From August 2023 the comments on statistics, a short description of selected, recently issued statistical data in the area of monetary statistics and the non-residents sector statistics, are no longer published. They are replaced by Statistical releases.

Comments on monetary developments for March 2019

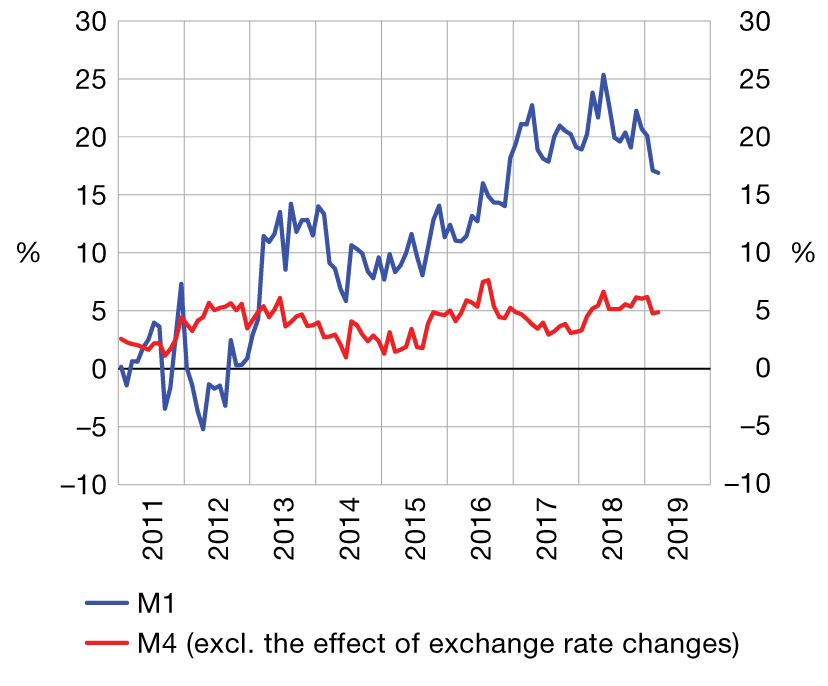

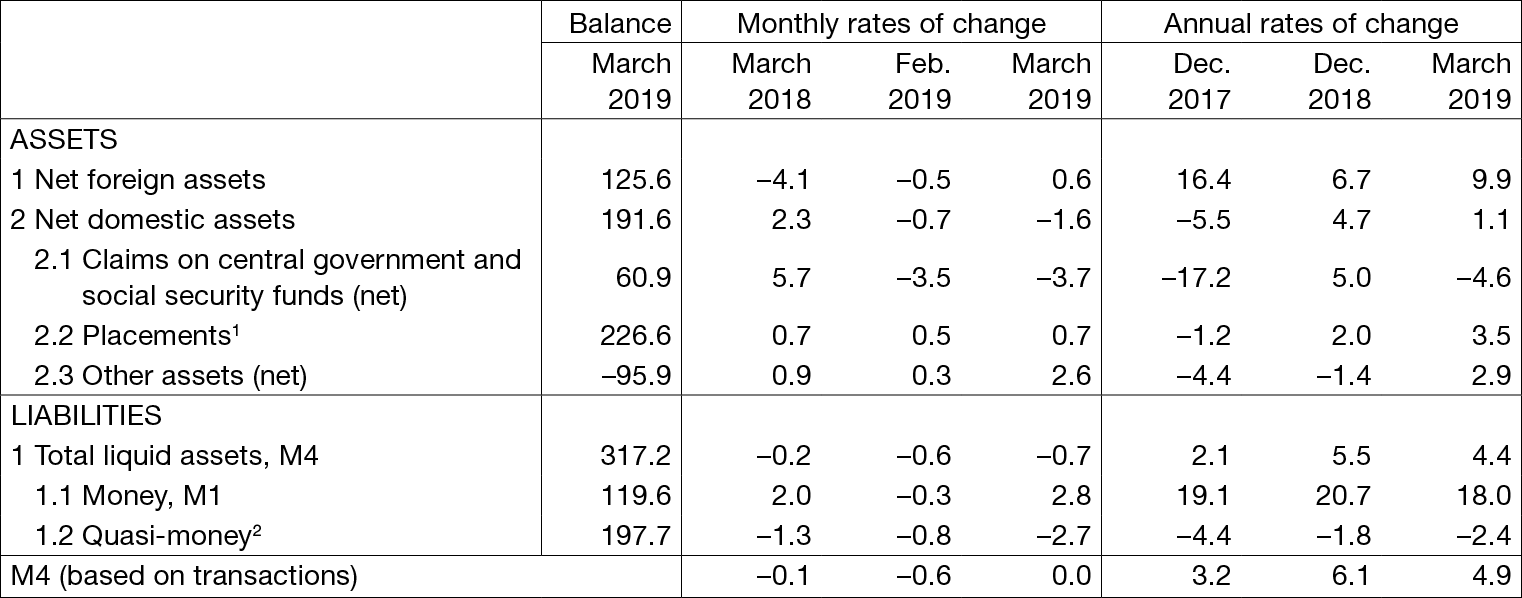

Total liquid assets (M4) stood at HRK 317.2bn at the end of March 2019, stagnating from the previous month (based on transactions, Table 1). The nominal monthly decrease in M4 of HRK 2.3bn or 0.7% is a consequence of the reclassification of almost all money market funds from the monetary financial institutions sector to the sector of non-money market investment funds as a result of the harmonisation of monetary and financial statistics with the Regulation on money market funds (Regulation (EU) No 2017/1131) of the European Parliament and of the Council. The reclassification also affected changes in the balances of other monetary aggregates. For example, on the assets side of the monetary institutions' balance sheet the balance of credit institutions’ gross claims on the central government decreased and the claims on non-money market investment funds increased. Furthermore, money (M1) increased as a result of reclassification by slightly over HRK 1.0bn due to the increase in demand deposits of non-money market investment funds. At the same time, quasi-money decreased by HRK 3.3bn, with the shares of money market funds declining to only HRK 1.3m, from HRK 6.0bn at the end of February, while reclassification increased the balance of total deposits (excluding demand deposits) of non-money market investment funds by HRK 2.7bn.

