From August 2023 the comments on statistics, a short description of selected, recently issued statistical data in the area of monetary statistics and the non-residents sector statistics, are no longer published. They are replaced by Statistical releases.

Comments on loan and deposit developments in August 2023

The seasonal upsurge in total domestic[1] deposits in August slightly accelerated the annual rate of their growth following the almost uninterrupted slowdown since the beginning of the year. Strong growth in total loans continued, primarily in housing loans to households and, to a lesser extent, in consumer loans, while growth in corporate lending remained subdued.

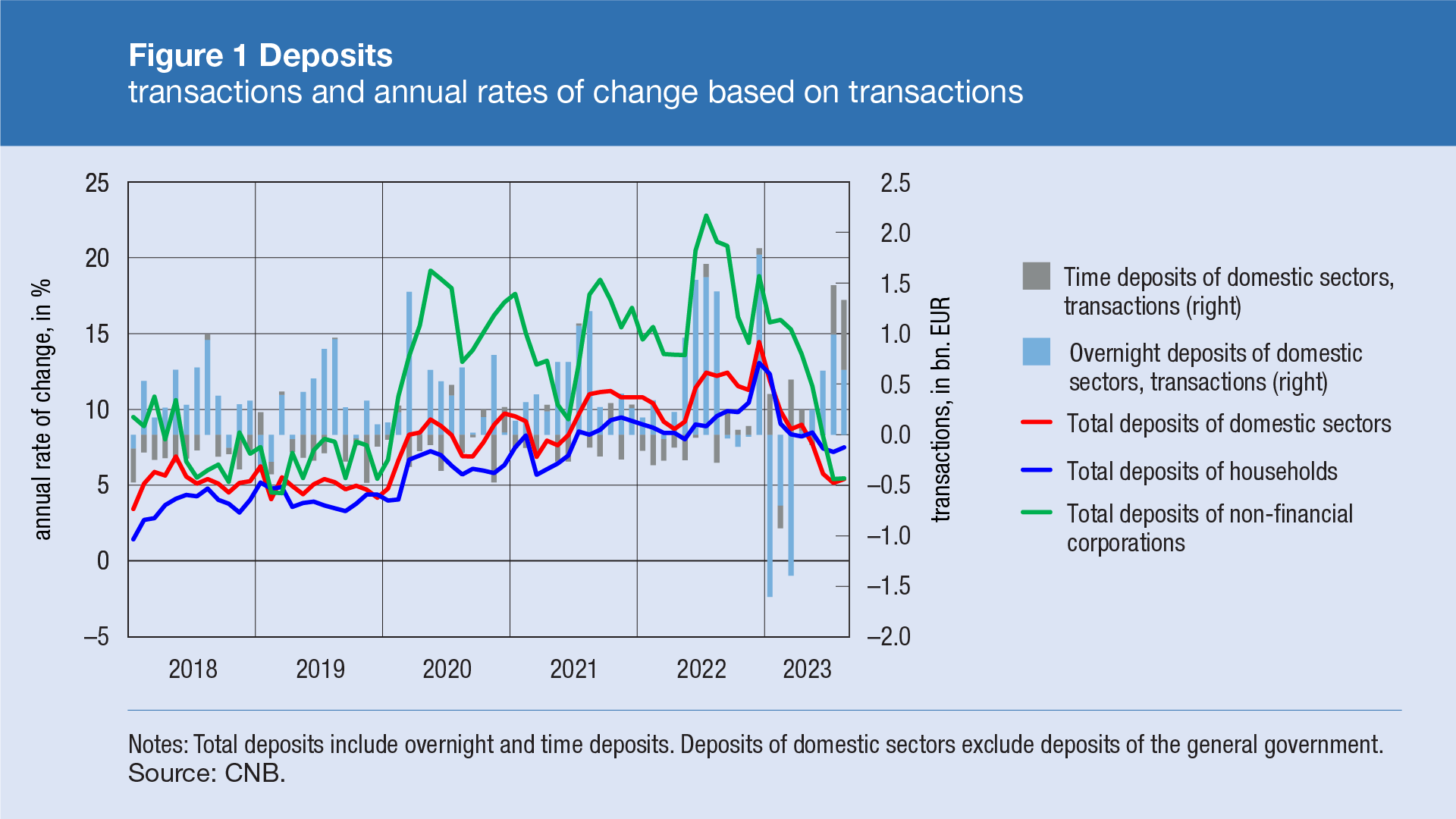

Following their increase in July, total domestic deposits also grew strongly in August (by EUR 1.3bn or 2.4% based on transactions), reflecting the favourable financial results of the tourist season. Corporate deposits with banks increased by EUR 0.7bn (with time deposits and overnight deposits increasing by EUR 0.4bn and EUR 0.3bn, respectively), of which more than a half is attributable to corporations engaging in accommodation activities, particularly hotel and similar accommodation, and food service activities. Household deposits also increased by EUR 0.6bn (of which EUR 0.1bn refers to time deposits and EUR 0.5bn to overnight deposits), while deposits of other financial institutions grew only slightly as the rise in time deposits (EUR 0.2bn) was almost offset by the decline in overnight deposits. Total domestic deposits picked up from 5.2% in July to 5.4% in August (based on transactions) on an annual basis, with growth in household deposits accelerating from 7.2% to 7.5% and growth in the deposits of non-financial corporations picking up slightly from 5.4% to 5.5% (Figure 1).

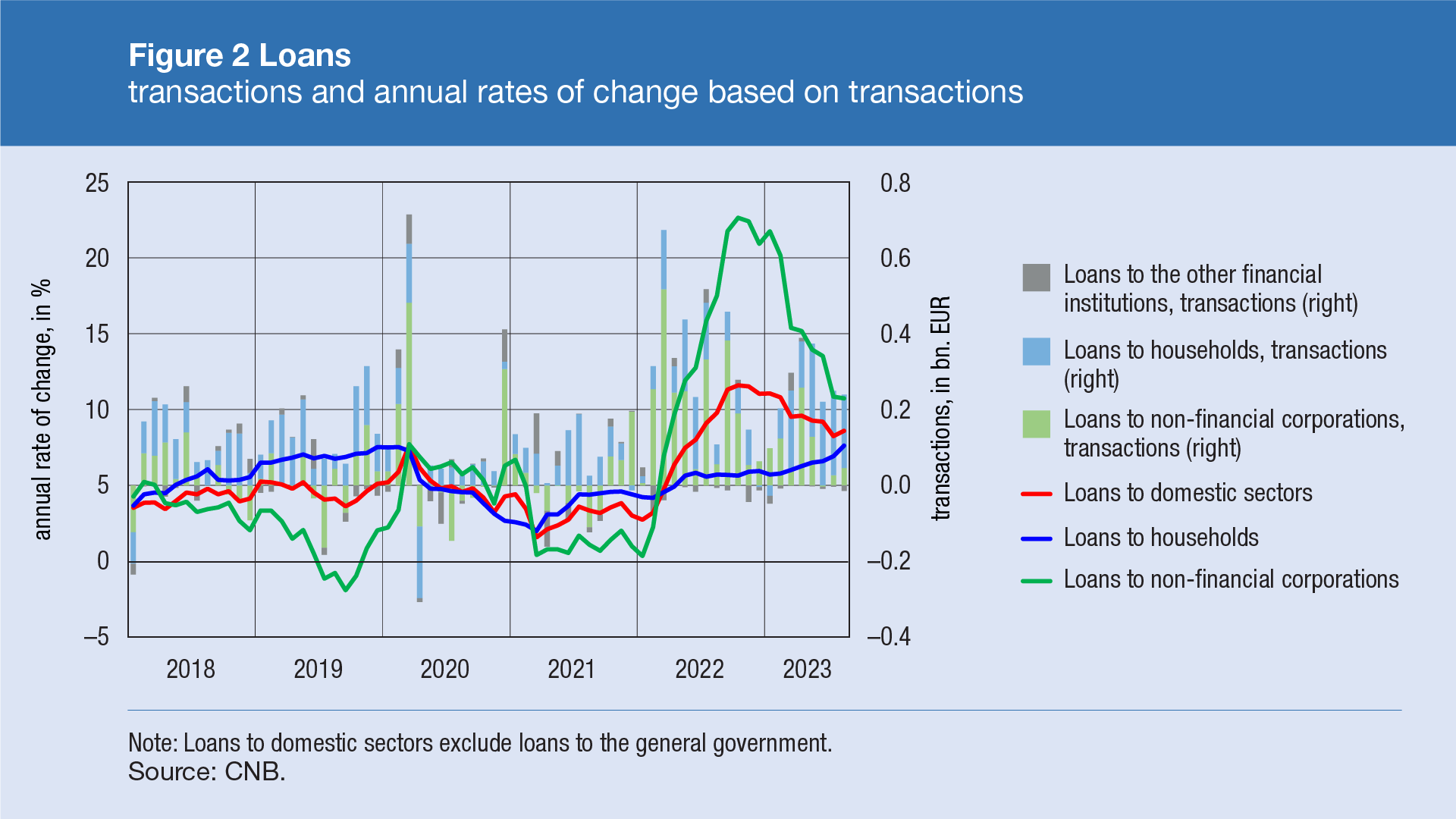

In August, total loans increased by EUR 224m or 0.6% from July, continuing the relatively strong upward trend in lending seen over the past months. The rise in total loans mainly reflects the increase in household loans (EUR 194 m), of which EUR 124m is attributable to housing loans, which still reflect the effects of government subsidies for housing loans, while general-purpose cash loans account for the remaining EUR 55m. The growth in corporate lending remained subdued (EUR 46m) despite being somewhat more pronounced than in July. In the structure of corporate loans, shares in syndicated loans and, to a smaller extent, investment loans[2] grew, while working capital loans declined. Observed on an annual basis, total loans accelerated from 8.2% in July to 8.6% in August (Figure 2) under the influence of a considerable pick-up in growth in household loans (from 6.9% to 7.6%). The increase in housing loans picked up from 9.5% to 10.1%, whereas general-purpose cash loans grew from 6.8% to 7.4%. Corporate loans slowed down slightly on an annual basis (from 10.8% to 10.7%) due to the base effect, i.e., the slightly stronger growth in loans to the corporate sector seen in August 2022.

Against the backdrop of strong deposit growth and the significantly slower growth in lending activity in August, foreign assets of credit institutions increased by EUR 1.2bn. The largest share of claims on non-residents refers to assets placed by domestic credit institutions to parent banks as reverse repo loans.

Key figures:

- In August, total domestic deposits increased by EUR 1.3bn (2.4% based on transactions) from July this year, while the increase in deposits from August 2022 amounted to EUR 2.9bn (5.4% based on transactions).

- Total loans grew by EUR 0.2bn (0.6% based on transactions) in August from July this year, while the increase in loans from August 2022 amounted to EUR 2.9bn (8.6% based on transactions).

For detailed information on monetary statistics as at August 2023, see:

Središnja banka (HNB)

Druge monetarne financijske institucije

-

Domestic sectors in the Comments exclude the general government. ↑

-

Investment loans are loans granted for medium- and long-term financing of investment projects or programmes to build, modernise or expand production facilities, invest in business premises, warehouse facilities, construction plots, vehicle and vessel fleets used in production or performance of activities and invest in other fixed assets. They include all investment loans which cannot be classified as construction loans, loans to agriculture or loans to tourism. ↑