From August 2023 the comments on statistics, a short description of selected, recently issued statistical data in the area of monetary statistics and the non-residents sector statistics, are no longer published. They are replaced by Statistical releases.

Comments on monetary developments for December 2016

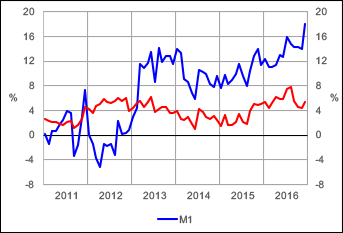

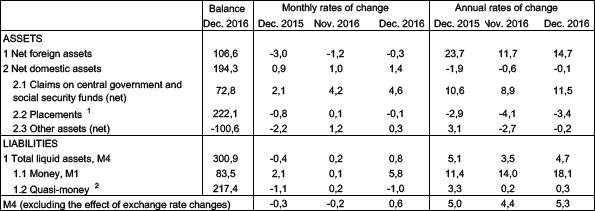

Total liquid assets M4 (or money broadly defined) stood at HRK 300.9bn at the end of December 2016, an increase of HRK 2.4bn or 0.8% from the end of November. The annual rate of growth in M4 thus rose to 4.7% (or 5.3%, if the effect of exchange rate changes is excluded). The growth in M4 also accelerated from 2015 when it stood at 5.0%, the effect of exchange rate changes excluded. The annual growth rate of M4 reached its maximum during the tourist season. In the structure of M4, money, M1 (or money narrowly defined) rose the most, with its growth rate reaching a high 18.1% at the end of 2016 (Figure 1). The growth in M4 was the result of a strong growth in net foreign assets (14.7%) and stagnation in net domestic assets (–0.1%) of monetary institutions.

|

Figure 1 Monetary aggregates |

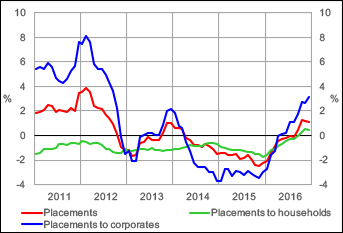

Figure 2 Placements |

|

|

|

Source: CNB. |

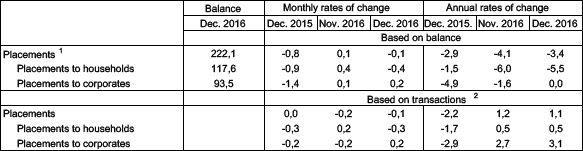

Total placements of monetary institutions to domestic sectors (except the government) stood at HRK 222.1bn at the end of December 2016, having fallen by HRK 0.1bn or 0.1% from the end of November. On an annual level, those based on transactions rose by 1.1% (Figure 2). The developments in total placements was much more favourable than in the previous several years. In 2016, placements to the household sector rose for the first time after seven years (0.5%) and placements to corporates also rose faster (3.1%). However, in nominal terms, at the end of 2016, placements were down 3.4% from the end of 2015, reflecting a partial write-off of household loans indexed to the Swiss franc and the sale of non-performing placements of banks. In the process of conversion of household loans indexed to the Swiss franc, from November 2015 to December 2016, the banks wrote off a total of HRK 6.0bn and the stock of these loans fell from HRK 21.7bn prior to conversion to 1.6bn at the end of 2016. The sale of non-performing placements of banks stood at HRK 4.2bn in the first nine months, with placements to non-financial corporations accounting for the bulk of this amount.

Table 1 Short consolidated balance sheet of monetary institutions

Source: CNB.

Table 2 Growth of placements (except the central government) and main components

Source: CNB.

For detailed information on monetary statistics for the year ending December 2016, see:

Central bank (CNB)

Other monetary financial institutions