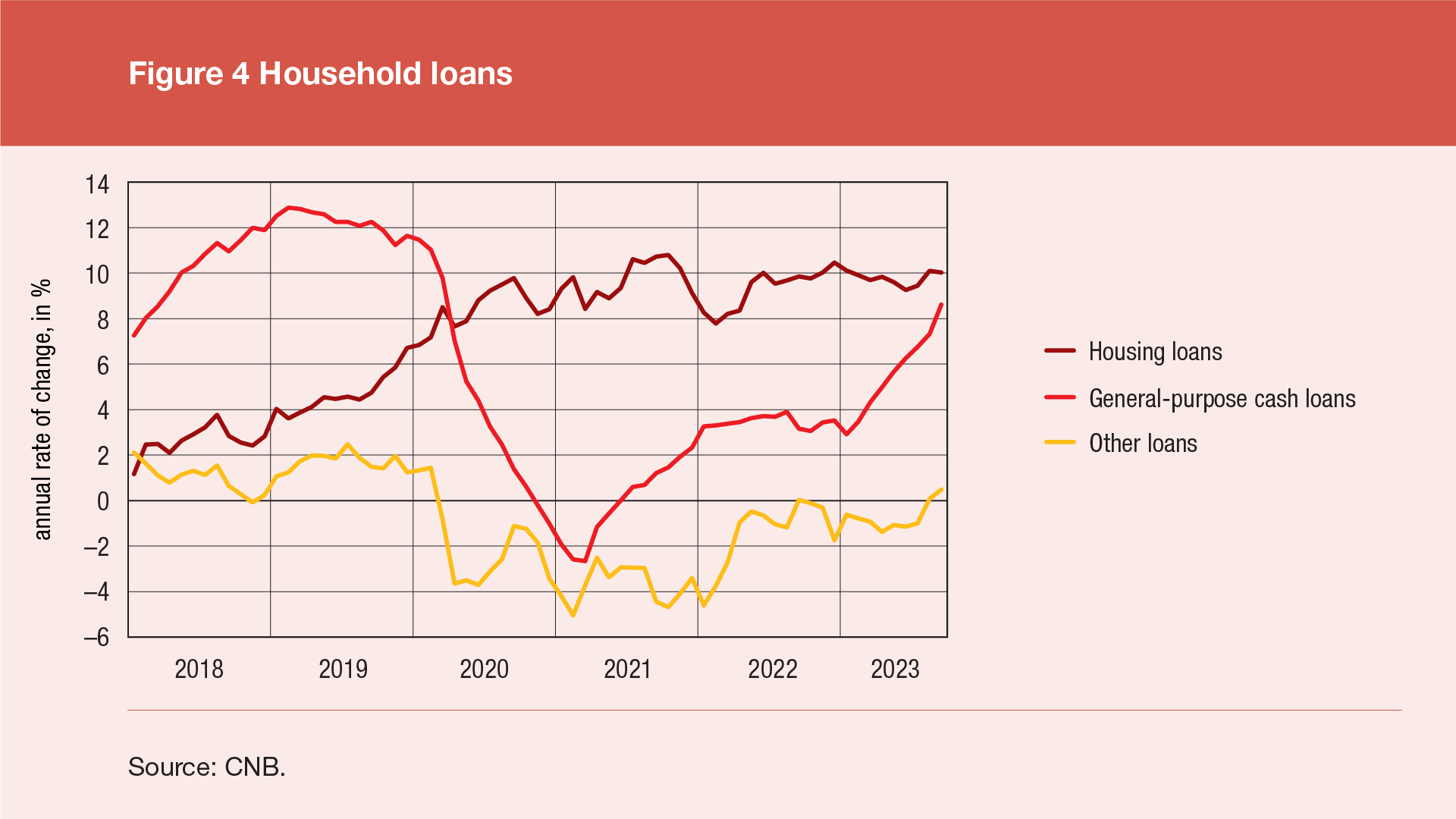

Broken down by sectors, at the end of September 2023, household loans stood at EUR 21.3bn. In the third quarter of 2023, household loans increased by EUR 0.6bn (2.9%), or up by EUR 1.6bn (8.1%) from the end of the third quarter of 2022. In the third quarter of 2023, housing loans grew by EUR 0.4bn (3.5%), and general-purpose cash loans by EUR 0.2bn (2.7%), while all other household loans rose by 1.1%.

On an annual level, the growth in household loans accelerated from 6.6% at the end of June 2023 to 8.1% at the end of September 2023, which was driven by the increase in the annual growth rate of general-purpose cash loans from 6.3% to 8.6%, housing loans from 9.3% to 10.0% and other loans from –1.2% to 0.5%.