| Figure 1 Monetary aggregates annual rates of change based on transactions |

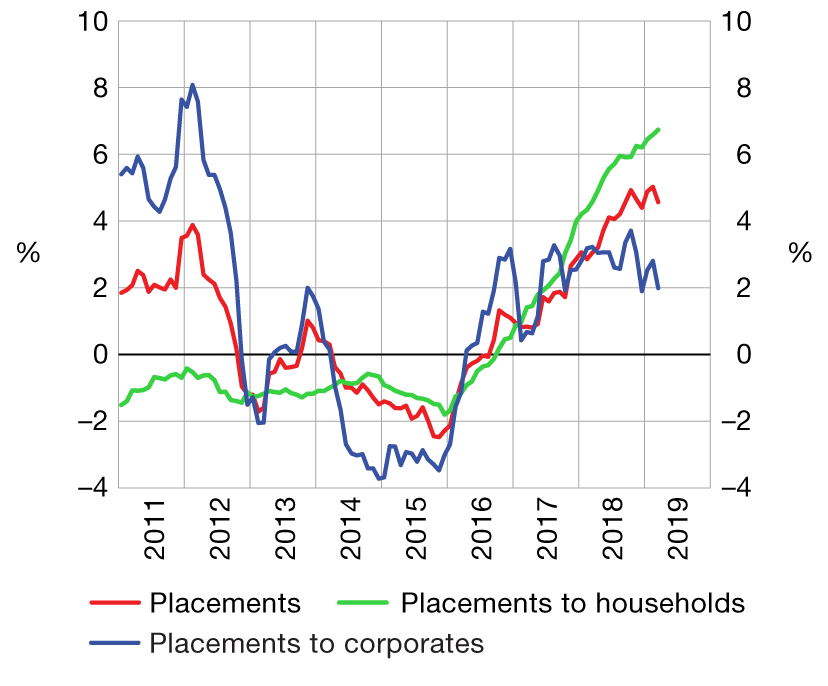

Figure 2 Placements annual rates of change based on transactions |

|

|

| Source: CNB. |

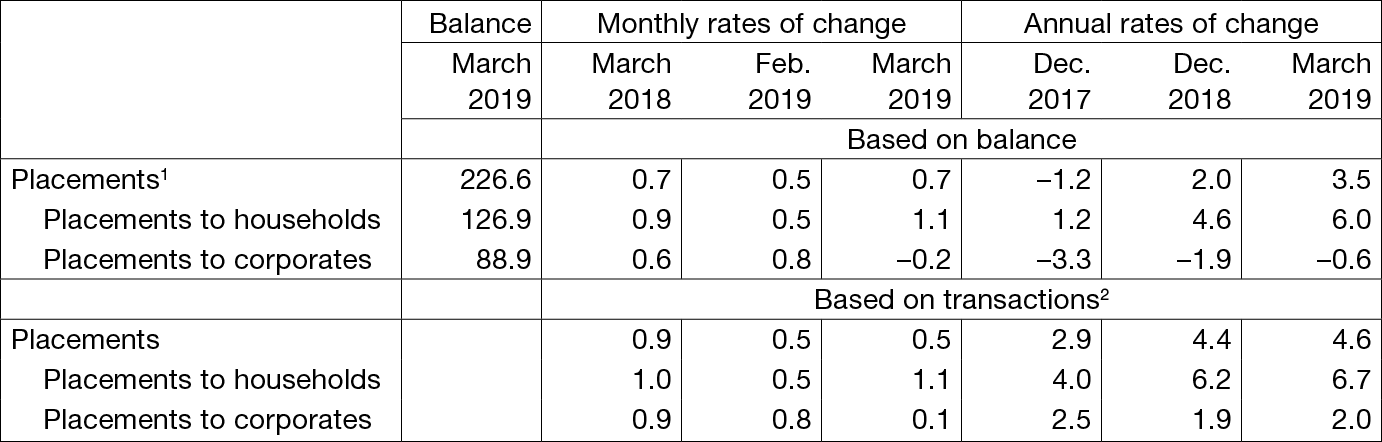

Total placements of monetary institutions to domestic sectors (excluding the government) increased by HRK 1.0bn in March (transaction-based), ending the month at HRK 226.6bn. The annual growth of total placements slowed down to 4.6% in March (Table 2). This was facilitated by the slowdown in lending to non-financial corporations on an annual level (2.0%) and by the fall in lending to other financial institutions (–4.3%), excluding the effect of reclassification of money-market funds. On the other side, the annual growth in household placements continued to accelerate slightly, reaching 6.7% in March. The annual growth of general-purpose cash loans slowed down slightly to 12.8%, while the dynamics of other types of lending to this sector strengthened. As for the nominal balance of total placements, their annual growth stood at 3.5% in March and was slower than the transaction-based growth, primarily as a consequence of the sale of non-performing placements.

Table 1 Summary consolidated balance sheet of monetary institutions

in billion HRK and %

1The sum total of asset items 2.2 to 2.8 of Bulletin Table B1: Consolidated balance sheet of monetary financial institutions.

2The sum total of liability items 2 to 5 of Bulletin Table B1: Consolidated balance sheet of monetary financial institutions.

Source: CNB.

Table 2 Placements (except the central government) and main components

in billion HRK and %

1In addition to placements to households and corporates, they also include placements to the local government and other financial institutions.

2The transactions show changes that exclude the effects of exchange rate changes, securities price adjustments, reclassification and write-off of placements, including the sale of placements in the amount of their value adjustment.

For detailed information on monetary statistics as at March 2019, see: