To provide the business community and the general public with additional information on developments in loan demand and supply, the Croatian National Bank has decided to start releasing aggregated results of the Bank lending survey. The quarterly Survey has been conducted since October 2012 and by end-2016, 18 rounds of the Survey were conducted, with average participation of almost all the banks in the Republic of Croatia. The results of the Survey are released quarterly in the form of tables and figures and individual banks' responses are aggregated in net percentages based on each bank's share in relevant loan groups.

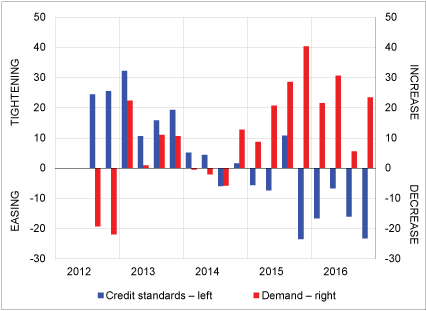

Banks' credit standards as applied to the approval of loans to enterprises continued to ease in the fourth quarter of 2016 and the demand for loans continued to grow. The easing of standards for loans to enterprises in the last quarter of 2016 and throughout the previous year was mostly due to favourable conditions on the banking market (competition among banks and liquidity) but also to positive expectations regarding general economic activity. The improvement in economic conditions also had a positive impact on demand for loans, and the growth in loan demand of enterprises in the fourth quarter of 2016 was mostly driven by fixed investment, while inventories and working capital financing made the biggest positive contribution to demand throughout the previous year.

Figure 1 Loans to enterprises

Note: Data show the net percentage of banks weighted by the share in total loans to enterprises. Net percentage for credit standards is the difference between the share of banks which indicated tightening of credit standards and the share of banks which indicated easing of credit standards. Net percentage for demand is the difference between the share of banks which indicated increased demand and the share of banks which indicated decreased demand.

Source: CNB.

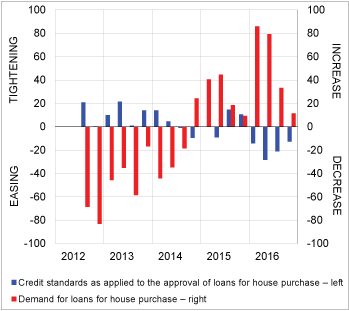

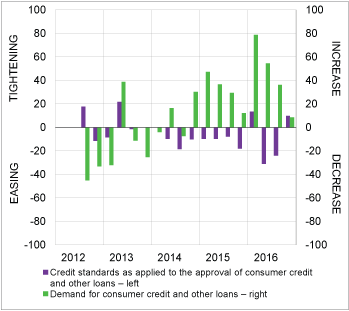

As regards the household sector, credit standards as applied to the approval of loans for house purchase continued to ease in the last quarter of 2016, in contrast with those for consumer and other loans which tightened. Almost throughout 2016, credit standards for both types of household loans eased, mainly due to competition among banks, lower costs of financing and positive expectations regarding economic developments, while the tightening of credit standards for consumer and other loans was considerably due to clients' creditworthiness. The demand for both groups of household loans continued to grow in the fourth quarter, though at a lower intensity than in the previous part of 2016. Increased consumption of households, better housing market prospects and growing consumer confidence were also the main factors behind growing demand of households for loans in 2016.

Figure 2 Loans to households

| a) Loans for house purchase | b) Consumer credit and other lending |

|

|

Note: Data show the net percentage of banks weighted by the share in total loans to households. Net percentage for credit standards is the difference between the share of banks which indicated tightening of credit standards and the share of banks which indicated easing of credit standards. Net percentage for demand is the difference between the share of banks which indicated increased demand and the share of banks which indicated decreased demand.

Source: CNB.

For detailed results of the Survey for the period up to and inclusive of the fourth quarter of 2016, see: Results of the Bank lending survey