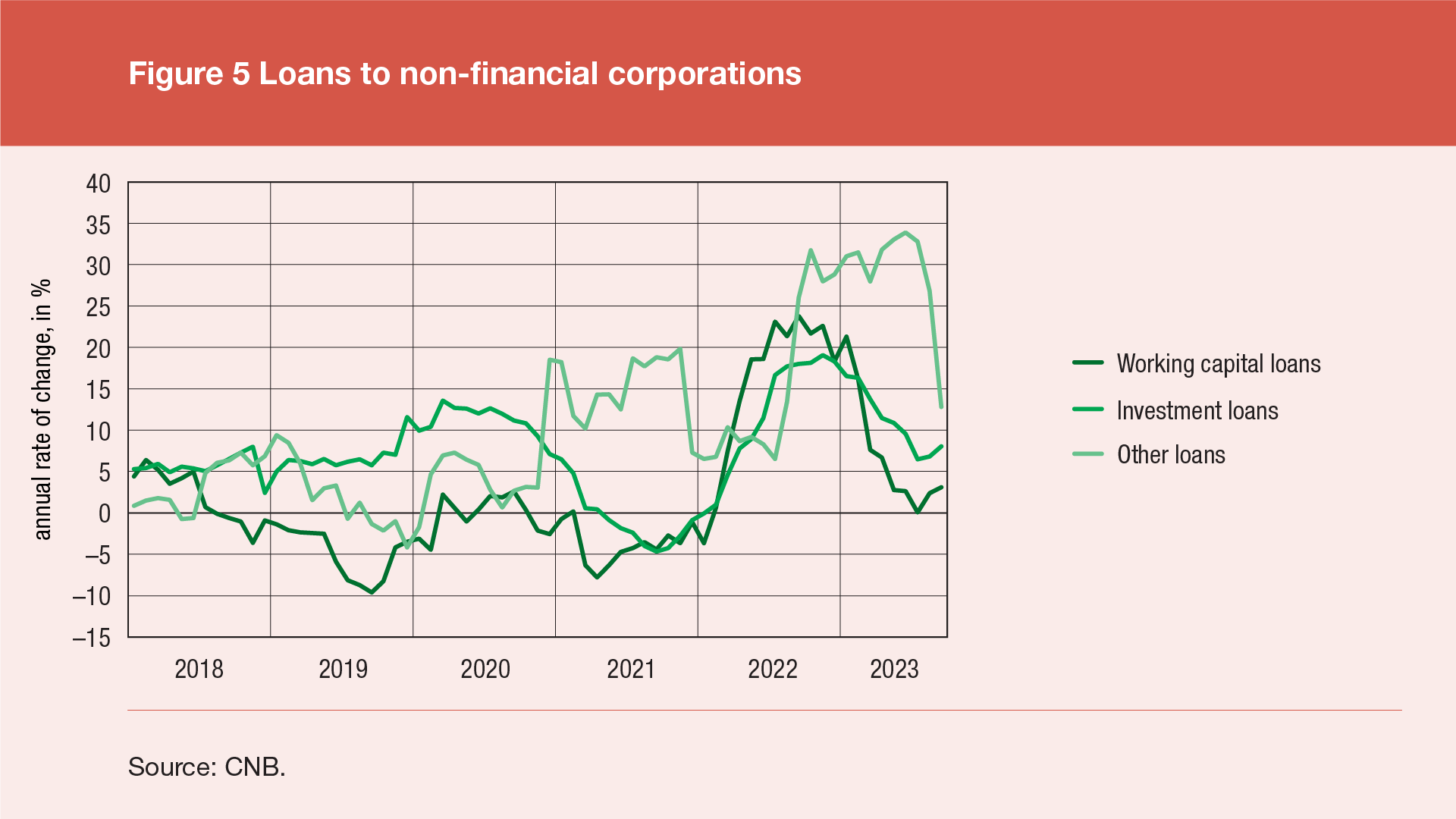

At the end of September 2023, loans to non-financial corporations stood at EUR 14.5bn and in the third quarter of 2023 grew by EUR 0.1bn (0.9%), and relative to the end of the third quarter of 2022 they grew by EUR 1.0bn (7.8%).

On an annual level, the growth in loans to non-financial corporations slowed down from 13.3% at the end of June 2023 to 7.8% at the end of September 2023, reflecting the deceleration in the growth of investment loans (from 9.6% to 8.1%) and other loans (from 33.9% to 12.8%), while the growth in working capital loans accelerated moderately (from 2.6% to 3.1%).

Statistical time series: Aggregated balance sheet of other monetary financial institutions

-

Monetary statistics shows the indicators of stocks and transactions of financial assets and liabilities of credit institutions. The changes and rates of change in the Release are shown based on transactions. The transactions show changes that exclude the effects of exchange rate changes, reclassifications and write-offs of loans. ↑

-

Domestic sectors in the Release include the general government, households, non-financial corporations, other financial institutions (investment funds other than money market funds, other financial intermediaries and financial auxiliaries) and insurance corporations and pension funds. ↑

-

Overnight deposits comprise transaction (giro and current) accounts, savings deposits and a small share of electronic money and restricted deposits. ↑