From August 2023 the comments on statistics, a short description of selected, recently issued statistical data in the area of monetary statistics and the non-residents sector statistics, are no longer published. They are replaced by Statistical releases.

Comments on the balance of payments, gross external debt and the international investment position in 1Q 2023

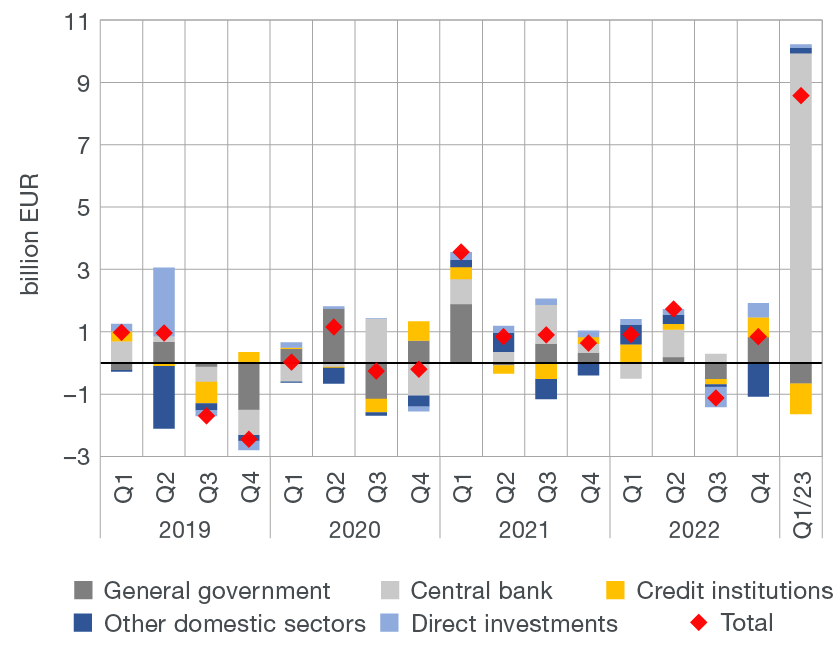

The current and capital account balance improved noticeably in the first quarter of 2023 relative to the same period in 2022, reflecting positive developments in all sub-accounts except in foreign goods trade. Accordingly, net capital inflow in the financial account decreased slightly from the same period in 2022.

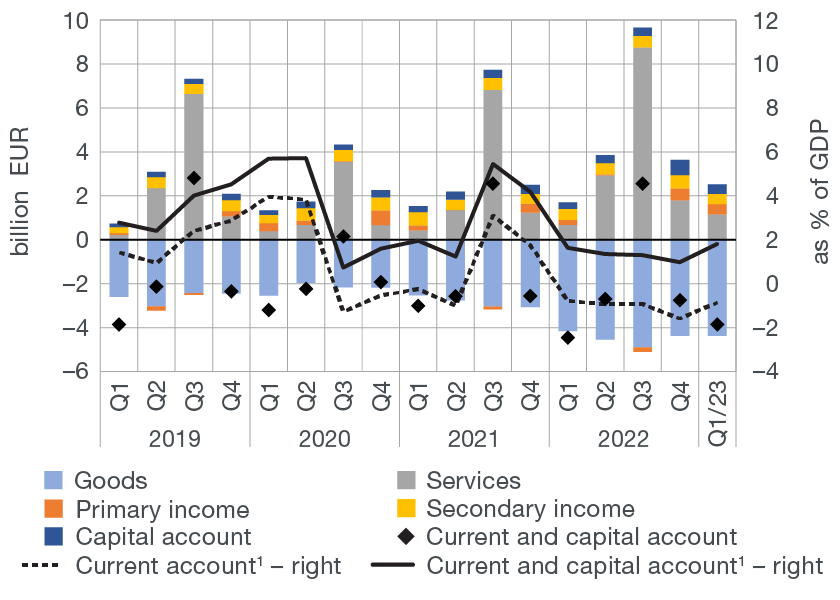

The current and capital account of the balance of payments ran a deficit of EUR 1.9bn in the first quarter of 2023, down by EUR 0.6bn from the same period in the year before (Figure 1a). This was primarily a result of an increase in net exports of services, most notably those related to tourism, coupled with a concurrent increase in the primary income account surplus, mostly reflecting the growth in revenues of persons temporarily employed abroad. Furthermore, the continued rise in the disbursements from EU funds to end users noticeably increased the overall surplus in the secondary income and capital transaction accounts. On the other hand, the strong growth in net imports of other goods continued to widen the deficit in the foreign goods trade regardless of the decline in the net imports of energy resulting from the decline in energy prices on global markets. As a result of developments referred to above, over the past four quarters, the cumulative surplus in the current and capital account grew considerably; in the period up to the end of March 2023, it stood at 1.8% of GDP, having gone up from 1.0% in 2022.

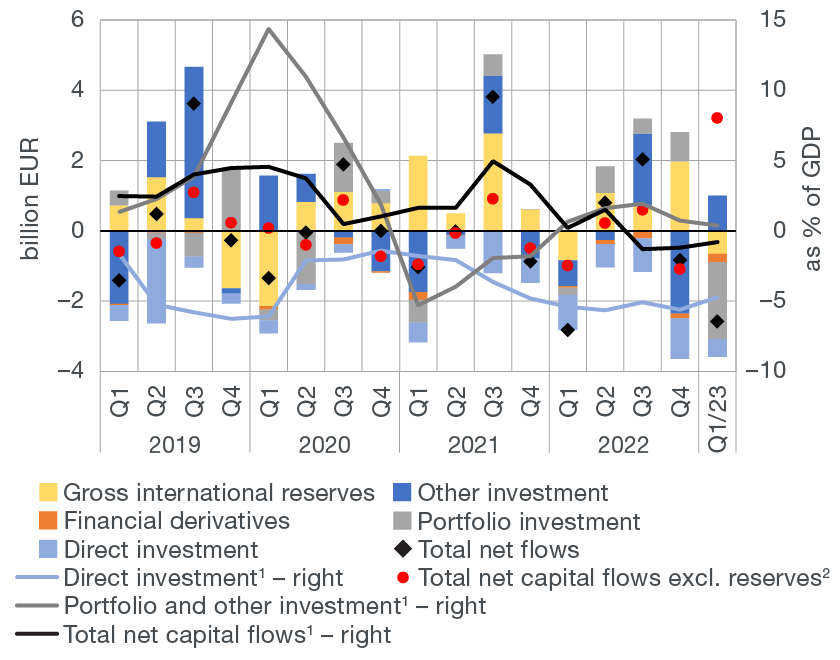

Figure 1 Balance of payments

| a) Current and capital account | b) Financial account |

|

|

1 Sum of the last four quarters.

2 Excluding the change in gross international reserves and foreign liabilities of the CNB.

Note: In the figure showing the financial account, the positive value denotes net capital outflow abroad and the negative value denotes net capital inflow.

Source: CNB.

The financial account of the balance of payments recorded a net capital outflow of EUR 2.6bn in the first quarter of 2023, which is a decrease of EUR 0.2bn from the same period of the previous year (Figure 1b). In the first quarter of 2023, all sub-accounts of the financial account saw net inflows, except other investment, which recorded a noticeable net outflow. The latter was mainly a result of the increase in government foreign deposits based on the foreign deposit of funds raised by the issue of a national bond in early April to repay the ten-year US dollar bond from 2013. The strong net capital inflow in the account of portfolio investments was almost exclusively a result of the central bank's exceptionally strong divestment from foreign short-term securities, which, in turn, caused a noticeable increase in the CNB’s claims on the Eurosystem within the TARGET2 system, recorded in other investment. In addition, as a result of joining the euro area[1], CNB assets were redistributed from the reserve assets item to other foreign claims of the CNB so that the effect of the introduction of the euro on the central bank’s foreign position remained neutral. However, due to the changes in the methodology of classifying individual central bank positions and changes within functional categories related to the introduction of the euro, the scope of certain sub-accounts changed, so that, except for the sub-account of direct investment, they cannot directly be compared to the preceding periods. The net inflow of foreign direct investments is, by and large, a result of the increase in domestic corporate debt to affiliated creditors abroad and, to a lesser extent, of direct equity investment, primarily resulting from investments in the IT sector and real estate purchase by non-residents. The net inflow of foreign direct investments shrank noticeably from the same period in 2022 due to the increase in equity investments abroad of one pharmaceutical company. Due to aforementioned developments, over the past four quarters, the cumulative net inflow in the financial account dropped from 1.2% of GDP in 2022 to 0.8% of GDP in the period up to the end of March 2023.

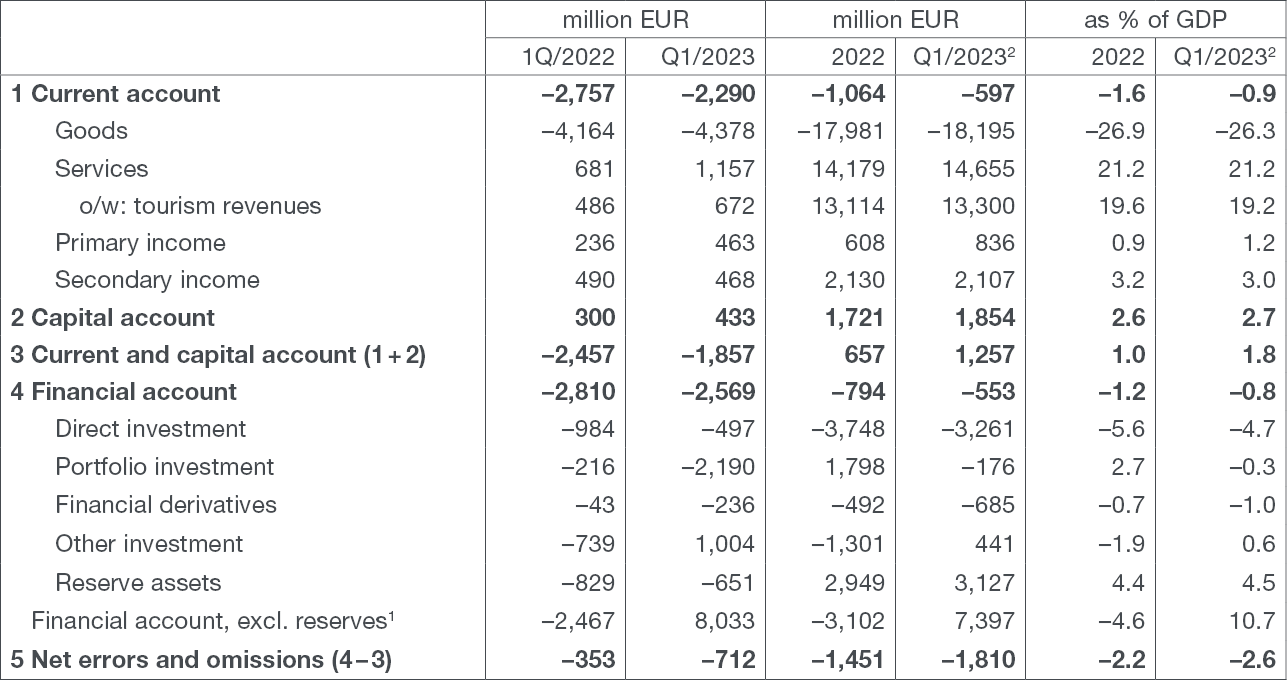

Table 1 Balance of payments

1 Excluding the change in gross international reserves and foreign liabilities of the CNB. The investment of a portion of international reserves in reverse repo agreements results in a simultaneous change in CNB assets (recorded in the reserve assets account) and liabilities (recorded in the other investment account) and thus has a neutral impact both on changes in the central bank’s net foreign position and the overall financial account balance.

Note: The positive value of financial transactions denotes net capital outflow abroad and the negative value denotes net capital inflow.

Source: CNB.

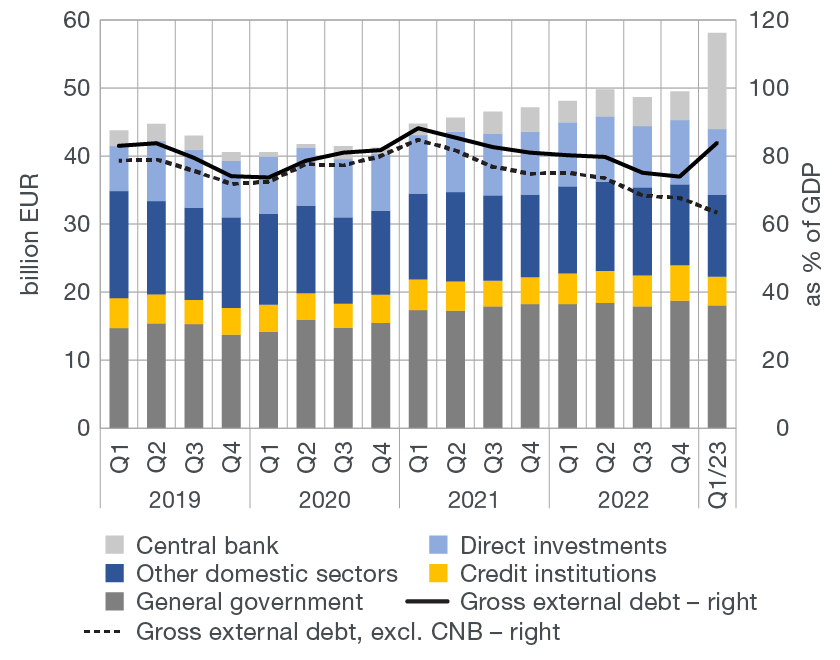

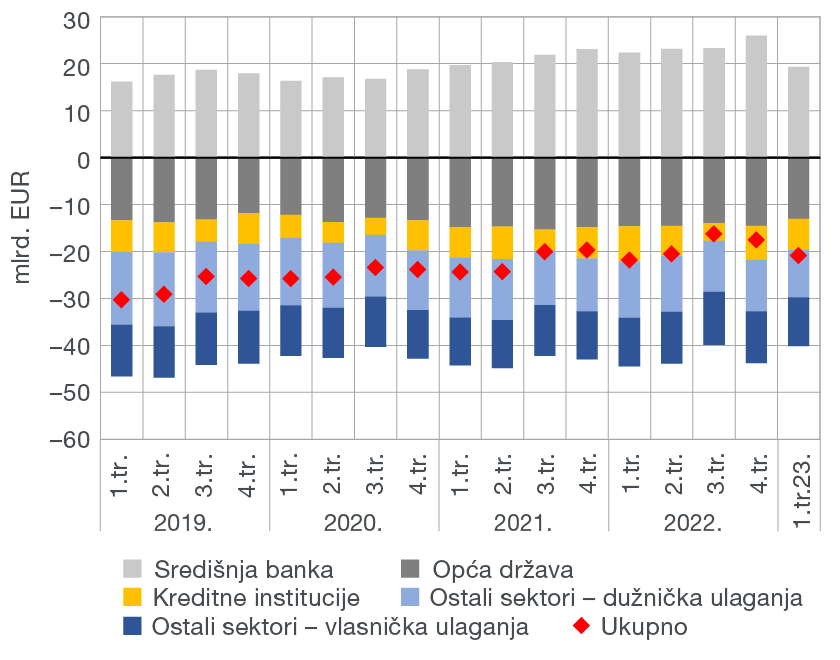

The gross external debt stood at EUR 58.1bn or 83.9% of GDP at the end of March 2023 (Figure 2a), up by EUR 8.6bn from the end of December 2022 (Figure 2a). This is primarily attributable to the change in the rules on recording euro cash in the balance sheets of Eurosystem national central banks (Figure 2b). Specifically, the total amount of euro cash in circulation is distributed between the balance sheets of national central banks in line with the Eurosystem capital key. Since CNB put into circulation an amount of euro significantly smaller than the amount of cash in circulation recorded in its balance sheet (by almost EUR 10bn), the difference is recorded as a claim of the CNB towards the rest of the Eurosystem. However, the effect of the application of the aforementioned rules on recording euro cash on the CNB’s foreign position is neutral, as the difference between issued and recorded cash is, at the same time, recorded in external debt statistics as a liability of the central bank. If the central bank is excluded, the gross external debt of Croatia decreased noticeably by the end of March 2023 relative to December 2022.

Figure 2 Gross external debt

| a) Stock of gross external debt | b) Change in gross external debt |

|

|

Note: Changes in gross external debt are a result of net transactions of domestic sectors and exchange rate and other adjustments.

Source: CNB.

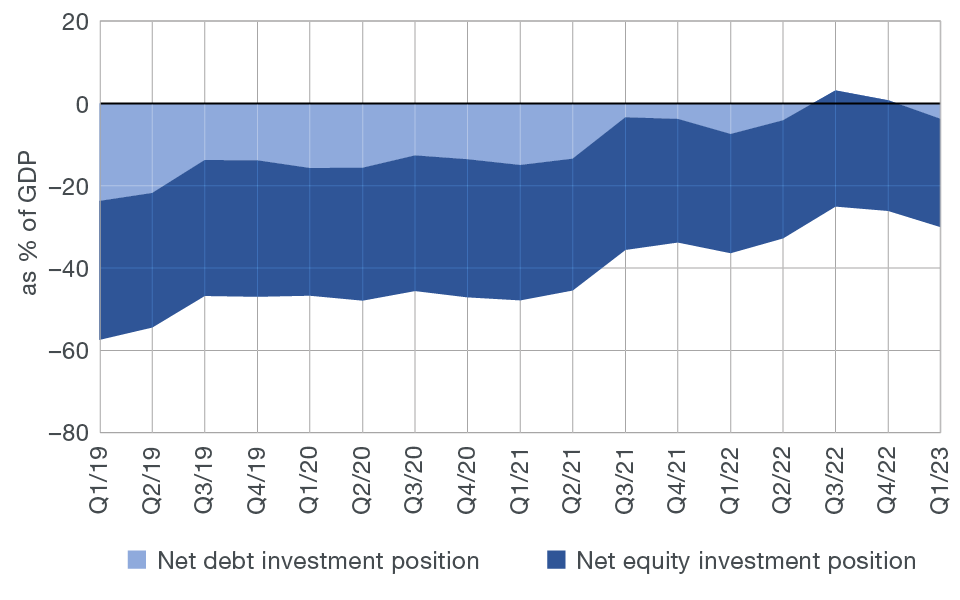

Net external debt increased noticeably in the first three months of 2023 (by EUR 2.9bn), with all sectors improving the net debt position except for the central bank. The deterioration in the central bank’s foreign position is, to an extent, attributable to the issue of a national bond used to repay the international US dollar bond that matured in early April. The government deposited the funds raised by the issue of the national bond abroad, which, prior to the repayment itself, withdrew a portion of liquidity from the financial system, i.e., reduced the balance of TARGET2 accounts held with the CNB by commercial banks. Thus the stock of net external debt stood at EUR 3.2bn or 4.6% of GDP at the end of March 2023, up from EUR 0.3bn or 0.4% of GDP at the end of 2022. The net international investment position also worsened, having fallen from EUR –17.5bn or –26.1% of GDP at the end of December 2022 to EUR –20.8bn or –30.1% of GDP at the end of March 2023 (Figures 3a and 3b).

Figure 3 International investment position (net)

| a) Position by sector | b) Relative indicator by type of investment |

|

|

Note: The international investment position (net) equals the difference between domestic sectors' foreign assets and liabilities at the end of a period. The negative value of the net international investment position indicates that foreign liabilities of Croatian residents are greater than their foreign assets. Included are assets and liabilities based on debt instruments, equity investments, financial derivatives, and other instruments. Figure 3b includes financial derivatives and other liabilities in the net debt investment position.

Source: CNB.

Data revision

Data on the balance of payments, gross external debt and the international investment position are revised in accordance with the commonly used practice, based on subsequently available data.

Detailed balance of payments data

Detailed gross external debt data

Detailed data on the international investment position

-

Upon entering the euro area, the euro part of the CNB’s foreign claims, which was classified under reserve assets until the end of 2022, is considered a claim in domestic currency due to currency changeover and is no longer an integral part of international reserves. Claims in domestic currency include the capital paid to the ECB and the portion of international reserves transferred to the ECB. The aforementioned reclassification has had a neutral effect on the CNB’s foreign position, but has greatly affected the size and amount of official international reserves. See the following link for more on the effect of euro adoption on the international reserves of Croatia (available only in Croatian): https://www.hnb.hr/-/sto-ce-biti-s-medjunarodnim-pricuvama-kada-uvedemo-euro- ↑